PEPE Price Surge: Whale Accumulation & Bullish On-Chain Signals Point to Major Rally

Memecoin PEPE is making waves again—this time with heavyweight investors stacking bags as on-chain metrics scream buy.

Whales are circling

Blockchain trackers spot massive PEPE movements into cold storage—the kind of accumulation that typically precedes double-digit pumps. Meanwhile, exchange reserves are drying up faster than a DeFi project's treasury.

On-chain doesn't lie

Network activity shows retail FOMO hasn't even kicked in yet. The big money's positioning first—just like they did before PEPE's last 10x run. Now the question is whether Wall Street's 'risk management' teams will notice after the fact (again).

One thing's certain: when the suits finally start calling PEPE 'digital exposure,' you'll know the top is in.

TLDR

- PEPE has surpassed 463,000 holders, showing increased retail participation and user adoption

- The token is forming a bullish cup-and-handle pattern with potential breakout above $0.00001580 resistance

- Derivatives data shows 60% volume surge to $3.67B and 8.20% increase in Open Interest to $705.27M

- Whale accumulation is rising with large transactions up 6.63% and exchange reserves declining

- On-chain metrics show 39% increase in new addresses and 38% growth in active addresses

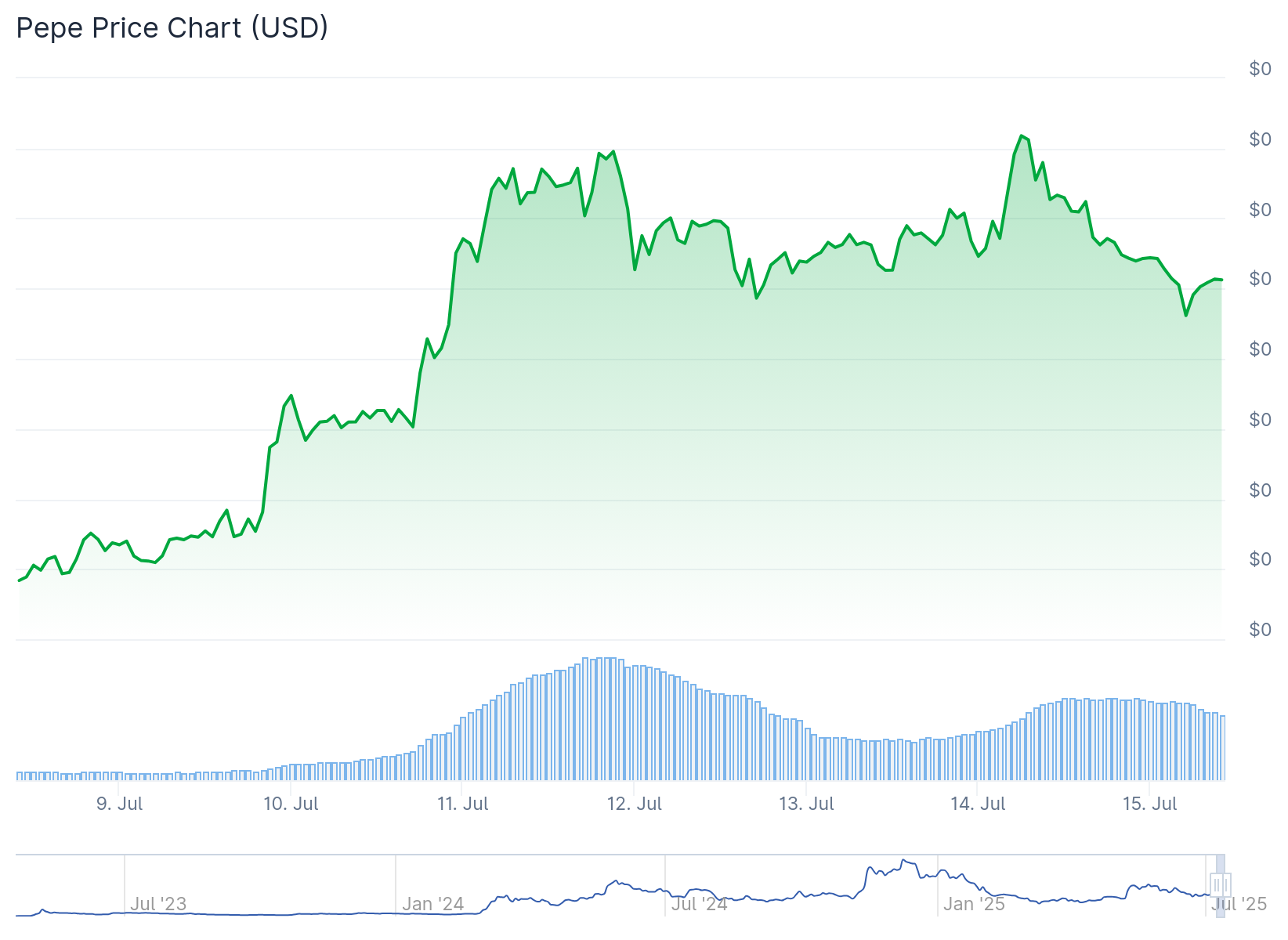

Pepe has crossed a major milestone by exceeding 463,000 holders, marking a surge in user acquisition and retail enthusiasm. The memecoin is currently trading around $0.00001252, gaining 1.68% in the past 24 hours.

This growth in holders comes as memecoins regain momentum across the ethereum ecosystem. The rising holder count reflects increasing faith in the token’s long-term potential and suggests renewed retail participation.

A clear cup-and-handle formation has emerged on PEPE’s daily chart, hinting at a potential bullish continuation. The handle is nearing completion, with price hovering just below the $0.00001580 resistance zone.

If this neckline breaks, a rally toward $0.000030 could follow. The Directional Movement Index supports the bullish case, with +DI at 35.3 well above -DI at 12.7, indicating strong buyer dominance.

The ADX sits at 23.0, signaling a developing trend that still has room to strengthen. A confirmed breakout could trigger accelerated upside momentum.

