BREAKING: Nasdaq Greenlights Canary Capital’s XRP ETF (XRPC) – Trading Starts Today

Wall Street just got a new crypto toy. The Nasdaq officially approved Canary Capital's XRP ETF for trading under ticker XRPC—effective immediately. Here's why it matters.

XRP bulls finally get their mainstream moment. After years of regulatory purgatory, Ripple's native token cracks the ETF big leagues. No more OTC limbo—this is direct exposure with Wall Street's stamp of approval.

How it works: XRPC tracks XRP's price through institutional-grade custody. No self-custody headaches, no exchange hacks—just pure, SEC-vetted speculation. Perfect for hedge funds who want crypto exposure without the crypto headaches.

The cynical take? Another financialized wrapper for an asset that was supposed to 'bank the unbanked.' But hey—when did Wall Street ever miss a chance to repackage something and charge fees?

One thing's certain: The crypto ETF arms race just got hotter. With Bitcoin and Ether ETFs already trading, XRP's admission signals regulators might—might—be softening on 'altcoins.' Next stop: Solana ETF?

Trading starts at market open. Buckle up.

TLDR

- The Canary Capital XRP ETF will be listed under ticker XRPC on Nasdaq today.

- It’s the first single-token, spot-based XRP ETF approved for trading.

- The ETF tracks the XRP-USD CCIXber Reference Rate Index for investors.

- The ETF’s launch follows the end of the U.S. government shutdown.

