Cardano Price Prediction: ADA Nears Potential Bear Trap - How High Will It Soar?

Cardano's ADA is setting up for what could be the ultimate bear trap reversal—and the charts are screaming bullish divergence.

The Technical Setup

ADA's consolidation pattern suggests institutional accumulation while retail traders panic-sell. Every dip below key support levels gets immediately bought up—classic whale behavior that precedes major breakouts.

Price Trajectory Analysis

Historical data shows Cardano tends to move in explosive 300-500% runs after prolonged consolidation phases. Current technical indicators point toward similar potential, with Fibonacci extensions suggesting targets well above previous all-time highs.

Market Psychology at Play

Traders chasing quick profits keep getting shaken out while long-term holders continue stacking ADA at discounted prices. The coming weeks could separate the weak hands from the diamond hands in spectacular fashion.

Because nothing says 'financial revolution' like watching traditional investors finally FOMO into an asset they mocked for years—just in time to buy your bags at 10x.

ADA price woes worsen in Q4

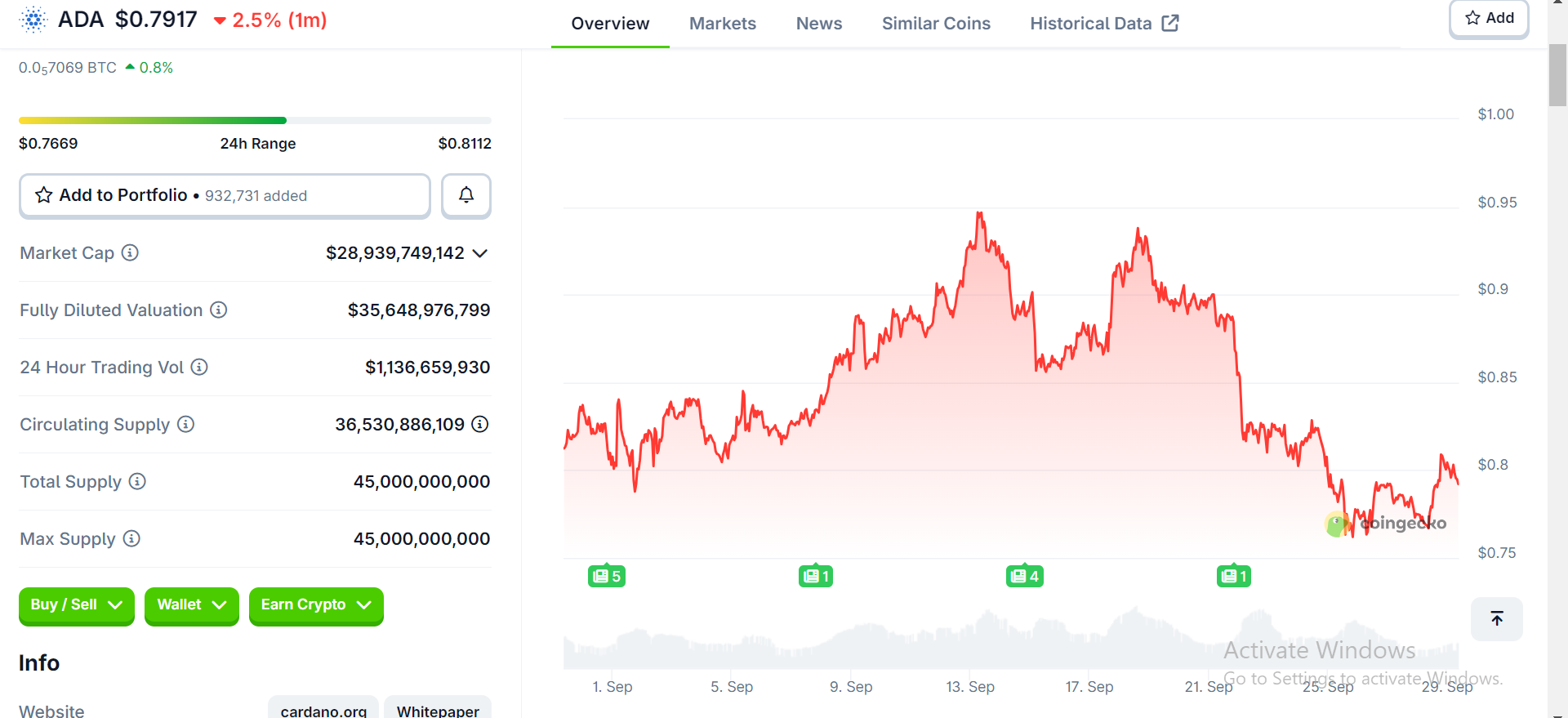

The Cardano (ADA) price movement is giving holders a lot to worry about after stagnating throughout September. According to top analysts, ADA’s decline coincides with the broader market slump associated with rumours of a US government crackdown on digital assets.

At the time of writing, ADA has consolidated around $0.79, representing 4.5% losses since August. Following this decline, many holders are curious whether the Cardano price prediction will change for the better as we enter the decisive month of October.

Some observers believe ADA is forming a potential bear trap zone at $0.75 to $0.78. Sellers may exit at this price range while buyers absorb pressure, forming a breakout that traps short positions. Therefore, if this support holds, the cardano price could surge back around $0.85 in the short term and $1.5 in the upcoming bull cycle.

The problem with traditional banks

Traditional banks reject loans for those who need it the most, pay out 1-2% interest on deposits, then use that same money to generate massive investment returns. This outdated system has left millions feeling powerless about their financial lives. But that was until PayDax came along.

