Ethereum Eyes $3,700 Target, But This Key Resistance Stands in the Way

Ethereum's price action hints at a bullish breakout, but the path to its next major target is anything but clear.

The Setup for a Surge

Momentum is building. The charts show a foundation that could support a significant upward move, with key technical indicators aligning in a favorable pattern. Traders are watching for a decisive close above a critical level to confirm the trend.

The Wall at $3,700

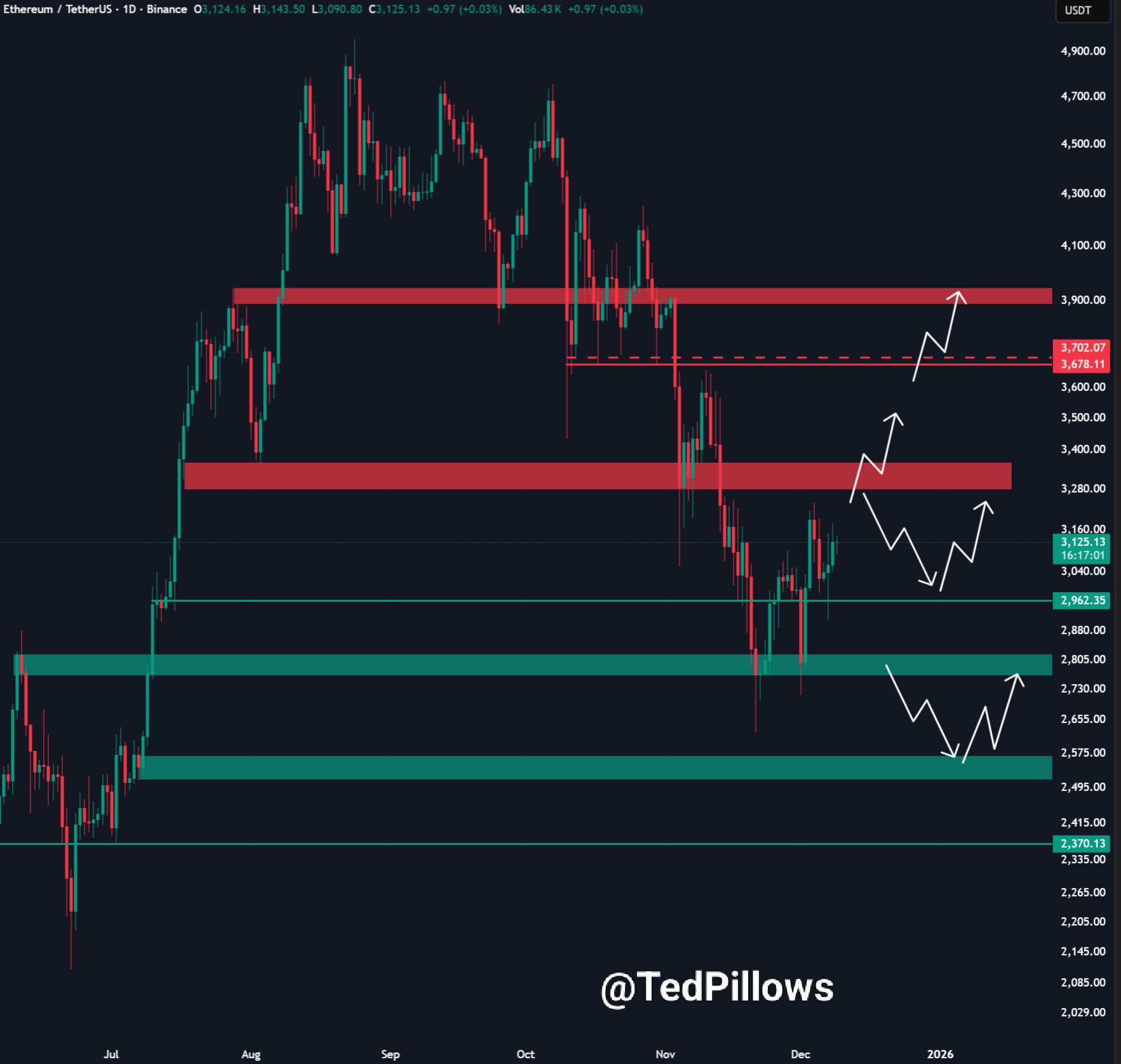

That's where the real test begins. The $3,700 mark isn't just a number—it's a psychological and technical fortress. Historical data shows heavy selling pressure clustered around this zone, a reminder that every rally faces its skeptics. Breaking through requires sustained buying volume, the kind that shakes out weak hands and convinces the sidelines to jump in.

Navigating the Noise

Market sentiment is a fickle beast. One day it's fueled by institutional adoption narratives, the next it's spooked by regulatory whispers from a bureaucrat who probably still thinks a 'hard fork' is a breakfast item. Cutting through that noise is key. The price will follow pure supply and demand dynamics, not Twitter threads.

The stage is set. Ethereum has the promise, but now it needs the push. Watch for a clean break and hold above resistance—that's the signal the market is waiting for. Until then, it's all just hopeful chart-drawing and the kind of optimistic predictions that keep crypto analysts in business.

TLDR

- Ethereum price is up 6.7% and trades near $3,320, aiming for $3,710.

