Ethereum’s $5,000 Comeback: Oversold RSI Signals Potential Breakthrough

Ethereum bulls eye critical resistance as technical indicators flash oversold signals.

Market Momentum Shifts

The Relative Strength Index dipping into oversold territory creates perfect conditions for a major rebound. Traders watch key levels as ETH tests market resilience.

Technical Breakout Potential

That $5,000 psychological barrier looms large—proving once again that in crypto, extreme fear often precedes the biggest opportunities. Because nothing says 'healthy market' like cheering for oversold conditions to justify another speculative run.

Ethereum Price Action Near Key Levels

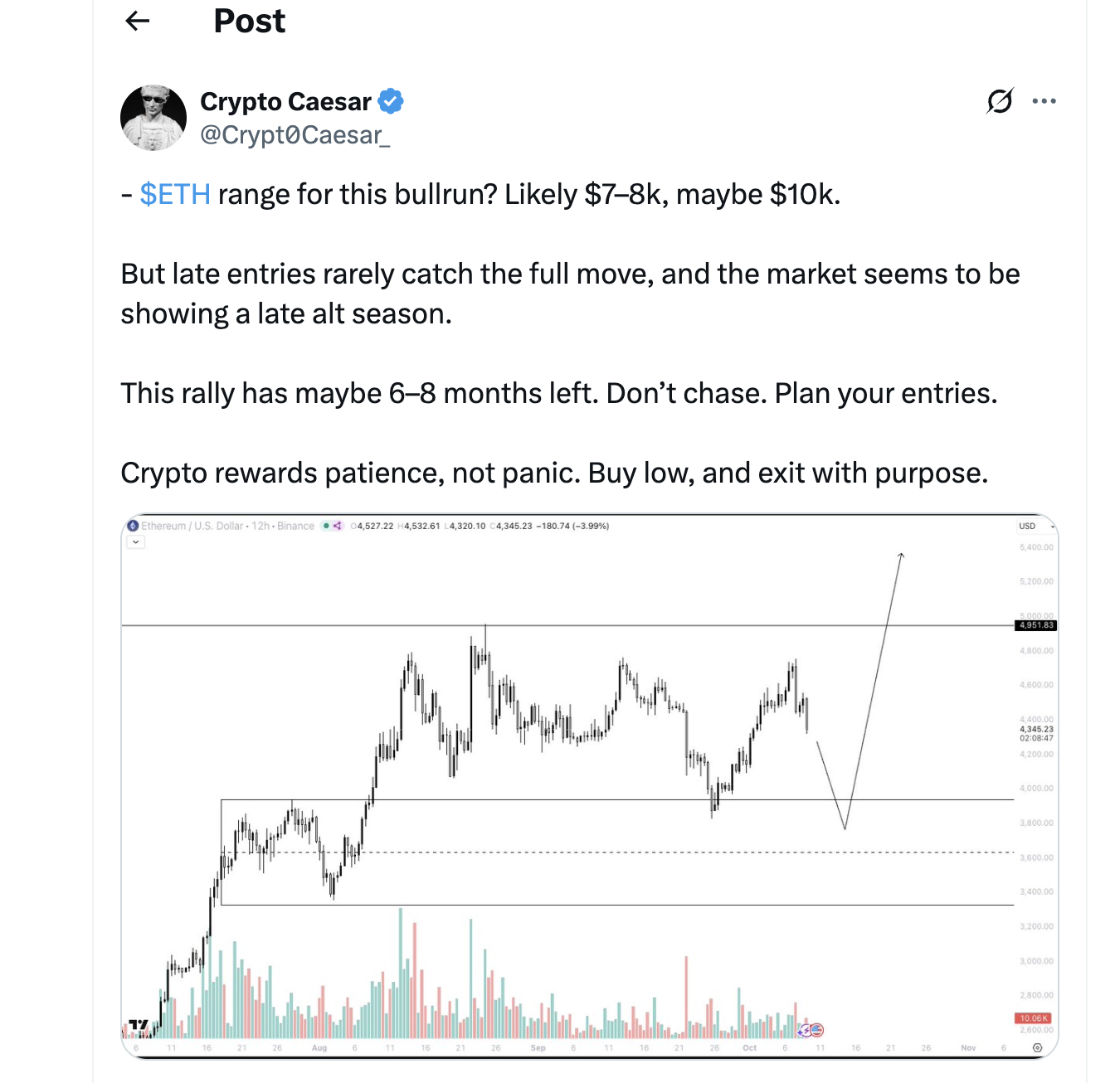

Ethereum price dropped sharply this week, mirroring Bitcoin’s selloff, but analysts say the network’s adoption still supports a path toward $10,000 in the long run. ETH fell to around $4,300 after facing repeated rejections NEAR $4,800, marking its fourth attempt to break that level in ten weeks.

Crypto analyst crypto Caesar said a dip below $4,000 may serve as a final shakeout before ETH recovers. The Relative Strength Index (RSI) shows the market near oversold levels, suggesting that a rebound could follow.

Investor Jelle also expects ETH to continue upward, calling the recent consolidation “a setup for continuation”. If momentum holds, ETH could climb above $5,000, confirming a bullish pattern that many traders are watching closely.

Ethereum Network Data Supports Bullish Outlook

Beyond short-term price moves, Ethereum’s network strength paints a solid picture. Data from CryptoQuant shows Ethereum’s internal contract calls, a measure of DeFi and tokenized asset activity, have risen to 9.5 million daily, up from 7 million in July.

This growth shows consistent user engagement, not just speculative activity. Analysts LINK this rise to three main drivers:

- Clearer stablecoin regulations in the U.S.

- Record institutional inflows into spot ETH ETFs

- The growing “treasury war” among corporations holding ETH

Ethereum also dominates the tokenized real-world assets (RWA) space, holding over 56% of market share. The sector’s total value now exceeds $11.7 billion, driven by projects like BlackRock’s BUIDL fund, which holds about $2.4 billion in assets on Ethereum.

Key Takeaways on Ethereum Price Prediction

- ETH RSI nearing oversold zone, signaling a possible rebound

- Price target: short-term $5,000, long-term $10,000

- Ethereum leads the RWA tokenization market

- Institutional inflows continue to grow

MAGACOIN FINANCE: The Altcoin to Watch Alongside Ethereum

As traders track ethereum price recovery, MAGACOIN FINANCE is catching eyes as a top altcoin to buy now. It’s built for stability during market swings and is positioned to outpace Ethereum’s price action in the next rebound.

The project’s price increases every hour, creating a sense of urgency among traders. With over 20,000 investors already in, many see it as a SAFE diversification play — especially as ETH aims for $5,000.

Early investors can get a 50% bonus using code PATRIOTS100X, and listings on major exchanges are said to be near.

Why MAGACOIN FINANCE:

- Price rises hourly — no dips

- Early investor 50% bonus active

- Over 20,000 holders already joined

- Exchange listing expected soon

- Ideal for diversification during volatile markets

How Traders Can Position Now

Ethereum remains a key player for long-term growth, especially as it nears oversold levels. But smart traders diversify. As ETH eyes $5,000, MAGACOIN FINANCE offers an early entry before exchange listings. Act early — visit the official website, follow on X, and join the Telegram group to stay updated:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance