Bitcoin (BTC) Price: Recovery Rally Stalls as Whales Dump $16.5 Billion BTC

Bitcoin's comeback hits a wall as major holders unleash massive sell-off.

The Whale Exodus

Just when bulls thought the coast was clear, Bitcoin's largest investors dropped a $16.5 billion bomb on the market. The recovery rally that had traders buzzing now faces its toughest test yet.

Market Mechanics Exposed

Whale movements always reveal the real story behind price action. While retail investors chase momentum, the big players are cashing out at levels that would make traditional bankers blush—though they'd never admit crypto's outperformance stings.

This isn't your typical pullback—it's a calculated retreat by the very entities that propelled Bitcoin's recent gains. The question isn't whether BTC will recover, but when the next wave of institutional money decides traditional finance's 2% returns are downright pathetic.

TLDR

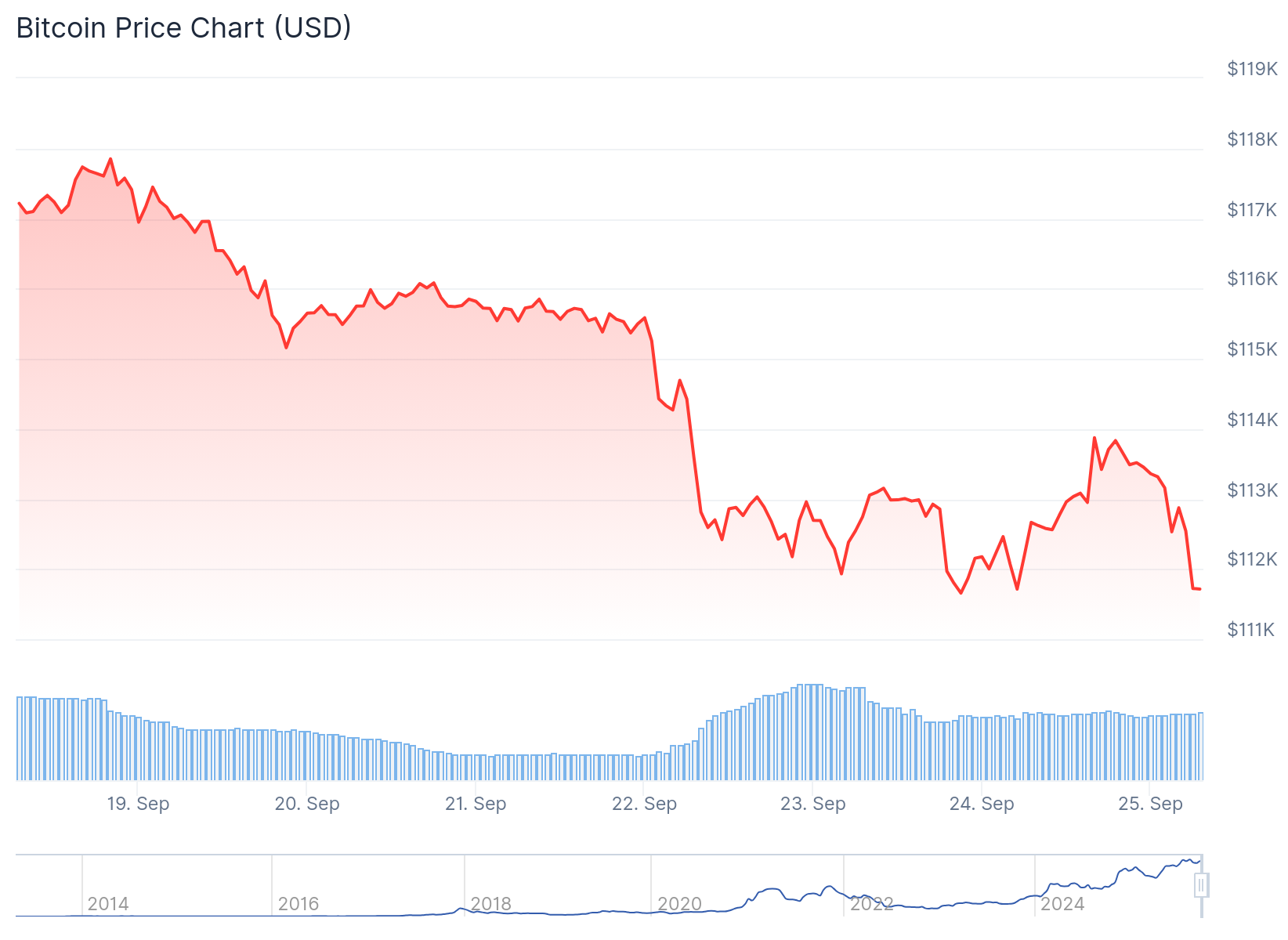

- Bitcoin rallied to $113,900 on Wednesday after testing weekly lows near $111,000

