PayDax Protocol (PDP) Unveils Ethereum’s Most Resilient Banking Infrastructure

DeFi just got a banking upgrade—and it's built to last.

The PayDax Protocol (PDP) is rewriting the rules of decentralized finance with institutional-grade infrastructure on Ethereum. No more fragile bridges or shaky liquidity pools—this system is engineered for stability.

Key features include:

- Battle-tested smart contracts that survived the 2024 'DeFi Stress Test'

- Zero-downtime upgrades (unlike certain legacy banks during quarterly maintenance)

- Compliance rails that actually work with regulators instead of pretending they don't exist

Early adopters report 99.99% uptime even during network congestion—a stark contrast to the 'banking hours' mentality of traditional finance.

One hedge fund manager quipped: 'Finally, a DeFi project that doesn't treat security like an afterthought—though I'll believe the 'no downtime' claim when I see it during the next crypto winter.'

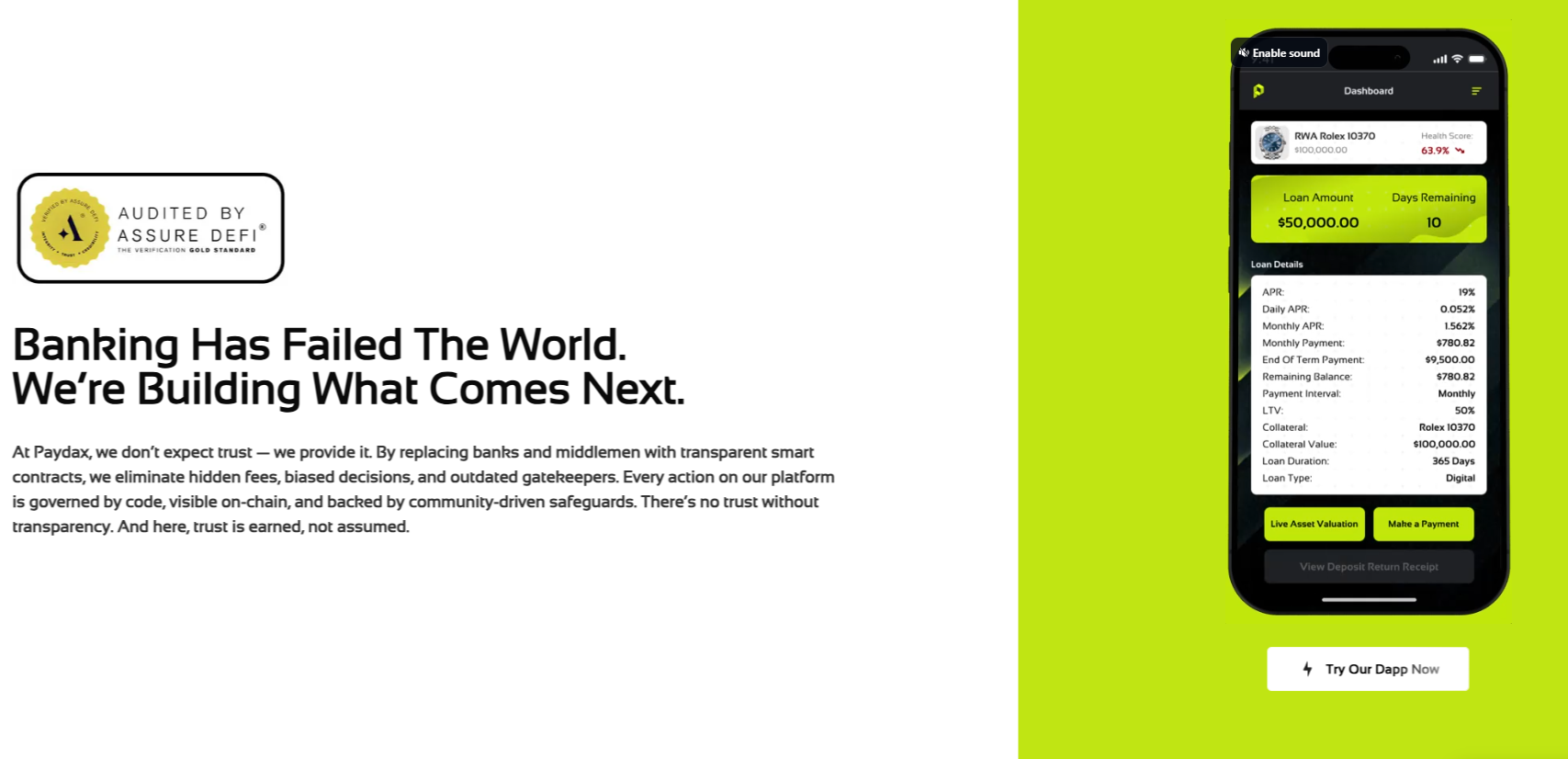

How Lending Works in PayDax

Paydax’s key innovation lies in its unique lending model. Users can pledge cryptocurrencies such as Ethereum, Solana, or XRP as collateral and access loans at flexible loan-to-value (LTV) ratios of 50%, 75%, 90%, or even 97%. This flexibility enables borrowers to manage their liquidity without having to sell.

The system becomes even more innovative with tokenized real-world assets. Luxury watches authenticated by Sotheby’s, Gold bars secured by Brinks, or even prime real estate can be tokenized and used as collateral. Instead of gathering dust in vaults or sitting idle, these assets are transformed into productive tools that unlock liquidity.

By combining crypto and RWAs under one protocol, PayDax bridges the gap between decentralized finance and traditional banking. The result is a borderless, global lending model where users from any location can unlock capital without the barriers of geography or centralized institutions.

What Lenders and Stakers Gain

PayDax isn’t just for borrowers; it also opens up attractive opportunities for lenders. By funding overcollateralized loans, lenders can earn yields of up to 15.2% APY, far exceeding the low returns of traditional savings accounts. Without intermediaries, all profits stay between lenders and borrowers.

