Cardano in 2025: Still a Smart Crypto Bet or Falling Behind?

Proof-of-stake pioneer Cardano faces its make-or-break year as ETH 2.0 dominates headlines. Can ADA's 'peer-reviewed' approach compete with the hype trains?

The bull case: Institutional adoption accelerates

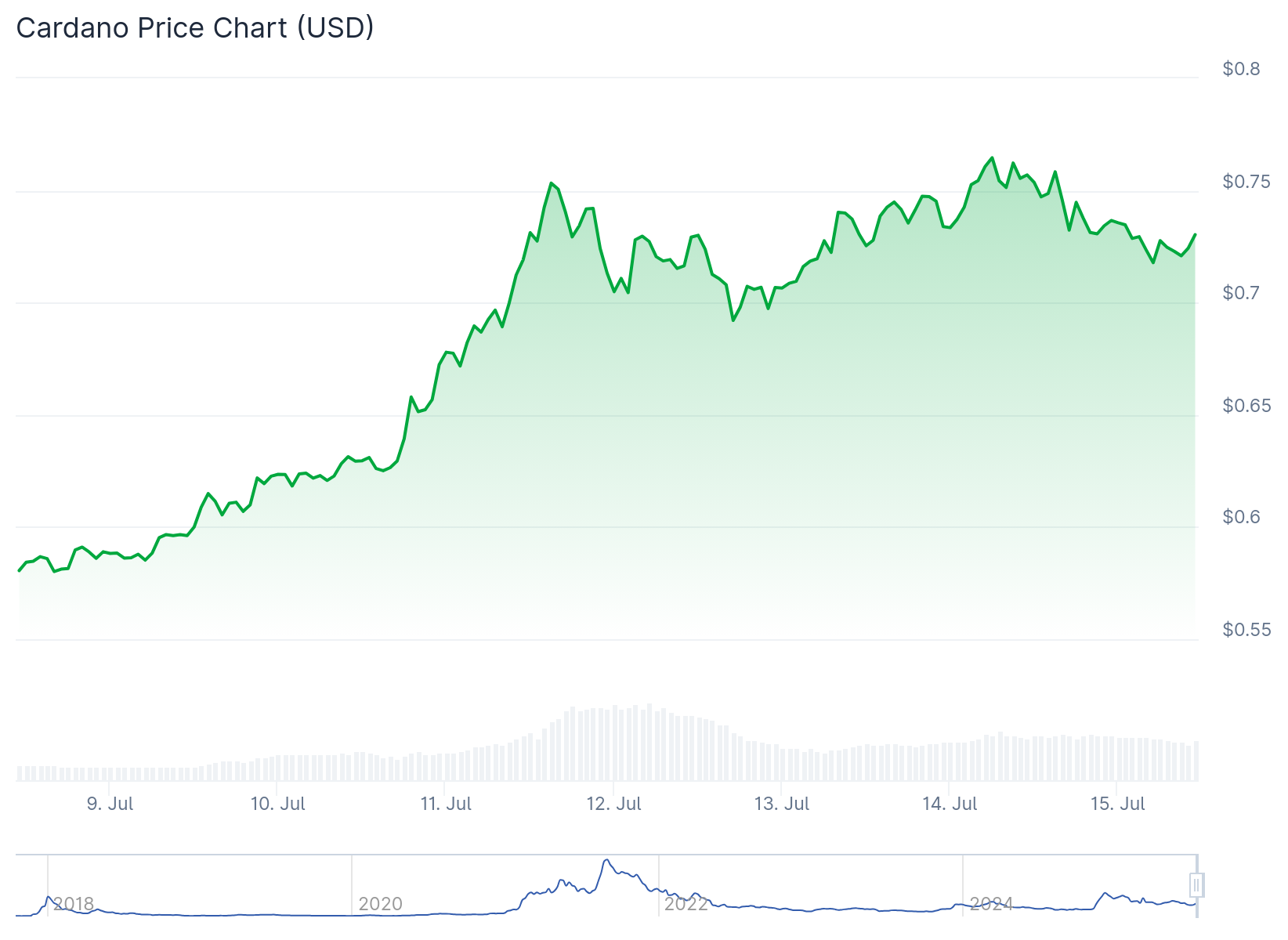

Binance listings and Grayscale trust rumors sent ADA up 120% last quarter. Staking yields still beat traditional savings accounts—if you ignore the volatility.

