Ethereum (ETH) Soars as Corporate Treasuries and ETF Inflows Fuel Explosive Market Rally

Ethereum rockets higher—Wall Street finally wakes up.

Corporate treasuries and ETF inflows are pumping ETH's price like a 2021 meme coin. Suddenly, every CFO wants a slice of the blockchain pie (after fighting it for a decade).

The institutional floodgates swing wide.

BlackRock's ETH ETF crossed $1B AUM in 72 hours—faster than their Bitcoin product. Meanwhile, Fortune 500 balance sheets now collectively hold over 3M ETH. Guess they've moved on from 'it's a scam' to 'how high can it go?'

Technical breakout confirms the hype.

ETH smashed through $4,200 resistance like a hot knife through institutional FOMO. The 30-day RSI hasn't been this overbought since the ICO craze—but this time, it's suits writing the checks.

The cynical take? Banks will front-run the rally, dump at the top, then lobby for stricter regulations. Rinse and repeat.

TLDR

- Corporate Ethereum treasury companies accumulated more than 545,000 ETH worth $1.6 billion over the past month

- US spot Ethereum ETFs saw record weekly inflows of 225,857 ETH, marking the fourth-largest weekly inflow on record

- SharpLink became the largest corporate Ethereum treasury with over 255,000 ETH holdings