- Bullish divergences on RSI indicators and record-low volatility signaled potential trend reversal

- Large whale holders sold 147,000 BTC worth $16.5 billion since August highs

- Bitcoin’s implied volatility dropped to lowest levels since October 2023

- Market remains cautious following $1.5 billion crypto liquidations earlier this week

Bitcoin staged a swift recovery to $113,900 on Wednesday after testing weekly lows NEAR $111,000. The bounce came during the Asia trading session on Binance.

The recovery followed a challenging start to the week. Bitcoin had fallen nearly 3% on Monday as roughly $1.5 billion of crypto positions were liquidated in a single day.

This liquidation wave marked the biggest sell-off since March. The forced selling across derivatives markets led to sharp losses on bitcoin and other cryptocurrencies.

Technical indicators supported the Wednesday recovery. Bullish divergences appeared between the relative strength index (RSI) and Bitcoin price on shorter timeframes.

A bullish divergence occurs when price registers lower lows while RSI forms higher lows. This pattern often indicates weakening bearish momentum and potential for reversal.

The recovery also coincided with Bitcoin retesting its daily order block. This provided a technical base for a possible push toward $115,000.

Key Technical Levels to Watch

Traders are monitoring several critical price levels for confirmation of the trend change. A four-hour candle close above $113,400 WOULD signal a clear shift from bearish to bullish structure.

Reclaiming the 200-period exponential moving average on the four-hour chart would reinforce positive momentum. MN Capital founder Michaël van de Poppe noted the strength of the rebound.

This is a good candle for #Bitcoin and the markets. pic.twitter.com/u5q2W7IJZB

— Michaël van de Poppe (@CryptoMichNL) September 24, 2025

However, some traders remain cautious about the sustainability of the move. crypto trader Crypto Chase warned that Bitcoin must reclaim the $113,400 to $114,000 range with conviction.

Without strong conviction, the recent gains could unravel and send BTC back toward $107,000 levels.

Whale Activity Shows Mixed Signals

Onchain data reveals diverging signals from large Bitcoin holders. Whale entities holding 1,000 BTC or more have sold roughly 147,000 BTC since August.

This represents $16.5 billion worth of Bitcoin sold since the all-time high above $124,500. The 2.7% reduction in holdings shows sustained selling pressure from large investors.

🚨BREAKING: BlackRock just sold $980M $BTC 5 hours ago. pic.twitter.com/D0GwtlrzeI

— Coin Bureau (@coinbureau) September 23, 2025

Despite whale selling, other market indicators suggest an unusually quiet environment. Bitcoin’s implied volatility dropped to its lowest levels since October 2023.

XWIN Research noted this period preceded a 325% rally from $29,000 to $124,000 for BTC. The current setup resembles a potential “quiet before the storm” scenario.

Low volatility and muted trader positioning may be storing momentum for a decisive move. CryptoQuant data shows exchange reserves hovering at multi-year lows.

This leaves fewer coins available for selling on exchanges. Bitcoin’s Market Value to Realized Value ratio sits near the neutral zone.

The neutral MVRV reading implies limited pressure for panic-selling or aggressive profit-taking. These factors paint a market caught between whale distribution and tightening supply.

Federal Reserve Chair Jerome Powell’s recent comments added to market caution. He said the central bank must tread carefully in weighing further rate cuts.

Powell acknowledged a softer labor market could allow more easing. However, he warned cutting too aggressively risked undermining inflation progress.

Traders are now focused on Friday’s release of the U.S. personal consumption expenditures index. This serves as the Fed’s preferred inflation gauge.

Bitcoin last traded 0.8% higher at $113,240 as of Wednesday afternoon, hovering near two-week lows despite the intraday recovery.