Bitcoin Price Prediction: BTC Rockets to $123K—Is $130K Next Before the Cycle Peaks?

Bitcoin just blasted past another psychological barrier—$123K—and the bulls aren't tapping the brakes. With institutional FOMO reaching a fever pitch, the question isn't 'if' but 'how high' before this cycle tops out.

### The $130K Threshold: Greed or Gravity?

Market makers whisper about 'resistance turned support' while retail traders leverage up like it's 2021. Meanwhile, Wall Street quietly hedges—because nothing says 'confidence' like a double-digit derivatives book.

### The Liquidity Paradox

Every CEX's order book shows buy walls thicker than a banker's skull, yet OI-weighted funding rates suggest someone's about to get liquidated. Spoiler: It's never the whales.

As the halving echo pumps scarcity narratives (again), remember: cycles don't die of old age—they get murdered by the Fed. Place your bets.

Bitcoin Just Hit $123K – Here’s What’s Driving the Rally

Bitcoin experienced another aggressive rally over the weekend, taking its market cap to a whopping $2.43 trillion.

Spot volumes surged past $100 billion in the past day alone – which is impressive considering weekends usually mean lighter trading.

On top of that, Bitcoin futures open interest just reached an all-time high of $41.2 billion, suggesting traders think there’s more room to run.

Several key factors are driving this rally. Big institutions continue to pour money into the spot bitcoin ETFs – especially BlackRock and Fidelity – which creates steady, upward pressure on the BTC price.

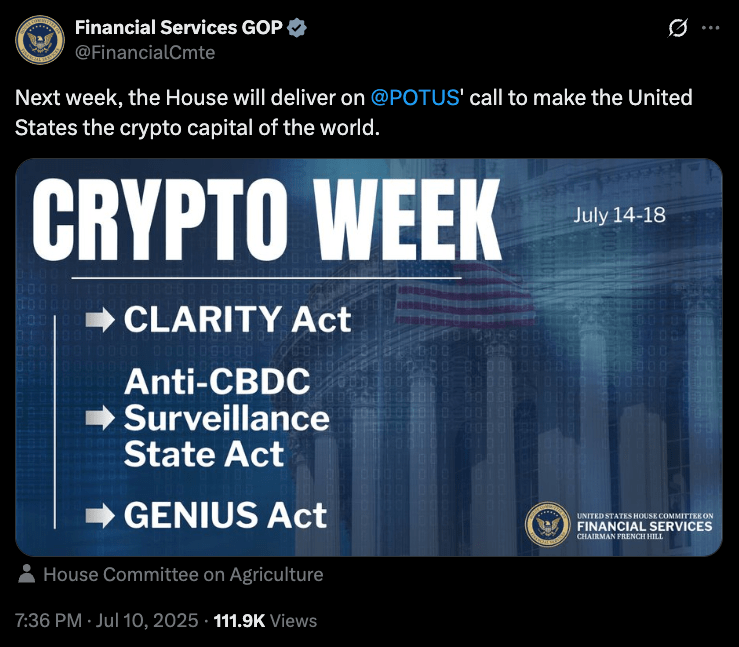

Meanwhile, “Crypto Week” in Washington this week has traders optimistic, as lawmakers discuss making the U.S. a global crypto hub.

Even corporations are increasing their exposure: Metaplanet recently joined the top-five Bitcoin-holding companies.

And investors are increasingly turning to Bitcoin as inflation worries and geopolitical tensions drive demand for non-traditional hedge assets.

Could Bitcoin Hit $130K This Cycle? Here’s What to Watch

With Bitcoin already above $123,000, reaching $130,000 isn’t much of a stretch – only around a 6% jump from here.

Analysts are optimistic it could happen, with the likes of 10x Research and Bitget targeting anywhere between $130,000 and $160,000 this year. Some even see $200,000 if things go particularly bullish.

Plus, from a technical perspective, $130,000 is the next logical level to watch, since it’s a round number.

For Bitcoin to reach that level, the current pace of institutional inflows needs to keep up.

Spot ETFs will keep absorbing more Bitcoin than miners produce – creating a constant squeeze on supply.

Meanwhile, clearer crypto-friendly regulations from the U.S. and Europe could inspire even more institutional buying.

Add in ongoing inflation worries, fiscal policy risks, and geopolitical uncertainties, and Bitcoin’s appeal as “digital gold” just keeps growing.

The rally doesn’t seem like it’ll slow down anytime soon.

BTC’s Rally Could Boost Altcoins Like Bitcoin Hyper – New Layer-2 Project Raises $2.7M

Whenever Bitcoin breaks new ground, altcoins tend to follow, especially projects closely aligned with the coin’s growth.

Right now, one new project capturing attention is Bitcoin Hyper (HYPER), a Bitcoin-focused Layer-2 network that’s going viral in its presale.

Bitcoin Hyper has already raised over $2.7 million, with the native HYPER token currently available for just $0.01225.

Its big selling point is that it aims to make Bitcoin more useful – not just a way to store and transfer value, but a fast, affordable blockchain supporting DeFi, staking, NFTs, and even meme coins.

Using the Solana VIRTUAL Machine (SVM) and secured by zero-knowledge proofs, Bitcoin Hyper plans to speed up BTC-based transactions and cut costs.

Popular crypto analysts like JRCRYPTEX have highlighted Bitcoin Hyper as a promising altcoin pick because of this setup. He also noted how early investors can generate passive income while the presale is live.

Right now, HYPER staking yields are sitting at 320% APY. And over 163 million tokens have already been locked in the staking pool.

As Bitcoin’s rally draws more attention to BTC-linked altcoins, projects like Bitcoin Hyper could benefit significantly.

That’s because early-stage projects like this give investors a chance to buy before tokens hit exchanges and everyone else catches on.

It’s definitely one to watch as Bitcoin continues to grow stronger.

Visit Bitcoin Hyper Presale