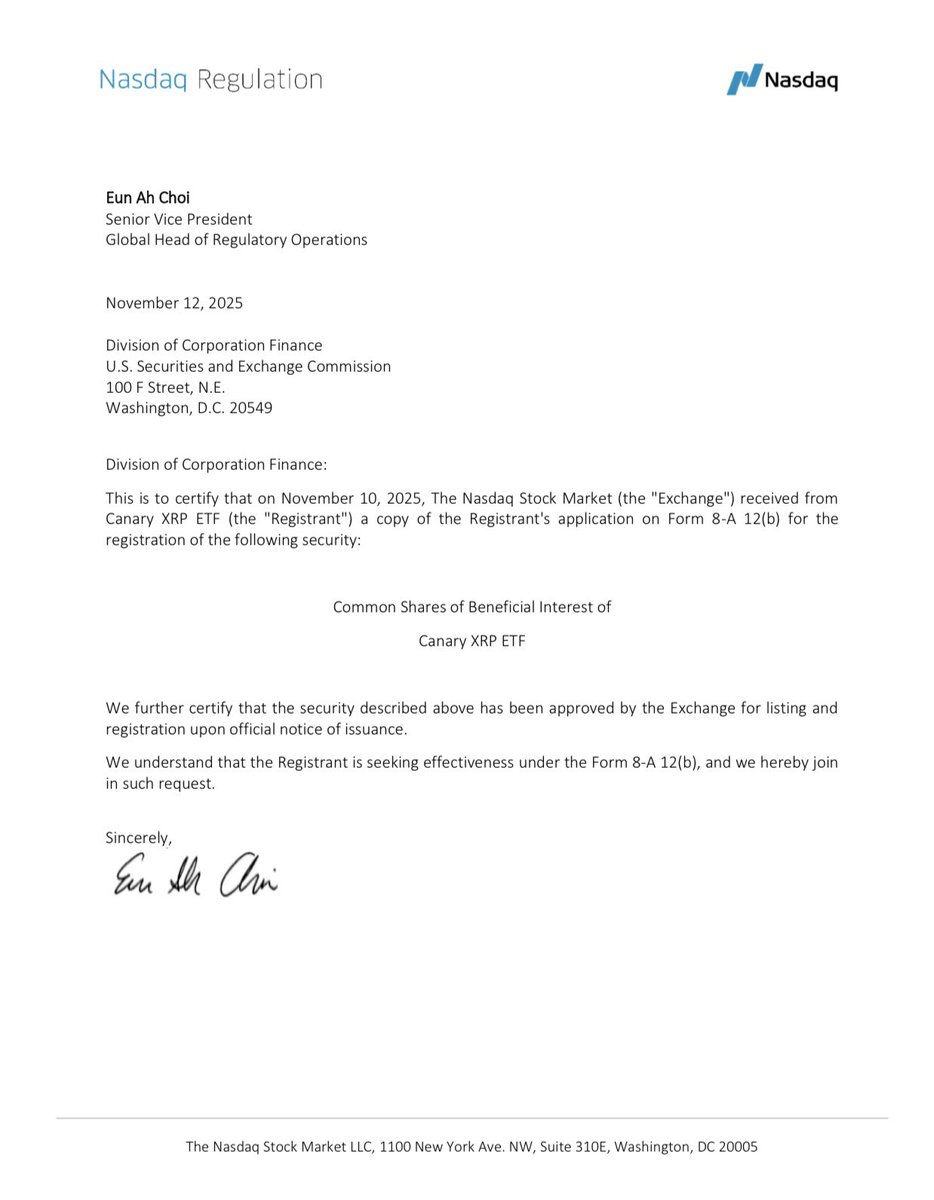

The Nasdaq exchange has officially approved the Canary Capital XRP ETF for trading. This certification marks a significant step in the cryptocurrency investment landscape. The ETF, which will be listed under the ticker XRPC, is set to launch today. It represents the first single-token spot XRP exchange-traded fund (ETF) to be available to investors on a major U.S. exchange.

XRPC ETF to Track XRP-USD Index

The Canary Capital XRP ETF will track the XRP-USD CCIXber Reference Rate Index. This index measures the value of XRP in relation to the U.S. dollar, providing investors with a way to gain exposure to XRP without holding the cryptocurrency directly. The ETF is expected to offer an accessible investment product for those interested in the digital asset, providing the opportunity to buy and sell XRP through traditional brokerage platforms.

The ETF will be listed under the ticker symbol XRPC, and trading is set to commence immediately after the official certification. With this launch, investors will be able to trade the fund just like any other exchange-traded product. The ETF is the first of its kind, following a regulatory pathway that allows it to hold XRP directly under the Securities Act of 1933.

Canary Capital’s Milestone in Crypto ETFs

The approval of the Canary Capital XRP ETF positions the firm as the first issuer to launch a single-token, spot-based XRP ETF. This achievement comes after Canary Funds submitted its final FORM 8-A with the Securities and Exchange Commission (SEC) earlier this week, clearing the final hurdle for Nasdaq’s certification.

Steven McClurg, CEO of Canary Funds, expressed his excitement about the ETF’s launch. He thanked the leadership at the SEC, particularly Chairman Paul Atkins and Commissioner Hester Peirce, for their role in supporting free markets. “We are very excited to go effective with the first single-token spot XRP ETF. This WOULD not have been possible without the leadership of Chairman Atkins, Commissioner Pierce and all of the other fine people at the SEC,” said McClurg.

A Boost for Cryptocurrency Investors

The launch of the Canary Capital XRP ETF is expected to draw significant attention from investors seeking exposure to XRP. Many analysts predict sizable inflows into the fund, which could help further integrate cryptocurrency investments into traditional financial markets. This launch comes as other asset managers, including Franklin Templeton, Bitwise, and 21Shares, are also working on their own XRP-based funds.

This development follows a period of Optimism in the U.S. following the resolution of the government shutdown. With a renewed focus on economic stability, some analysts believe that digital assets like XRP may see greater liquidity and stronger market performance. This may help foster greater interest in the newly launched ETF.

Regulatory Developments and the Future of Crypto ETFs

The approval of the Canary Capital XRP ETF also signals a shift toward greater regulatory clarity for the cryptocurrency sector. SEC Chair Paul Atkins recently emphasized the need for clearer frameworks for cryptocurrencies, extending beyond enforcement actions. The approval of this XRP ETF suggests that regulators are becoming more comfortable with crypto-based financial products, which could pave the way for further innovation in the sector.

As more crypto ETFs launch, analysts will continue to monitor the market’s response to this new investment vehicle. The Canary Capital XRP ETF is just the beginning, with many industry observers predicting that similar products for other cryptocurrencies will soon follow.