October 2025 Crypto Gold Rush: Top Picks as Bitcoin Shatters $126K Barrier and Altseason Signals Ignite

Bitcoin's historic surge past $126,000 triggers massive capital rotation into altcoins—here's where smart money flows next.

Market Tsunami Hits Crypto

Traditional finance veterans scramble as Bitcoin's unprecedented rally creates ripple effects across every major exchange. Institutional FOMO reaches fever pitch while retail investors hunt for the next 10x opportunity.

Altcoin Domino Effect

Layer-2 protocols surge 40% weekly as Ethereum's scaling solutions finally deliver real-world utility. DeFi blue chips outperform memecoins for the first time in eighteen months—signaling maturing market dynamics.

Regulatory Green Lights Flash

Global watchdogs quietly approve three major crypto ETFs while Asian markets remove remaining capital controls. Wall Street analysts now project $150K Bitcoin by year-end despite traditional finance pundits still calling it a 'glorified Ponzi scheme.'

The smart money already positioned itself weeks ago—the question isn't whether you should buy, but how much you can afford to miss out.

Bitcoin leads the best crypto to invest in as Wall Street piles in

Bitcoin’s surge past $126,000 marks a new all-time high, though prices pulled back to around $122,000 in the second week of October, as analysts flagged short-term overheating. Still, institutional demand remains relentless. Morgan Stanley’s recent portfolio allocation guidelines are effectively a watershed moment, with the financial services giant recommending crypto exposure in growth-oriented portfolios for the first time.

The bank’s analysts view Bitcoin as a “scarce asset, akin to digital gold” with increasing institutional relevance. bitcoin exchange balances hit a six-year low according to Glassnode, reflecting sustained accumulation by long-term holders and institutional players rather than speculative trading.

Wall Street banks are lining up aggressive targets, and Citigroup forecasts $133,000 by December based on steady ETF inflows and digital asset treasury allocations. JPMorgan projects $165,000 using Gold parity metrics, and Standard Chartered stays most bullish at $200,000, citing sustained ETF inflows averaging over $500 million weekly.

