Crypto Carnage: $1 Billion Liquidated as Altcoins Plunge 12% in 24-Hour Bloodbath

Digital asset markets got absolutely crushed overnight as leveraged positions evaporated in a cascade of forced selling.

The Altcoin Massacre

Alternative cryptocurrencies collectively shed 12% of their value—wiping out gains from the previous week in a single brutal session. The liquidation tsunami hit both long and short positions, but overeager bulls bore the brunt of the pain.

Margin Calls Galore

That $1 billion liquidation figure tells the real story: traders who thought they could outsmart volatility got their portfolios handed to them. Classic crypto—where your 'safe' 3x leverage becomes a suicide mission when the market sneezes.

Meanwhile, traditional finance guys are probably sipping champagne and muttering 'told you so' about volatility—while quietly increasing their own crypto allocations on the dip.

TLDR

- Bitcoin futures open interest holds at $25 billion but negative funding rates on Binance and OKX show traders are betting on price drops

- The 1-week 25 Delta Skew jumped to 12.6%, showing some traders are buying call options and expecting price increases

- Altcoins TAO, ASTER, and LDO dropped over 12% while TRX posted small gains during Thursday’s sell-off

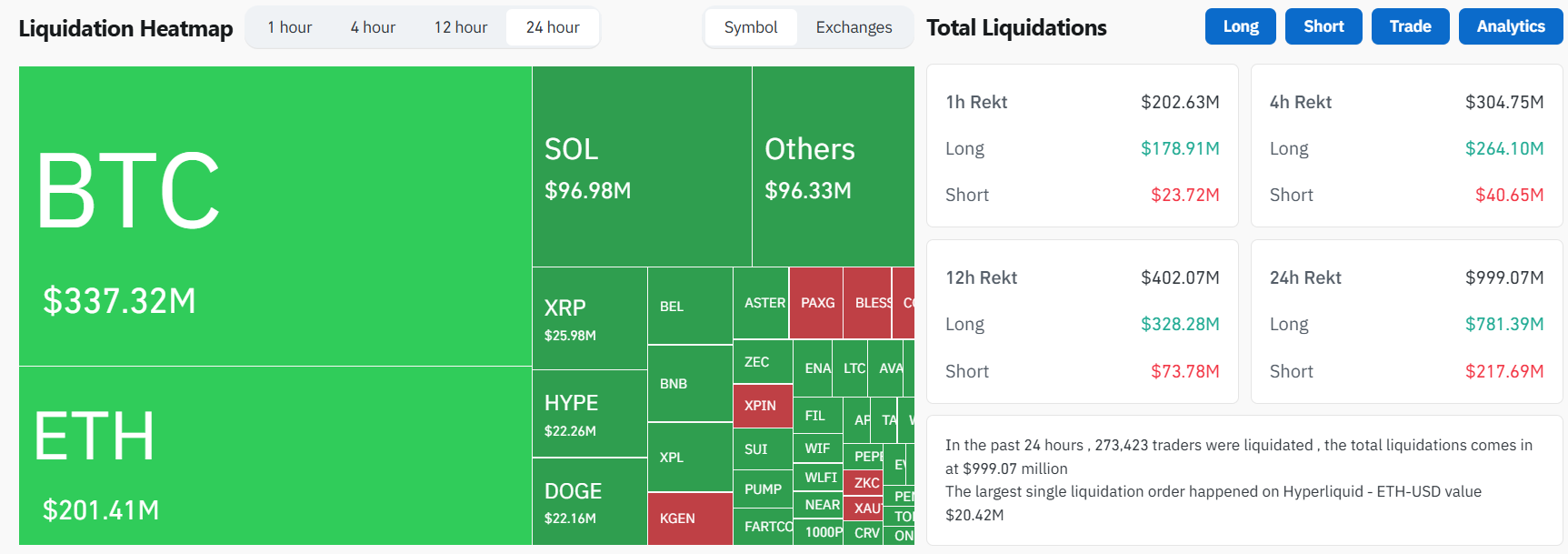

- Total liquidations reached $1 Billion in 24 hours with 70% being long positions, led by ETH at $115 million and BTC at $80 million

- US stocks fell on Thursday with the Dow dropping 300 points as regional bank loan problems and US-China trade tensions weighed on markets

Bitcoin and altcoins extended their October losses on Thursday as the crypto market faced another day of steep declines. The sell-off follows a weekend that saw $500 billion wiped from crypto market values.

Bitcoin futures open interest remained stable at around $25 billion. The 3-month annualized basis stayed in the 5-6% range. However, funding rates showed a split picture across exchanges.

Binance and OKX posted negative funding rates between -2% and -3%. Other platforms showed flat or slightly positive rates. The negative funding on major exchanges means many traders are holding short positions and betting on further price drops.

Options market data painted a different picture. The 1-week 25 Delta Skew spiked to 12.62%. This metric shows traders are paying higher premiums for call options and positioning for potential price increases.

The 24-hour Put/Call Volume ratio was roughly balanced. This indicates steady demand from both buyers and sellers in the options market.

Liquidation Data Shows Heavy Losses

Total liquidations hit $999 million over 24 hours. Long positions made up 70% of the liquidations while shorts accounted for 30%. ethereum led liquidations at $115 million, followed by Bitcoin at $80 million and other cryptocurrencies at $43 million.

The Binance liquidation heatmap identified $110,009 as a key level to watch. This level could trigger more liquidations if Bitcoin’s price drops further.

Altcoin Performance

Several altcoins suffered double-digit percentage drops on Thursday. TAO, ASTER, and LDO all fell more than 12%. TRX was an outlier, posting modest gains while most of the market declined.

Market liquidity remained thin throughout the session. Traders showed increased caution to avoid another liquidation cascade similar to the weekend’s event.

Traditional Markets Also Decline

US stock markets fell on Thursday with similar concerns affecting investor sentiment. The Dow Jones Industrial Average dropped 300 points or 0.6%. The S&P 500 fell 0.6% and the Nasdaq Composite lost 0.5%.

Regional bank stocks fell after Zions Bancorporation and Western Alliance reported loan problems. These disclosures raised concerns about credit quality in the banking sector.

The 10-year Treasury yield dropped below 4% as investors moved into bonds. Gold prices climbed above $4,300 per ounce, setting a new record. The US-China trade tensions continued with President TRUMP confirming elevated friction between the countries.

The US government shutdown entered its third week. The shutdown has prevented the Federal Reserve and Wall Street from receiving key economic data. Experts expect the stoppage to continue into November.

Coinglass data shows the Binance liquidation heatmap indicates $110,009 as a core liquidation level for Bitcoin in case of further price drops.