XRP Escrow Shocker: Flare Vault Defies Ripple’s Schedule with 4M Token Lockup

Ripple's predictable escrow cycle just got disrupted—and the crypto world is buzzing.

The Unconventional Lockup

Flare Network's vault mechanism bypassed Ripple's established escrow rhythm, securing 4 million XRP tokens outside the scheduled release pattern. This move breaks from the automated monthly unlocks that typically govern XRP's circulating supply.

Market Mechanics in Motion

That's 4 million tokens removed from potential market circulation—a strategic play that could tighten supply dynamics. While Ripple's systematic escrow releases have created predictable selling pressure, this independent vault action introduces fresh variables into XRP's liquidity equation.

Strategic Implications

The Flare vault maneuver demonstrates how decentralized networks can influence asset economics beyond their creators' control. It's the crypto equivalent of finding extra cookies hidden behind the flour jar—everyone knows they exist, but their sudden appearance still changes the kitchen dynamics.

Another day, another clever financial engineering trick that makes traditional bankers scratch their heads while counting their 2% management fees.

TLDRs;

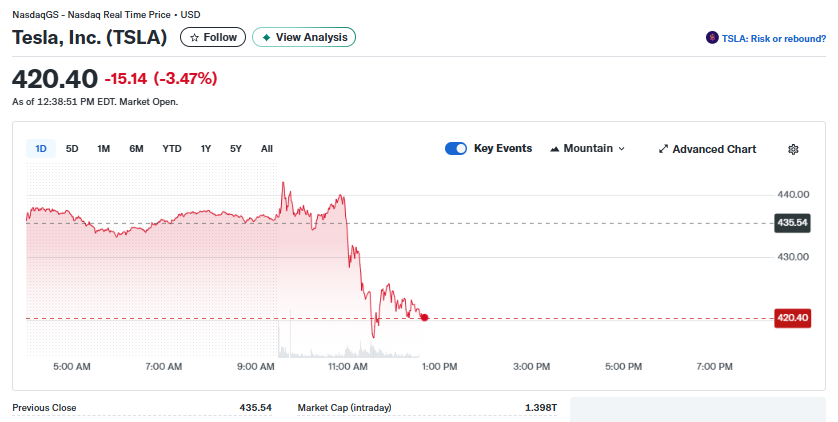

- Tesla shares fell 2.86% even as Musk could earn billions under his new pay plan.

- Some product milestones are broadly defined, allowing payouts without full autonomy.

- Two achievable targets could give Musk $26 billion in stock without profit milestones.

- ADAS subscriptions and EV growth reshape industry opportunities and regulatory compliance needs.

Tesla, Inc. ($TSLA) stock declined 2.86% Friday, reflecting investor caution despite Elon Musk’s potential multibillion-dollar payout under his new compensation plan.

The package, proposed in September, ties Musk’s earnings to a combination of vehicle sales, robotics, autonomous driving technology, company valuation, and profitability over the next decade.

Market watchers highlight that while some goals are extremely ambitious, others like sales and software subscription targets, are comparatively attainable. Meeting just two product-based milestones, for example, could earn Musk approximately $26 billion in stock, with total potential payouts exceeding $50 billion. This mix of high and moderate targets continues to draw attention from investors, analysts, and industry experts.

Vague Milestones Offer Flexibility

A key feature of Tesla’s compensation plan is the ambiguity in certain product goals, which provides Musk significant latitude in achieving them.

For instance, the robotaxi goal requires one million vehicles “without a human driver,” but experts note this could include remote control or passenger-assisted operation, as demonstrated in Tesla’s Austin pilot program. Similarly, the robotics clause covers “any AI-driven physical product,” not just humanoid machines, widening the scope for meeting milestones.

Law professor William Widen has highlighted that terms such as the “advanced driving system,” required for ten million Full Self-Driving (FSD) subscriptions, are loosely defined. As a result, Tesla could hit the milestone through pricing strategies, incremental feature rollouts, or subscription adjustments, rather than full autonomous functionality.

Stock and Profit Targets

The Tesla pay plan pairs product milestones with profit and company valuation targets. Some of the most difficult profit targets require EBITDA far above 2024 levels, which were $16.6 billion, with a range of $50 billion to $400 billion projected.

However, analysts note that large payouts can still be achieved through product-based milestones alone. For instance, achieving two product targets with a $2.5 trillion corporate valuation could result in $26.4 billion in stock for Musk without reaching any profit milestones.

This structure has fueled debate in the investment community, with critics pointing out that broadly defined milestones could allow significant compensation even if some of Tesla’s most challenging objectives are unmet.

Implications for the Auto Industry

Tesla’s aggressive push for FSD subscriptions and robotics has broader ramifications. If the company lowers prices to achieve ten million FSD subscriptions, competitors may accelerate their own ADAS subscription offerings, reshaping the automotive market.

Analysts estimate the ADAS market could reach $50 billion by 2030, with EVs and hybrids accounting for 15% of the car fleet, and ADAS features present in half or more vehicles by 2028.

This trend creates opportunities for payment orchestration, billing, and compliance vendors, particularly in Europe where some ADAS functionalities are becoming mandatory. Service providers will need tools to differentiate between standard features and premium add-ons while ensuring repair shops can monitor active features in vehicles.

Conclusion

That said, Elon Musk must remain at Tesla for at least seven and a half years to claim the full stock award, although he gains voting rights earlier. As the company pursues ambitious growth in subscriptions, robotics, and valuation, investors are closely monitoring how these broad, flexible goals will influence both Musk’s compensation and Tesla’s market trajectory.