Ethereum Supply Crisis Deepens: Exchange Reserves Hit 9-Year Low as Institutional Accumulation Intensifies

Ethereum's disappearing act from exchanges signals a fundamental supply shock that could reshape crypto markets.

The Great ETH Exodus

Exchange wallets are bleeding Ethereum at an unprecedented rate—supply levels haven't been this thin since the network's infancy. Institutional players are quietly building positions while retail traders sleepwalk through the accumulation phase.

Institutional Hunger Games

Wall Street's digital asset desks are executing nine-figure blocks off-exchange, bypassing traditional order books entirely. The smart money isn't waiting for ETF approvals—they're taking physical delivery now.

Supply Shock Mathematics

When demand meets vanishing supply, basic economics takes over. The nine-year low in available ETH creates a powder keg scenario that could make previous bull runs look like minor corrections.

The Regulatory Paradox

Traditional finance institutions keep demanding clearer regulations while simultaneously accumulating assets that regulators still struggle to categorize. Nothing says 'confidence' like billion-dollar bets on regulatory uncertainty.

As institutions hoard and exchanges run dry, the stage is set for a supply squeeze that could redefine crypto valuation models. Meanwhile, traditional finance analysts continue debating whether Ethereum is a security or commodity—missing the forest for the legal trees.

TLDR

- Ethereum exchange supply drops to 14.8 million ETH, the lowest level since 2016

- Over 2.7 million ETH worth $11.3 billion left exchanges in the past month alone

- Corporate treasuries and ETFs have accumulated around 10% of total ETH supply

- Long-term holders continue selling, creating opposing pressure against institutional buying

- ETH price remains stuck around $4,000 despite bullish accumulation trends

The amount of ethereum held on centralized exchanges has reached its lowest point in nine years. Exchange balances now sit at just 14.8 million ETH, according to data from Glassnode.

This decline represents a massive shift in how investors are holding Ethereum. The ETH supply on exchanges has been cut in half over the past two years.

The exodus from exchanges picked up speed in mid-July. Since then, exchange balances have dropped by 20%.

CryptoQuant data shows the Ethereum exchange supply ratio at 0.14. This marks the lowest level since July 2016.

In the past month alone, more than 2.7 million ETH has left exchanges. This movement is worth over $11.3 billion at current prices.

The 30-day moving average of total Ethereum exchange net flows reached its highest level since late 2022 this week. This shows the pace of withdrawals is accelerating.

When investors move crypto off exchanges, it typically signals long-term holding strategies. Assets moved off exchanges often go into cold storage, staking, or DeFi protocols for higher yields.

Corporate Treasuries Drive Accumulation

Corporate Ether treasuries have become major buyers since June. Companies like Tom Lee-chaired BitMine now hold over 2% of the total ETH supply.

Since April, around 68 entities have purchased 5.26 million ETH. This buying spree is worth approximately $21.7 billion and represents 4.3% of the entire supply.

Most of these corporate buyers are staking their Ethereum rather than keeping it on exchanges. This removes the tokens from immediate selling pressure.

US spot Ether exchange-traded funds have also increased their holdings during this period. These ETFs now control 6.75 million ETH worth almost $28 billion.

This represents 5.6% of the total Ethereum supply. Combined with corporate treasuries, institutional entities now hold around 10% of all ETH in existence.

Long-Term Holders Create Selling Pressure

Despite the institutional accumulation, Ethereum faces pressure from another source. Long-term holders have been selling their positions.

Ethereum’s Liveliness metric has been trending upward recently. This measure tracks long-term holder behavior, and increases typically indicate selling activity.

The selling from these established holders creates opposing pressure against the institutional buying. This dynamic has kept Ethereum’s price movement limited.