The bear trap: All tech, no traction?

While developers tout Haskell smart contracts, DeFi TVL lags behind Solana and Avalanche. Another 'academic perfect' project bleeding to fast-moving competitors?

Final verdict: Holds promise if you believe in slow-and-steady—but today's crypto whales want moon shots, not peer-reviewed white papers. (And yes, that's a jab at VC-funded 'research' tokens.)

TLDR

- Cardano’s Total Value Locked (TVL) in DeFi surpassed $2.2 billion in 2025, showing increased developer and user activity

- The blockchain uses energy-efficient Proof-of-Stake consensus and research-driven development approach

- ADA has a capped supply similar to Bitcoin and maintains partnerships with major institutions

- Development pace remains slower than competitors like Ethereum and Solana due to academic-first approach

- Platform supports growing DeFi protocols, NFTs, staking rewards, and governance participation

Cardano has achieved a major milestone in 2025 with its decentralized finance (DeFi) ecosystem surpassing $2.2 billion in Total Value Locked (TVL). This represents growing developer and user activity on the blockchain platform founded by ethereum co-founder Charles Hoskinson.

The achievement comes as Cardano continues to expand its suite of decentralized applications across DeFi, NFTs, and other blockchain services. The platform’s research-driven development approach has attracted institutional partnerships and a globally distributed community of supporters.

Cardano operates on the Ouroboros Proof-of-Stake consensus mechanism, which consumes less energy than traditional Proof-of-Work systems like Bitcoin. This environmental sustainability factor has become increasingly important as institutions evaluate blockchain platforms for long-term adoption.

The blockchain’s methodical approach to development involves peer-reviewed academic research before implementing new features. All upgrades undergo scientific rigor and error-checking processes, which supporters argue provides better security and scalability foundations.

ADA, Cardano’s native token, has a fixed supply cap similar to Bitcoin’s scarcity model. This capped supply structure is viewed by some investors as a factor that could influence long-term price dynamics.

The platform now supports various DeFi protocols allowing users to lend, borrow, and trade cryptocurrencies. Users can also create, trade, and manage native tokens and non-fungible tokens (NFTs) directly on the network.

Growing Ecosystem and Applications

Cardano’s staking mechanism allows ADA holders to earn rewards while participating in network governance decisions. This gives token holders direct input on protocol upgrades and network changes.

The blockchain has formed partnerships with academic institutions, governments, and major organizations to explore real-world applications. These collaborations focus on areas like supply chain tracking, identity verification, and financial services.

Last week, we published our 2024 Financial Insights Report.

Let's take a closer look at our financials: 🧵 https://t.co/n8ZAY0q1k6 pic.twitter.com/zezVkVDMGP

— cardano Foundation (@Cardano_CF) July 14, 2025

Recent technical developments include increased smart contract adoption and deployment of zero-knowledge smart contracts. These features expand the platform’s capabilities for privacy-focused applications and complex decentralized services.

Competitive Challenges

Despite the ecosystem growth, Cardano faces intense competition from established platforms like Ethereum and faster-moving alternatives like Solana and Avalanche. These competitors often deploy new features more rapidly than Cardano’s research-first methodology allows.

The academic approach to development, while praised for thoroughness, has historically resulted in slower feature rollouts. This has led to lower adoption rates in some areas compared to more aggressive blockchain platforms.

Market volatility remains a constant factor for ADA and all cryptocurrency investments. Price movements often reflect market sentiment rather than fundamental technological progress or adoption metrics.

Regulatory uncertainty continues to affect the broader cryptocurrency sector, with potential impacts on Proof-of-Stake networks and token classifications. Future regulatory decisions could influence how platforms like Cardano operate and how tokens are traded.

The Total Value Locked milestone of $2.2 billion represents increased confidence from developers and users choosing to build and invest in Cardano’s ecosystem throughout 2025.