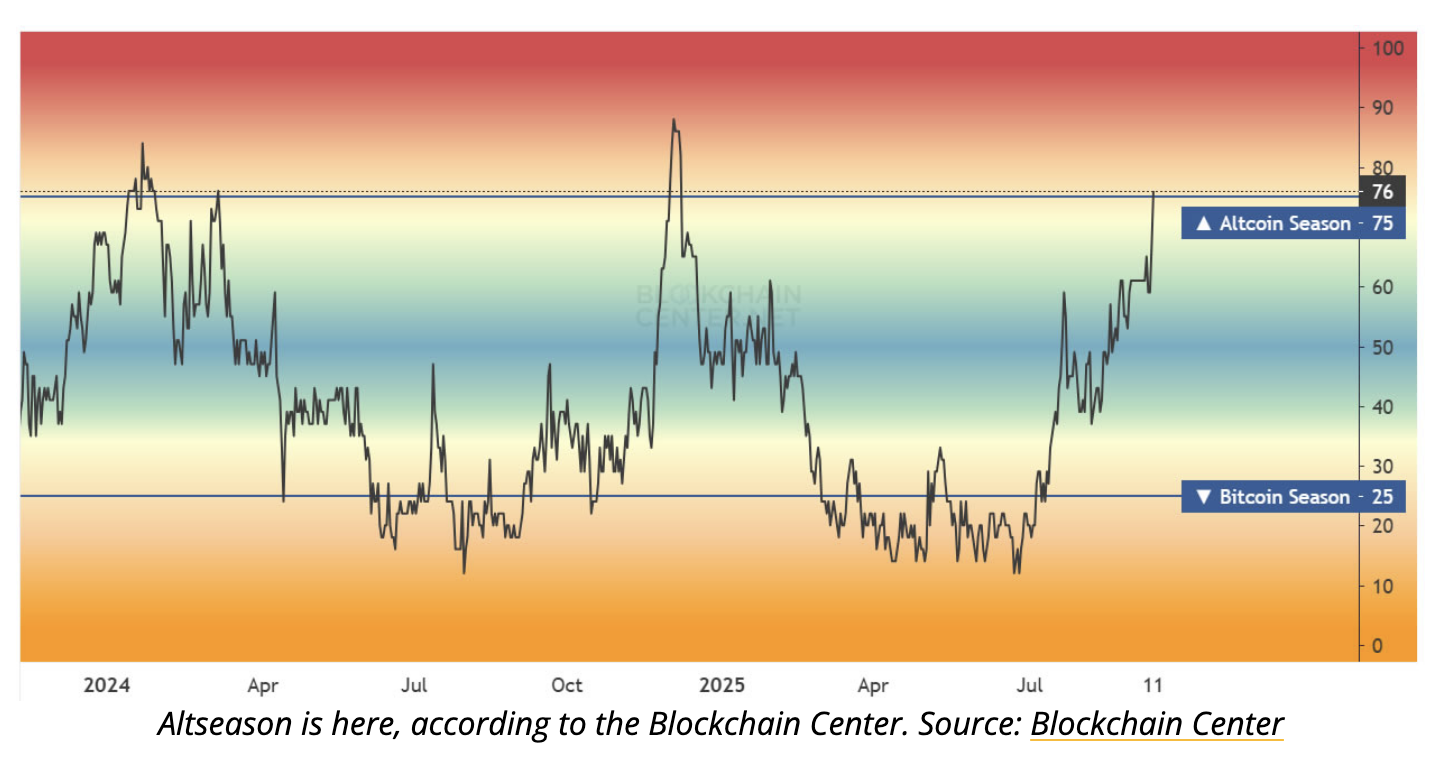

Altseason indicators hitting 76 out of 100 suggest capital is rotating beyond Bitcoin. The Blockchain Center criteria for altseason require 75% of the top 50 crypto assets outperforming Bitcoin over 90 days, a threshold recently crossed. Total altcoin market cap excluding Bitcoin and stablecoins sits at $1.63 trillion, approaching the $1.64 trillion peak hit in November 2024.

Bitcoin at $122K is wealth preservation, but while established altcoins offer solid gains, they’re not very likely to deliver the explosive multipliers early-stage presales provide when built right and timed well.

Best crypto to invest in this October

DeepSnitch AI price prediction

DeepSnitch AI stands apart with a technical infrastructure few presales can match. The platform deploys a suite of AI agents engineered to convert market noise into intelligence that traders can actually use.

Its Core mission is to democratize the intel advantage whales have hoarded for years. Right now, institutional players see moves before they happen, and DeepSnitch AI is here to change that.

With AI agents that will tap into a custom data pipeline pulling raw blockchain transactions, mempool activity, and smart contract events directly from nodes. That on-chain data gets enriched with off-chain signals from social platforms like X and Telegram, creating a full-spectrum view of market behavior.

The result is a tool that serves virtually every type of crypto holder, not just active traders. With the crypto market already exceeding half a billion participants globally, DeepSnitch AI’s addressable market is huge.

This is why traders are calling DeepSnitch AI the next 100x opportunity in crypto. The presale momentum corroborates that, with over $330,000 raised in Stage 1 alone, proving early demand is real.

And what separates DeepSnitch AI from typical presale promises is proof. The project earned audits from both Coinsult and SolidProof.

Ethereum price prediction

Ethereum reclaimed $4,200 this week as exchange supply dropped to its lowest level since 2016, signaling institutional accumulation is accelerating. DEX volume on ethereum surged 47% week over week to $33.9 billion, reflecting improving sentiment across the ecosystem.

Standard Chartered raised its 2025 target to $7,500, up from a previous $4,000 forecast. The bank cited record ETF and treasury buying, plus stablecoin growth following the GENIUS Act. Historical patterns favor October for ETH, with the month averaging 4.77% gains.

Ethereum remains the backbone of DeFi and stablecoins, with over 65% of total value locked across decentralized finance. Strong fundamentals, institutional support, and regulatory clarity are all intact, but at $500 billion market cap, even reaching $7,500 WOULD be solid but nothing seismic.

XRP price prediction

XRP reclaimed $3 after establishing strong support at $2.80, setting up for what could be its most important month of 2025. Between October 18 and October 25, the SEC will rule on six major spot XRP ETF applications from Grayscale, Bitwise, Canary, WisdomTree, and CoinShares.

Approvals could unlock $4 billion to $8 billion in first-year institutional inflows. The 3-day RSI just flashed a golden cross, a technical signal that preceded 75%, 28%, and even 575% rallies in past cycles. Analysts project targets between $3.98 and $4.32 if momentum holds.

XRP benefits from regulatory clarity post Ripple lawsuit, institutional integration through RippleNet, and growing ETF interest. Historical Q4 strength averaging around 50% gains supports bullish cases. But at $160 billion market cap, 40% to $4 is attractive but limited compared to what presales can deliver.

The takeaway

October 2025 is validating everything bulls predicted, with Bitcoin hitting $126K, altseason indicators surging to 76, Morgan Stanley endorsing crypto allocations, and Wall Street banks projecting $133K to $200K targets by the end of the year.

Bitcoin’s the safest bet for capital preservation, while Ethereum offers solid upside with DeFi dominance. XRP, facing six ETF rulings between October 18-25, could rally 40% to $4 if approvals land. All represent the best crypto to invest in if stable, measured growth is the goal.

But DeepSnitch AI at $0.01805 has all the right fix-ins, including exponential upside potential. It will release five AI agents that will democratize market intelligence, staking rewards for early backers, and with its Stage 1 presale pricing, even modest post-listing demand could multiply DeepSnitch AI many times over.

Visit the website for more information.

FAQs

Bitcoin at $122K offers stability, Ethereum targeting $7,500 provides DeFi exposure, and XRP, facing ETF rulings, could hit $4. But DeepSnitch AI at $0.01805 offers the best risk reward, combining AI utility with Stage 1 presale pricing for potential 100x gains.

Bitcoin remains the safest crypto bet with institutional backing and Wall Street targets of $133K to $200K. But at $2.4 trillion market cap, it can offer wealth preservation but not wealth creation. For explosive gains, presales like DeepSnitch AI offer better upside.

DeepSnitch AI combines five AI agents with real utility, dual security audits, active development, and $0.01805 presale pricing. While Bitcoin targets 10-20% gains and XRP aims for 40%, DeepSnitch AI could 100x when adoption scales and it lists on exchanges.