Why Crypto Markets Are Tumbling Today - The Real Reasons Behind September 2025’s Bloodbath

Crypto markets hit turbulence again today as digital assets across the board saw sharp declines. The sell-off isn't random—it's driven by concrete factors shaking investor confidence.

Regulatory Pressure Intensifies

Global regulators are tightening the screws with coordinated crackdowns. The SEC's latest enforcement actions against unregistered exchanges spooked traders, while Asian markets faced fresh compliance deadlines that forced massive position unwinding.

Macroeconomic Headwinds Bite

Rising interest rates and inflation concerns pushed traditional investors toward safer assets. When Treasury yields spike, speculative assets like crypto often take the hit first—a pattern playing out brutally this week.

Technical Breakdown Accelerates

Key support levels shattered as leveraged positions got liquidated en masse. The domino effect triggered stop-loss orders that amplified downward momentum, creating the perfect storm for today's decline.

Institutional Money Flees

ETF outflows hit record levels as hedge funds rebalance portfolios amid quarter-end pressures. Because nothing says 'risk management' like panic-selling at the bottom—classic Wall Street timing.

This dip represents another stress test for crypto's long-term thesis. Markets cycle, regulations evolve, but blockchain's fundamental value proposition remains intact. Today's panic might just be tomorrow's buying opportunity.

TLDR

- The crypto market cap dropped $150 billion in 24 hours to $3.70 trillion due to macroeconomic concerns and liquidations

- Bitcoin fell to $108,600 after $1 billion in liquidations, testing the $108,000 support level

- US government shutdown fears and Fed Chair Powell’s inflation warnings triggered risk-off sentiment

- Institutional outflows and options expiries drove large-scale selling across exchanges

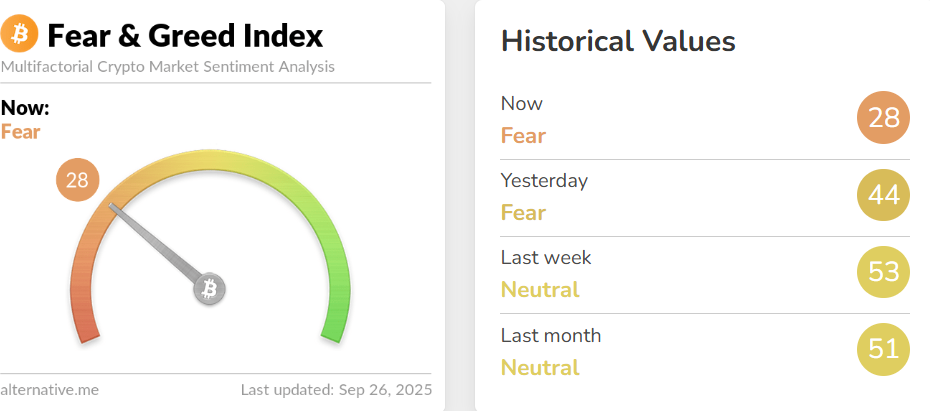

- The crypto Fear & Greed Index remains in “Fear” territory as traders reduce risk exposure

