PayDax Protocol (PDP) Ignites Crypto Frenzy: 100x Presale Opportunity Sparks Market Domination

PayDax Protocol's PDP token presale is setting the crypto world ablaze—positioning itself as the next moonshot with 100x potential. Here's why traders are FOMO-ing in.

The presale frenzy: PDP's aggressive tokenomics and DeFi integrations suggest it's aiming straight for the jugular of legacy payment systems. Early backers could ride the wave as PayDax carves its niche.

Market impact: If the hype holds, this could trigger a domino effect—altcoin liquidity shifts, copycat projects, and the usual cycle of euphoria followed by... well, you know how crypto winters start.

One thing's certain: while Wall Street debates CBDCs, PayDax is executing. Just don't mortgage your house for this presale—DYOR always applies.

The PayDax Protocol (PDP) Financial Model Built for People

For decades, banks and centralized platforms have extracted value by controlling the spread, which involves paying savers pennies while charging borrowers double digits.

DeFi was supposed to break this cycle, yet most protocols have only digitized the old system with small tweaks. PayDax Protocol (PDP) flips this script completely. It isn’t just a platform, but an entirely new framework where the spread vanishes and value flows directly between people.

This shift unlocks a flywheel effect across three key areas: lending, borrowing, and insurance. Each piece makes the system stronger for users while dismantling the dominance of centralized finance.

Lending: From Pennies to Double-Digit Yields

In today’s banking world, if Jane deposits $5,000, she might get a 1% annual return while her bank lends it out for 15%. On PayDax, Jane no longer plays the role of a passive saver. She becomes the bank, lending directly to borrowers at up to 15.2% APY.

The impact is twofold. Everyday people earn what banks used to hoard, and capital flows more efficiently across the ecosystem.

For early investors, this design demonstrates why PDP is being called a 100x token presale opportunity. In essence, PayDax doesn’t just promise higher yields; it rewrites the mechanics of finance itself.

Borrowing: Liquidity Without Gatekeepers

Traditional finance locks millions out of credit because of rigid collateral definitions and outdated scoring systems. Even DeFi incumbents like AAVE and MakerDAO impose strict limits.

However, PayDax Protocol (PDP) tears down these barriers by allowing real-world assets and crypto to serve as collateral, tokenized and verified on-chain.

Now, Alice can borrow against her Bitcoin without liquidating it. Michael can tokenize his Rolex, verified by Sotheby’s and secured by Brinks, to unlock funds without losing ownership.

For borrowers, this means instant liquidity without sacrificing prized or long-term holdings. For the crypto market at large, it signals an inclusive system where value isn’t dictated by banks, but by what people themselves decide has worth.

Insurance: Risk Shared, Not Centralized

Perhaps PayDax’s most disruptive feature is its approach to insurance. In most systems, lenders shoulder the full risk of defaults. On PayDax, risk is shared through the Redemption Pool.

If Bob lends Alice $10,000, Jack can step in as an insurer, underwriting the loan for a premium. If Alice repays, Jack earns the premium. If she defaults, the pool covers Bob’s losses, while Jack can still earn yields of up to 20% APY.

The outcome is a win-win cycle where lenders, borrowers, and insurers all benefit. This safety net doesn’t exist in legacy platforms, and it’s why many see PDP as not just another new token presale, but the key to a turning point for DeFi.