- Ethereum funds posted 12th consecutive week of inflows totaling $990 million

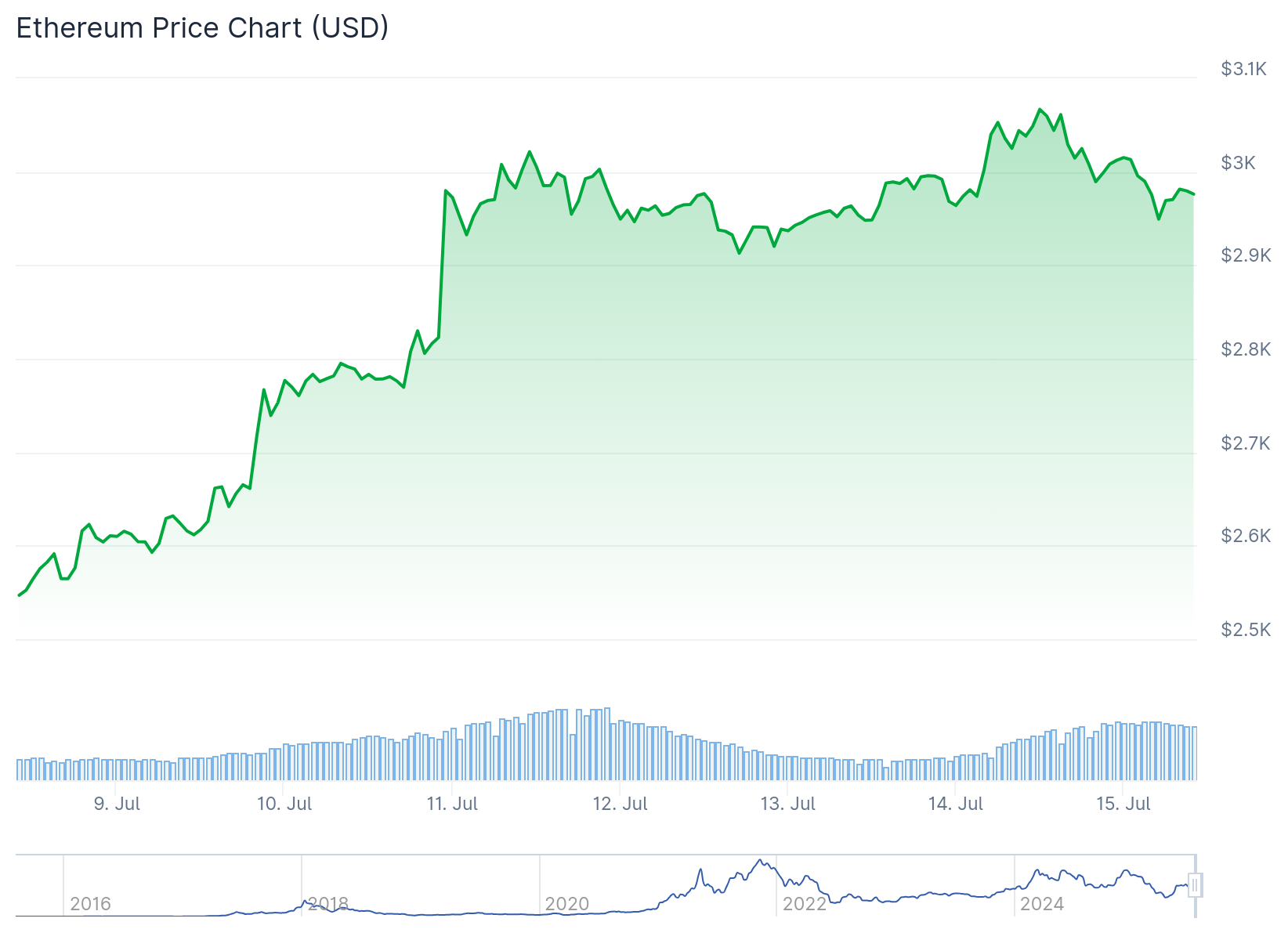

- ETH briefly topped $3,000 for the first time since February before pulling back to $2,986.76

Ethereum is experiencing strong institutional demand as corporate treasuries and exchange-traded funds drive purchasing activity. The cryptocurrency currently trades at $2,986.76, down 0.32% from the previous day.

Corporate treasury companies have accumulated more than 545,000 ETH over the past 30 days. This represents approximately $1.6 billion in purchases at current market prices.

BitMine Immersion Technologies announced its total Ether holdings reached 163,142 ETH. The company is chaired by Fundstrat’s Tom Lee. The holdings are worth around $480 million at current market value.

SharpLink has emerged as the largest corporate ethereum treasury. The gaming platform acquired 10,000 ETH on July 11, 16,370 ETH on July 13, and 24,371 ETH for $73.2 million on Monday.

Joseph Lubin’s company now holds over 255,000 ETH total. Lubin is the founder of Consensys and has called himself a “self-appointed representative of The League of Extraordinary ETH Accumulator Gentlemen.”

Record ETF Inflows Drive Institutional Interest

US spot Ethereum ETFs experienced their largest weekly net inflow on record. The funds received 225,857 ETH during the week, according to Glassnode data.

$ETH broke above $3K for the first time since February.

Meanwhile, US spot #Ethereum ETFs recorded their largest weekly net inflows since launch – 225,857 #ETH – extending a multi-week trend of growing institutional demand. pic.twitter.com/zRuhsE4f0u

— glassnode (@glassnode) July 14, 2025

Ethereum-based digital investment funds posted their 12th consecutive week of inflows. The total reached $990 million, marking the fourth-largest weekly inflow on record.

CoinShares reported that Ethereum products have seen more than $4 billion in inflows so far this year. Almost 30% of that total has come in the last two weeks.

The inflows represent 19.5% of total assets under management for all global Ether funds over the past 12 weeks. This compares to 9.8% for Bitcoin funds during the same period.

Additional Corporate Treasury Activity

Bit Digital maintains more than 100,000 ETH in its corporate treasury. The digital asset platform joins the growing list of companies holding Ethereum reserves.

Blockchain Technology Consensus Solutions raised $62.4 million to expand its ETH holdings to 29,122 ETH this month. GameSquare announced a strategic plan for a $100 million Ethereum treasury on July 8.

Price Movement and Trading Activity

ETH briefly topped $3,000 for the first time since February on July 11. The cryptocurrency has since pulled back below that level but maintains a 17% gain for the week.

Trading volume reached $32.34 billion, marking a 95.12% increase in market activity. The average price over the past seven days hovers NEAR $2,987.93.

Price forecasts for 2025 vary among analysts. DigitalCoinPrice estimates ETH may reach $6,507.27 in late 2025, while Changelly projects a more conservative range between $2,429.85 and $3,023.58.