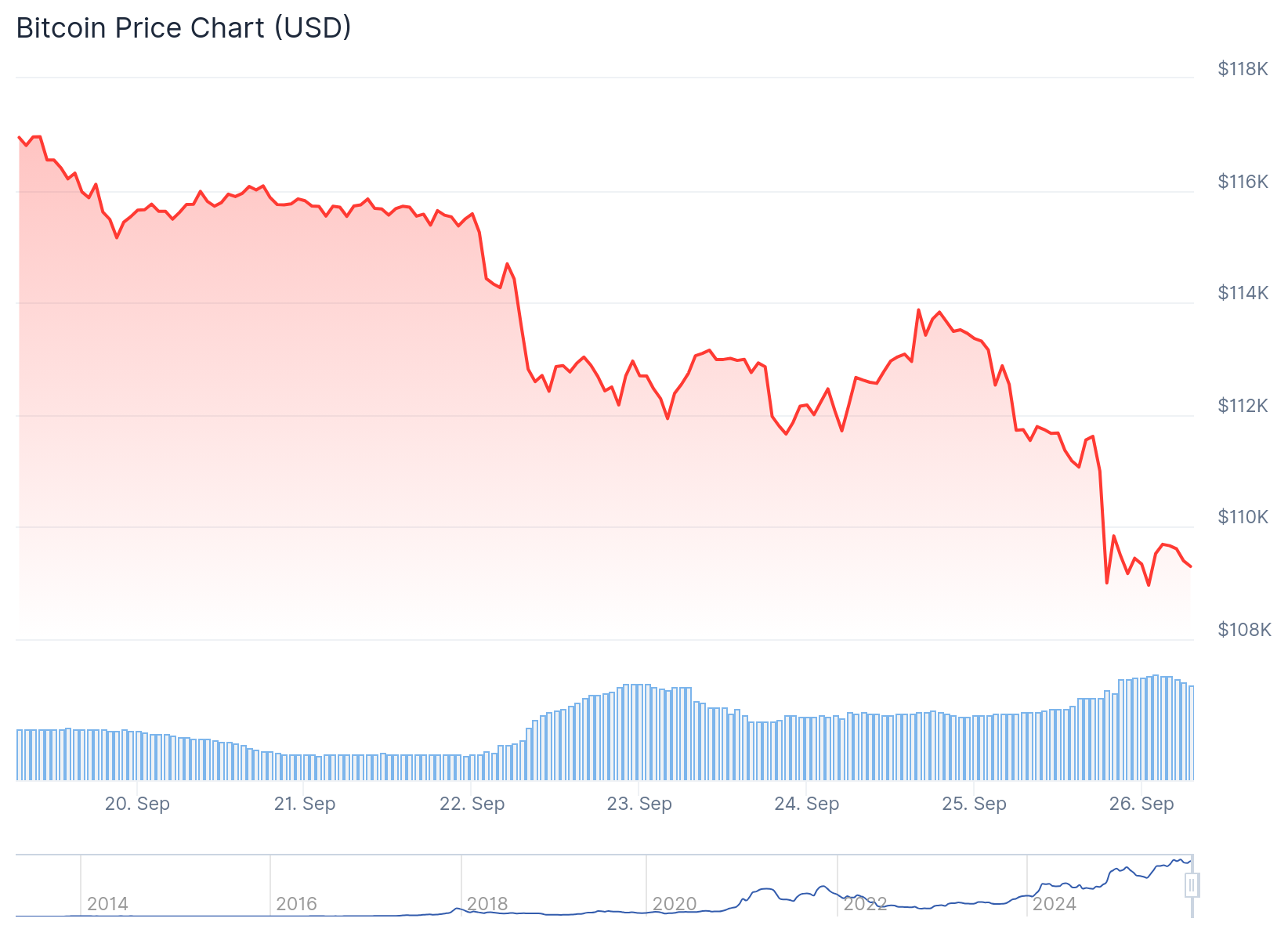

The cryptocurrency market experienced a sharp decline on September 26, 2025, with the total market capitalization falling $150 billion to $3.70 trillion. Bitcoin dropped to $108,600, marking a fall from $113,200 in the previous 24 hours.

The selloff was triggered by over $1 billion in liquidations across digital assets. ethereum traded around $3,900-3,950, falling below the psychological $4,000 level that many traders watched as key support.

Federal Reserve Chair Jerome Powell’s recent warnings about inflation risks and slowing labor market conditions contributed to the bearish sentiment. These comments raised concerns that persistent inflation could prevent potential rate cuts from the Federal Reserve.

Growing anxiety about a potential US government shutdown has created additional uncertainty in financial markets. This risk-off sentiment pushed investors away from volatile assets like cryptocurrencies and into safer investments.

Institutional Activity Drives Selling Pressure

Institutional investors have been pulling capital from crypto markets, leading to large liquidations across major exchanges. Options contracts worth billions of dollars are nearing expiry this week, adding to the selling pressure.

The crypto Fear & Greed Index remained in “Fear” territory, reflecting cautious market sentiment. This metric often amplifies price swings as traders reduce their risk exposure during uncertain periods.

Solana experienced a 21% decline over the week as part of the broader risk-off rotation. Dogecoin fell to $0.23, down 3-5% as speculative selling increased across meme coins.

Technical Levels Under Pressure

The total crypto market cap is currently holding above the $3.67 trillion support level. If this level fails, analysts expect a potential slide toward $3.58 trillion, which could expose the market to further declines.

Bitcoin’s fall below $110,000 points toward the $108,000 support zone as the next key level to watch. For recovery, Bitcoin would need to reclaim $110,000 as support to test the $112,500 resistance level.

Ethereum’s weak futures activity and failed support below $4,000 triggered additional downside moves. This technical breakdown has led to more cautious positioning among institutional traders.

The current price action reflects short-term macroeconomic concerns combined with technical breakdowns across major cryptocurrencies. Trading volumes increased as automated selling programs activated following the breach of key support levels.

Market participants are now watching economic data releases closely, as concerns about interest rates and inflation continue to impact both equity and crypto markets. The combination of institutional outflows and retail liquidations has created the current selling environment.