Pump.Fun Revenue Surpasses $40 Million Milestone as PUMP Token Explodes 25%

Revenue rockets past $40 million while native token delivers explosive gains

The Memecoin Factory's Financial Engine

Pump.Fun's revenue machine just hit overdrive—crossing that magical $40 million threshold that makes traditional finance executives nervously adjust their ties. The platform's native PUMP token didn't just climb, it launched 25% upward in what appears to be a classic case of success breeding more success.

Market Mechanics Behind the Surge

While Wall Street analysts debate P/E ratios, crypto's meme economy continues printing numbers that would give SEC regulators nightmares. The revenue surge demonstrates that retail investors remain hungry for the high-risk, high-reward playground that decentralized platforms provide—proving once again that in crypto, sometimes the silliest concepts generate the most serious profits.

Another day, another reminder that while traditional finance worries about basis points, crypto's wild west continues minting millionaires through platforms that would give your financial advisor an aneurysm.

Consistency and buyback strategy

GLC Research noted, “PUMP.Fun’s revenue has been remarkably consistent, with the only real dip in July due to incentives and the launchpad war with $BONK.” Moreover, PumpFun has shifted to a 100% buyback policy.

At the current pace, annualized revenues of $486 million could retire nearly 30% of the circulating supply within the next year. Already, about 7% has been bought back. Consequently, sustained revenue could keep buying pressure elevated for months.

Additionally, PumpFun has built up a massive cash reserve, holding between $1 billion and $1.5 billion against its $2 billion market value. Since no new tokens will unlock until July 2026, many see this as a strong bullish signal.

Moreover, another GLC data shows the platform has completed over 619,080 SOL in purchases, worth about $122 million. These transactions have already reduced nearly 8% of its circulating supply.

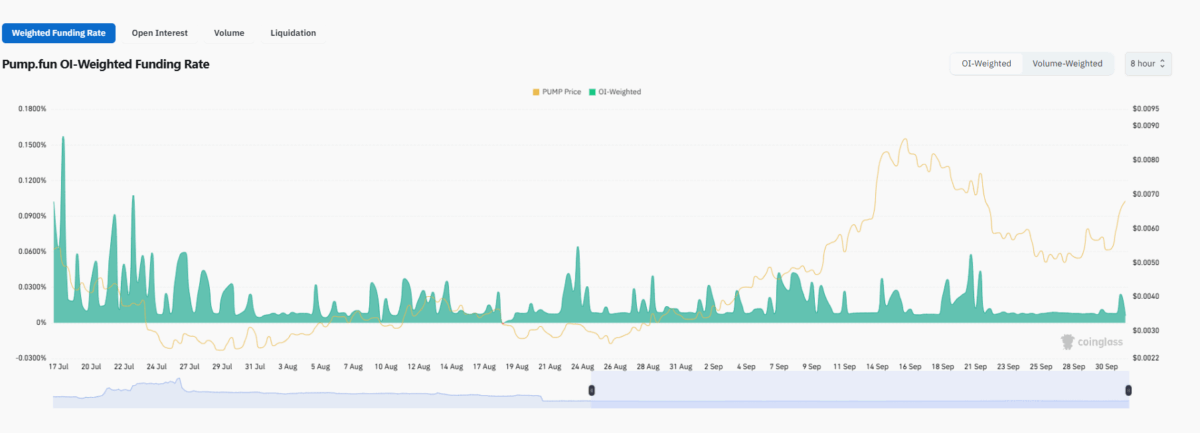

Notably, data from CoinGlass shows that PumpFun’s funding rates have cooled off since the wild swings in July. Back then, traders were paying steep premiums to hold positions. Now, those rates have dropped close to zero.

This suggests that PUMP’s price growth is being fueled by real buying rather than risky borrowing. Since early September, the token has steadily climbed from $0.004 to over $0.008 before easing a bit. Even after the correction, it remains strong above $0.006.

PumpFun’s steady revenue, ongoing token buybacks, and big cash reserves point to a positive outlook if the crypto market keeps up its momentum.

Also Read: XRP price prediction in October: Rise or Repeat History?