Why Trust Is Fueling Investor Confidence in PDP Token Presale

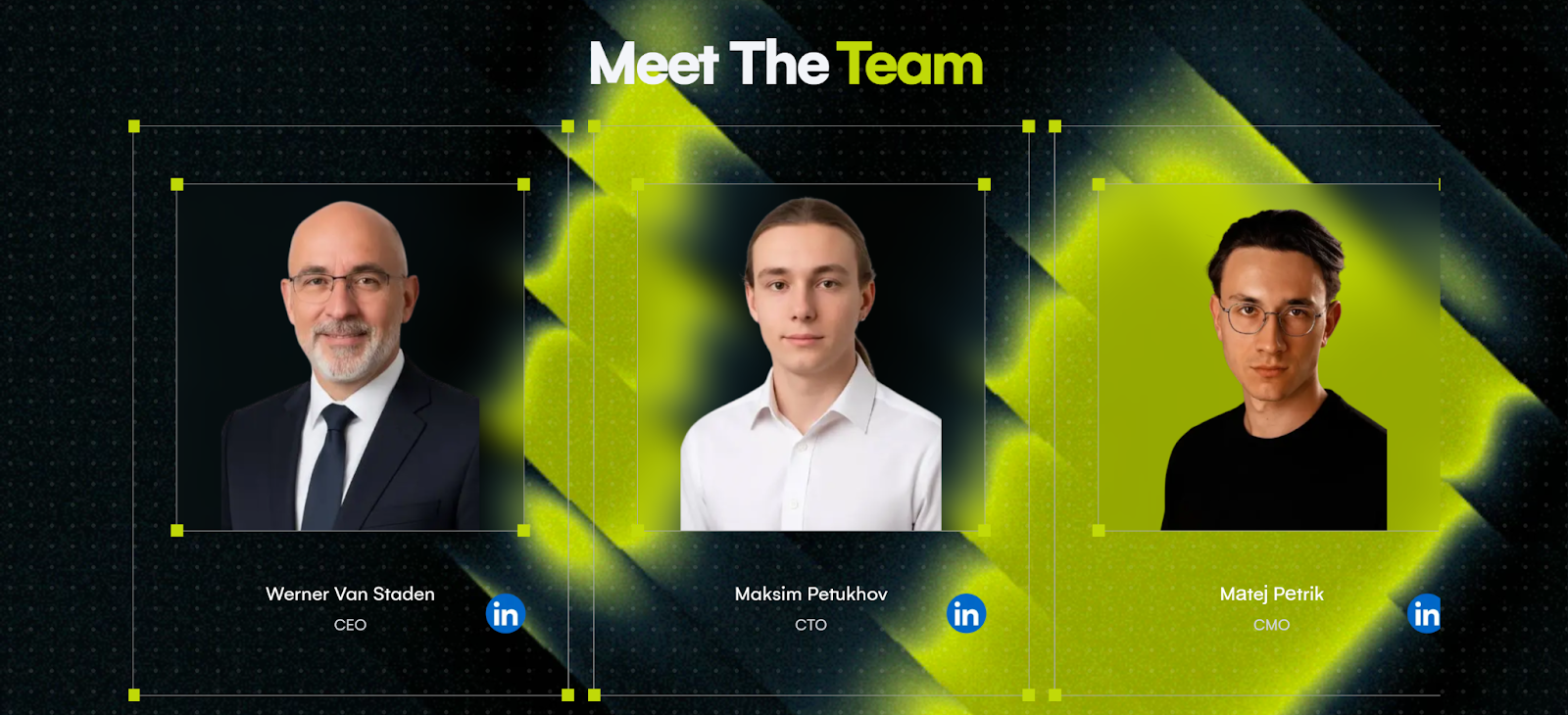

Narratives mean little without trust. Investors know this, which is why PayDax has doubled down on transparency. The team, led by CEO Werner Van Staden and CTO Maksim Petrukhov, has undergone full KYC audits, making them legally accountable.

This eliminates one of the biggest risks in new token presales, namely anonymity. On top of this, PDP’s smart contracts have been audited by Assure DeFi, providing ironclad verification of the system’s integrity.

For investors, these safeguards serve as a signal that PayDax is serious about its longevity. It’s why venture capital interest and institutional attention are beginning to circle the project.

The PDP Presale: A Window That Won’t Stay Open

At the center of it all is the PDP token, powering the ecosystem while capturing value for holders. Round 1 of the PDP token presale is live at just $0.015, with analysts projecting a 100x return potential as adoption grows.

At that projection, PDP can rise to $1.5 by the end of Q4, potentially turning a $1,250 Round 1 backing into $125,000. Moreover, early backers also have access to the PD80BONUS code, which delivers an 80% discount.

Momentum is already building, but time is running out. Over 20% of tokens in Round 1 have been sold, and with Q4’s bull run on the horizon, demand could push the stage to close ahead of schedule.

For investors watching the crypto market for the next breakout, this is a rare alignment of groundbreaking utility, verified trust, and an entry price that could translate into substantial gains but only if caught early.

Join the PayDax Protocol (PDP) presale and community: Join PayDax Protocol (PDP) presale | Website | Whitepaper | X (Twitter) | Telegram