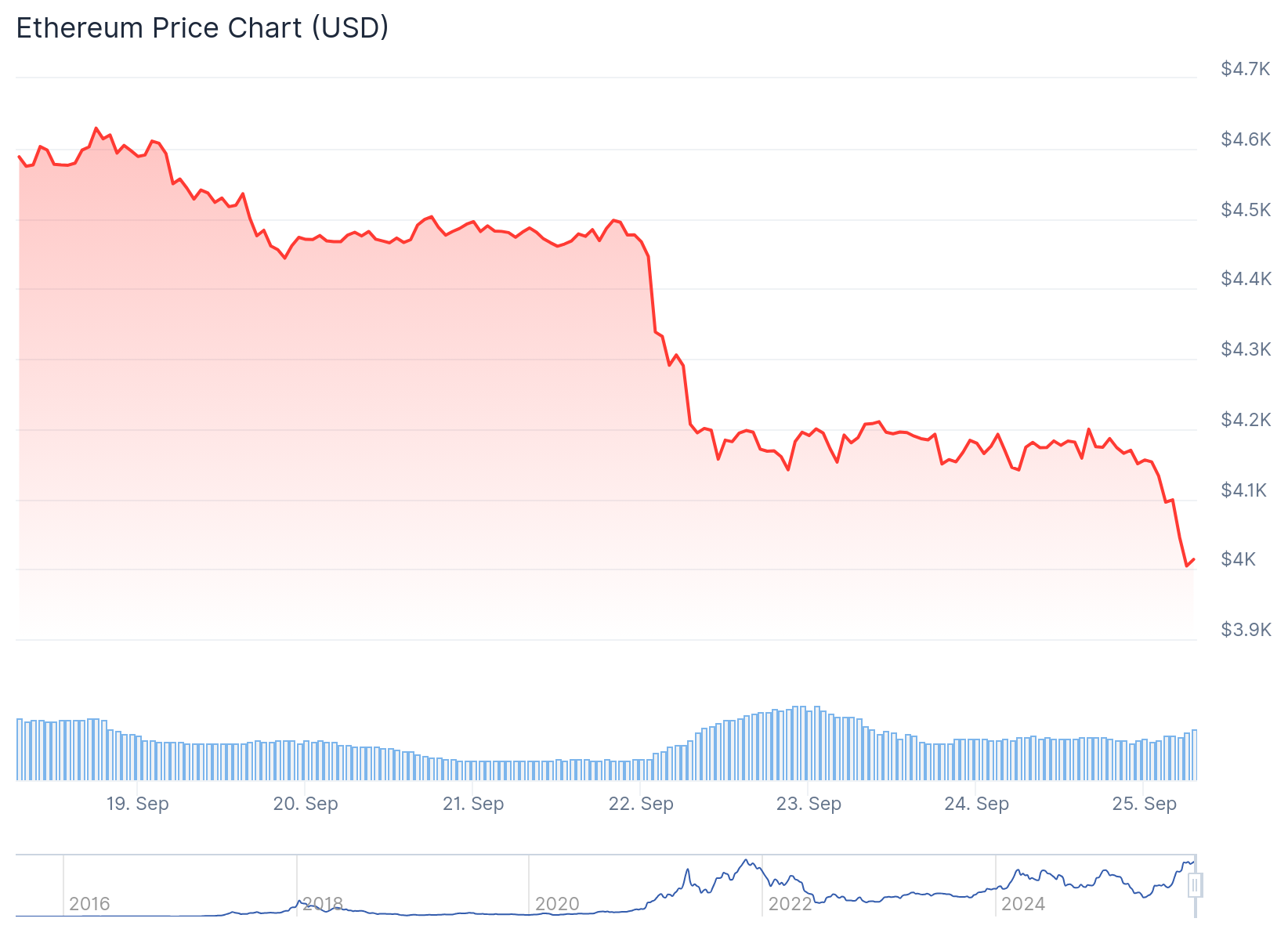

ETH currently trades around $4,176, holding just above the critical $4,074 support zone. The price has been stuck in a range between $4,000 and $4,500 for several weeks.

@ethereum is getting the Wall Street glow-up. Treasuries are stacking ETH, exchange supply hits 9-year low, and Tom Lee’s calling US$10K to US$15K by year-end. BitMine holds 2.4M ETH. @btcmarkets

— Rachael (@Rachael_M_Lucas) September 24, 2025

BTC Markets analyst Rachael Lucas described the situation as Ethereum getting “the Wall Street glow-up.” She noted that treasuries are accumulating ETH while exchange supply hits nine-year lows.

However, the price action hasn’t matched the bullish accumulation trends. Ether prices have fallen more than 11% over the past week, dropping below $4,100.

The immediate resistance for ETH sits at $4,222. A break above this level could enable a recovery toward $4,500.

If selling pressure continues, a breakdown below $4,027 support could push ETH toward $3,910. This WOULD invalidate the current bullish thesis based on institutional accumulation.

The standoff between institutional buying and long-term holder selling continues to limit strong price movements in either direction.