To add extra security, PayDax introduces the Redemption Pool, a decentralized insurance system. If a borrower defaults and collateral doesn’t cover the loan, the pool steps in to protect lenders. Stakers who fund the pool act as insurers, earning premiums of up to 20% APY in return for taking on the risk.

For experienced users, Leveraged yield farming offers even higher rewards. By borrowing extra funds, participants can increase their positions and potentially earn yields over 40% APY. With protections like overcollateralization and automated liquidations, this high-reward approach balances opportunity with stability.

Partnerships That Reinforce Trust

DeFi has often faced skepticism due to a lack of trust and transparency, but PayDax addresses this directly through world-class partnerships. Authentication of RWAs is handled by Christie’s and Sotheby’s, ensuring that assets, such as art and luxury items used as collateral, are genuine and properly valued.

Custodianship is managed by Brinks and Prosegur, both of which are trusted by governments and financial institutions worldwide. These custodians provide the same level of security for tokenized RWAs as they do for national treasuries, adding an unmatched LAYER of confidence for investors.

On the technology side, chainlink oracles stream real-time asset pricing, MoonPay provides seamless fiat on- and off-ramps, and Jumio handles KYC compliance. Together, these integrations create institutional-grade infrastructure, making PayDax one of the most credible banking solutions in the Ethereum DeFi space.

Transparency and Compliance

PayDax goes beyond partnerships to prioritize transparency at every level of its operations. The leadership team is fully doxxed, including the CEO, CTO, and CMO, who actively engage the community through AMAs, podcasts, and live video updates. This open communication promotes accountability and trust.

To ensure security, PayDax’s smart contracts are independently audited by Assure DeFi, providing confidence that the protocol is robust and free from hidden vulnerabilities. Regular audits are an integral part of the project’s commitment to protecting both users and institutional partners.

Adding to this credibility is PayDax’s official registration as a legal business entity. This structure reassures investors that they are dealing with a compliant organization rather than an anonymous startup with little accountability. Combined with open communication, these measures place PDP as the go-to project.