Derivatives Market Shows Growing Confidence

The derivatives market shows growing bullish conviction. Volume has surged by over 60%, reaching $3.67B, while Open Interest climbed 8.20% to $705.27M.

These metrics confirm rising speculative demand, as traders bet on further upside. The OI-Weighted Funding Rate remained positive at 0.0107%, indicating that long positions dominated sentiment.

This persistent positive rate shows that bulls are willing to pay a premium to hold positions. The futures activity reflects heightened trader Optimism and commitment to upward price movement.

PEPE’s on-chain growth has accelerated, with new addresses up 39.01% and active addresses climbing 38.43% over the past week. Zero-balance wallets also surged by 42.41%, reflecting intensified wallet churn and heightened speculation.

This user expansion signals rising confidence and growing token utility, potentially adding organic buy pressure. Meanwhile, whale interest is also increasing, as large transactions ROSE 6.63%.

Whale Accumulation Drives Supply Squeeze

Santiment data shows that whales have continued to accumulate Pepe coins this month. Holders with between 10 million and 100 million Pepe coins have increased their holdings to over 4.07 trillion tokens, up from 3.9 trillion.

The supply held in exchanges has continued to fall and reached a low of 98.9 trillion, down from 214 trillion in August last year. Plunging exchange balances are a bullish factor because it means investors are moving their coins to self-custody wallets.

The MVRV indicator has continued rising and has just exited the negative zone. The MVRV indicator remained below zero recently, meaning it has been highly undervalued.

It has now exited the sub-zero level and is pointing upwards, showing bullish momentum. The ongoing ethereum price surge is also expected to boost the Pepe price.

ETH has jumped to $3,000, and the odds of it reaching $4,000 have jumped. Such a move will increase the value of tokens in its ecosystem, including PEPE and Shiba Inu.

The token must close decisively above $0.00001580 to validate the cup-and-handle pattern. Without that breakout, momentum could fade. Traders should watch for rising volume and continued holder growth as confirming signals.