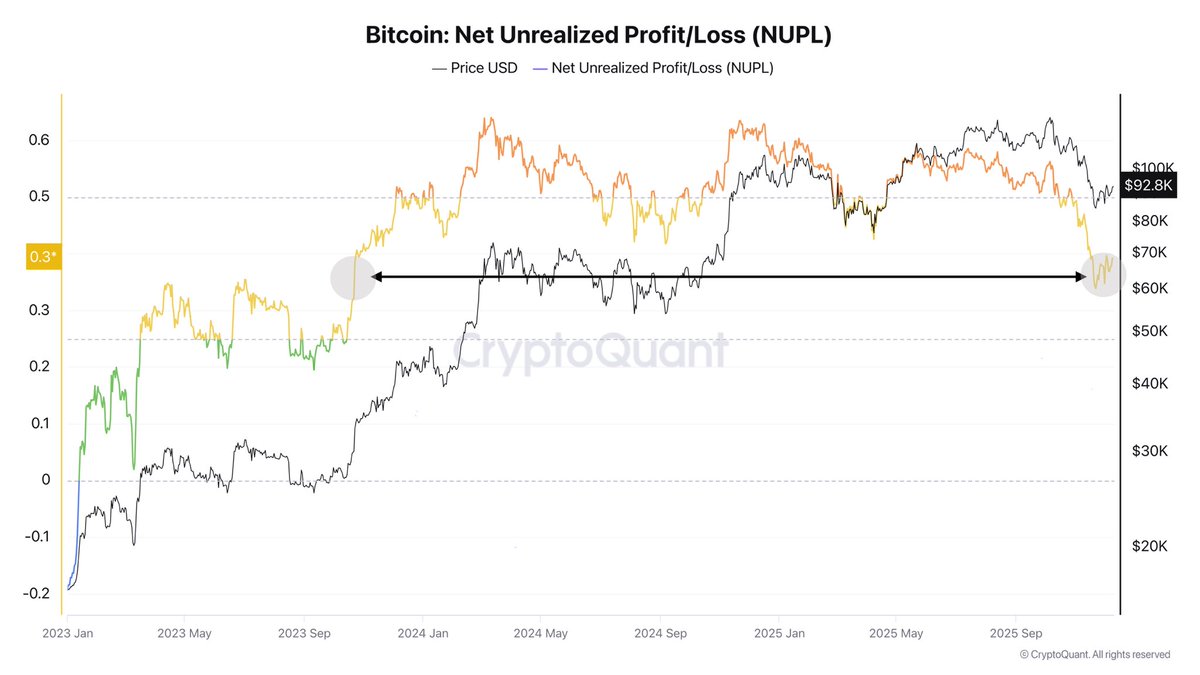

- Rising net unrealized profit/loss signals profit-taking risks for ETH.

- Ethereum’s bullish crossover on EMAs could trigger further price gains.

- A close above $3,390 may signal the move toward the $3,710 target.

Ethereum’s price has surged 6.7% in the past 24 hours, reaching around $3,320, fueling expectations of a rise toward $3,710. However, while a bullish breakout pattern is in play, rising paper profits could slow the climb. With ethereum holders sitting on unrealized gains, profit-taking could delay the anticipated move. Will Ethereum push higher, or will the growing selling pressure cause a pause? Here’s what to watch.

Ethereum Price Nears $3,700 Target but Faces Rising Profit-Taking Risks

Ethereum’s price has surged by 6.7% in the last 24 hours, trading at approximately $3,320. This movement follows the confirmation of a breakout structure on December 3, suggesting the price could head toward $3,710. However, mixed signals in the market suggest that Ethereum’s climb toward this target might take longer than anticipated.

Despite the bullish momentum, a key on-chain metric points to growing risks of profit-taking among investors. This uncertainty has raised concerns that the bullish crossover, which WOULD signal further upward movement, may be delayed as some investors may choose to sell their holdings.

Breakout Structure Remains Valid for Bullish Move

The recent price action shows Ethereum maintaining the inverse head-and-shoulders breakout pattern that was formed in late November. This pattern remains valid, with the right-shoulder support at $2,710 holding up well. As long as Ethereum stays above this level, the bullish setup continues, with a projected target of $3,710.

A crucial factor contributing to the positive outlook is the formation of a bullish crossover between the 20-period and 50-period Exponential Moving Averages (EMA). The 20-period EMA is crossing above the 50-period EMA, a typical signal of increasing buying strength. A confirmed crossover could push Ethereum toward the $3,710 target, providing further momentum to the current uptrend.

Rising Paper Profits Could Slow the Price Action

Although the technical setup for a continued rally remains intact, Ethereum’s Net Unrealized Profit/Loss (NUPL) metric is showing a rise. NUPL measures the “paper profits” of holders. When NUPL increases, more holders are sitting on unrealized gains, which may lead to profit-taking.

Ethereum’s NUPL has reached a level of 0.296, moving into the “Optimism–Anxiety” zone. This is the highest level since early November, suggesting that many holders might begin selling their positions to lock in profits.

The last time NUPL was at a similar level was on December 3, which saw a price correction of around 5.2% as holders cashed out. This pattern may repeat, as Ethereum’s price is once again NEAR resistance levels. If profit-taking picks up, it could delay the bullish crossover or even cause it to fail, stalling the upward momentum.

Key Price Levels to Watch for Ethereum’s Path Toward $3,710

For Ethereum to continue its upward movement, several key price levels must be cleared. A 12-hour close above $3,390 would be the first sign that the price is heading toward the $3,710 target. If this level is surpassed, the next resistance lies at $3,570. A break above $3,570 would unlock the full potential for Ethereum to reach the measured price target of $3,710.

On the other hand, if the selling pressure increases, Ethereum’s breakout structure could weaken. A MOVE below the support levels of $2,710 could invalidate the current bullish setup. A deeper pullback could occur if the price falls below $2,610.

For now, Ethereum remains in a critical position, caught between bullish momentum and the rising risk of profit-taking. The coming days will be crucial in determining whether the price can push toward $3,710 or if a correction will take precedence.