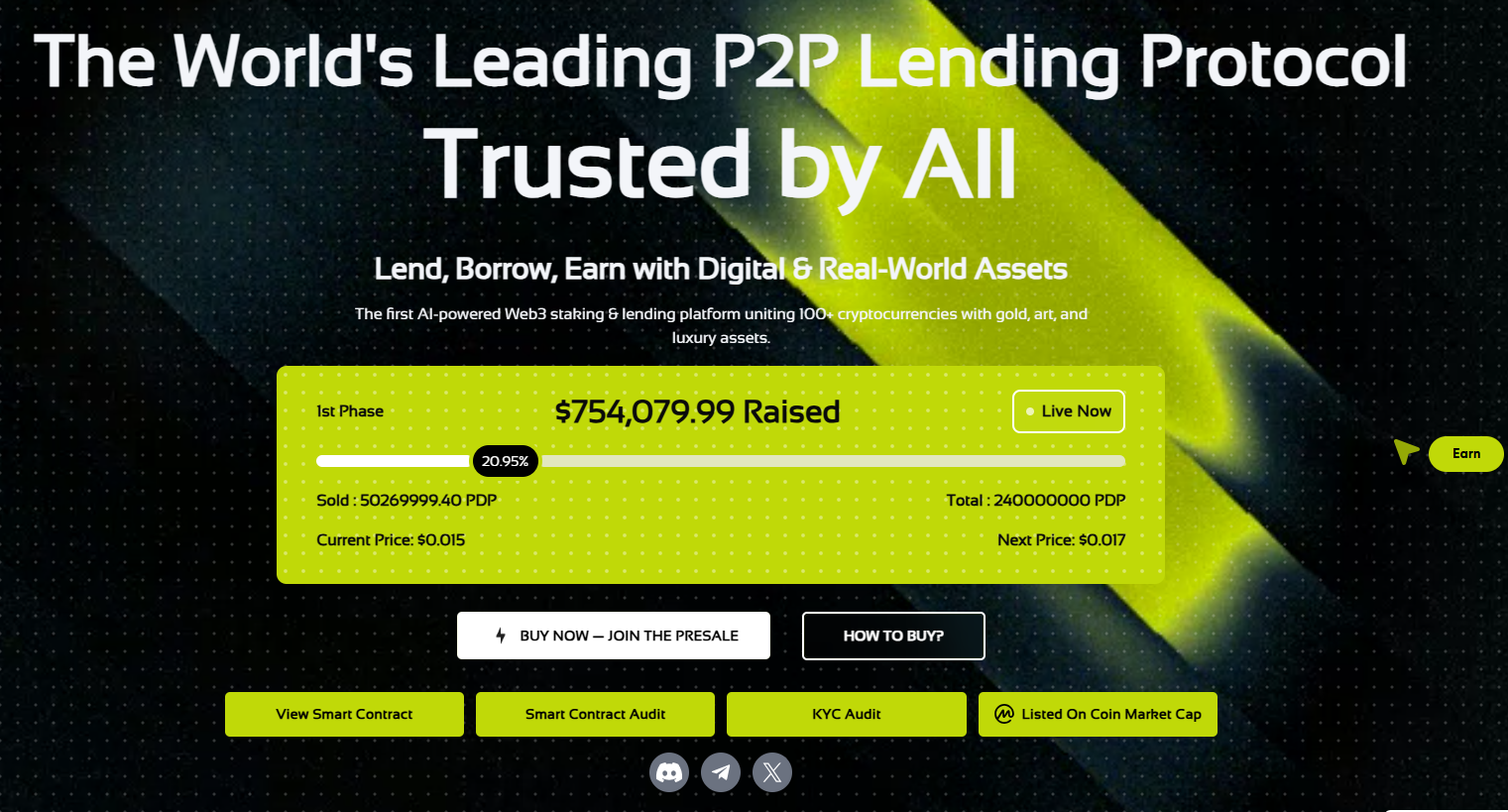

Invest Now in Ethereum’s New Banking Standard

Historically, October has often driven rallies in the crypto market, making PayDax’s entry perfectly timed. Priced at just $0.015 per token, the presale offers investors an early, low-cost entry before subsequent increases and listings. If adoption speeds up this cycle, early investors might see PDP rise above $1.

Every loan, staking commitment, and Redemption Pool payout boosts demand for PDP, positioning it as the new banking standard on Ethereum. With an impressive reward system that includes an 80% bonus, referral bonuses, and investor ranking rewards, every investor can anticipate excellent ROI.

Beyond hype, PayDax is building sustainable infrastructure by blending DeFi with real-world collateral. For investors looking for asymmetric upside, this presale could be the next 100x opportunity on Ethereum. Before listing, the PDP token could transition from a hidden gem to a market leader.

Join the Paydax Protocol (PDP) presale Today.