Bitcoin MVRV ’Death Cross’ Flashes Warning Signal As Onchain Data Sends Mixed Messages

Bitcoin's MVRV ratio just triggered what analysts call a 'death cross'—a bearish signal that's got traders watching every move.

Onchain metrics paint a complicated picture though. Some indicators scream caution while others hint at underlying strength. It's the kind of split personality that makes crypto veterans both nervous and excited.

Market Realized Value versus Actual Value—sounds fancy, but it basically measures whether investors are sitting on profits or losses. When the short-term average drops below the long-term? That's your death cross right there.

Timing everything perfectly is for day traders and fortune tellers. The rest of us just watch the signals and try not to panic-sell at the bottom—again. Because nothing says 'sophisticated investor' like buying high and selling low, right?

MVRV indicator signals exhaustion

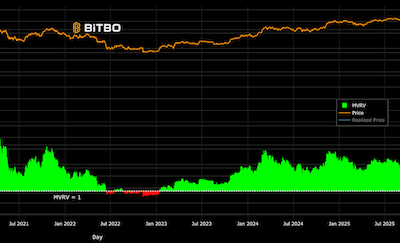

According to CryptoQuant analyst Yonsei_dent, the MVRV momentum indicator has shown a clear death cross between the 30-day and 365-day moving averages. Yonsei_dent explained:

History doesn’t repeat, it rhymes — and the signals from MVRV deserve attention.

The previous occurrence of this bearish crossover coincided with the 2021 cycle peak, which was followed by a 77% price decline from $69,000 to $15,500 during the 2022 bear market.

Despite bitcoin’s 13% rise to a new all-time high of $124,500 between January and August, MVRV continued to decline, suggesting weakening capital inflows.

See the current MVRV chart.

Analysts debate bear market risk

Ali Martinez, another market analyst, noted that the MVRV death cross indicates a macro momentum reversal.

If history repeats, short-term targets could fall to around $105,000, with some analysts warning of a possible further drop to $60,000 if a bear market takes hold.

Other indicators show room to run

However, not all signals are bearish.

The MVRV Z-score remains well below levels historically associated with market tops, currently “sitting at around 2,” according to analyst Stockmoney Lizards. They noted:

We’re not even close to the danger zone yet. People aren’t massively overextended on profits like they were at previous tops. This tells me we’ve got room to run.

Additionally, none of the 30 CoinGlass bull market peak signals indicate overheating, and historical MVRV Z-score peaks have ranged between 7 and 9.