PayDax Protocol (PDP) gives back to the masses, providing an ecosystem where borrowers and liquidity providers freely negotiate interest rates. Furthermore, PayDax is the first platform to successfully merge banking, insurance, and lending products on-chain, building a future where people, not corporations, determine how money flows.

Get Liquidity Without Selling Your Possessions

As the People’s Defi Bank, PayDax allows users to collateralize their crypto assets for loans with high LTV ratios. For instance, Sarah, a long-term ADA holder, wants to invest $50,000 into a small business but lacks the capital to do so.

Instead of selling her ADA for quick cash, Sarah can access fixed loan amounts up to 97%. But asset collateralization on PayDax is not limited to cryptocurrencies. Sarah can collateralize high-value RWAs, such as artwork or gold, for stablecoin loans, turning her idle wealth into liquidity.

High-Yield Opportunities for Lenders and Stakers

On the lending side, PayDax offers a range of yield-bearing opportunities that outperform near-zero interest paid on bank deposits. As a lender, you earn up to 15.2% APY for providing stablecoin loans or 20% APY for insuring loans through the Redemption Pool.

Meanwhile, those who stake ordinary crypto assets such as BNB, ETH, or BTC may earn up to 6% APY on PayDax or up to 41% APY using advanced yield farming strategies.

Why Investors Call PDP the Best Presale Crypto

To bridge the gap between traditional banking and DeFi lending, Paydax Protocol (PDP) collaborates with world-class infrastructure providers. For instance, all loan valuations on the network are powered by chainlink Oracles, preventing any mispriced deals.

Furthermore, Sotheby’s authenticates all RWAs before they can be tokenized on the network, while Brinks is in charge of keeping these high-value objects secure. Additionally, the PayDax team has undergone full KYC verification, which is important as crypto regulations tighten.

These factors, combined with the growth forecast of RWA lending by 2030, significantly increase the spotlight on PayDax. Now in its presale phase, PDP is trading for $0.015 per token, which is the lowest entry it will ever be until stage-based price increases.

More importantly, top analysts say PDP could hit $0.75 within three months, rewarding early backers with 4900% gains. With PayDax set for widespread DeFi adoption, today is the best time to secure your stake in this potential blue-chip token. Buying early also allows you to enjoy the 80% bonus available using the promo code PD80BONUS.

Join the Paydax Protocol (PDP) presale and community: