HBAR Price September 2025 Outlook: Key Projections & Market Expectations

Hedera's native token faces critical month as institutional adoption heats up

Market Momentum Builds

HBAR enters September riding wave of enterprise blockchain momentum—governance upgrades and CBDC partnerships fueling institutional interest that could push prices beyond current resistance levels

Technical Indicators Flash Bullish

Network activity spikes suggest underlying strength while trading volume patterns mirror previous breakout formations—traders watching key support levels that held through August volatility

Regulatory Tailwinds Emerge

Hashgraph's enterprise-friendly architecture positions HBAR favorably as regulators finally crack down on less compliant chains—because nothing makes traditional finance embrace decentralization quite like the threat of paperwork

September could deliver make-or-break momentum as institutional money either validates Hedera's enterprise thesis or exposes it as another blockchain experiment waiting for real-world use cases

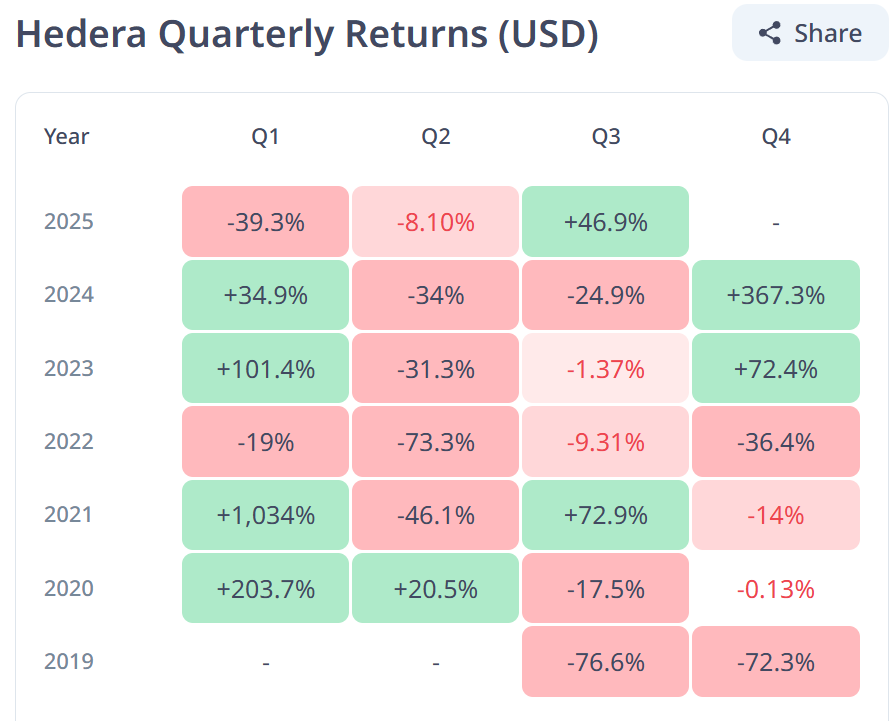

Hedera Has An Interesting History

HBAR’s quarterly performance this year has been notably stronger compared with the previous three years. Despite the struggles in August, the token has held up better than in past cycles, reflecting gradual improvements in resilience. A green Q3 WOULD mark a significant milestone for the network’s progress.

If HBAR closes Q3 in profit, it would represent the first positive quarter in four years. More importantly, it would also be the first quarter of 2025 to end in the green. Such an outcome could signal improving investor sentiment, even as short-term volatility continues to impact performance.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

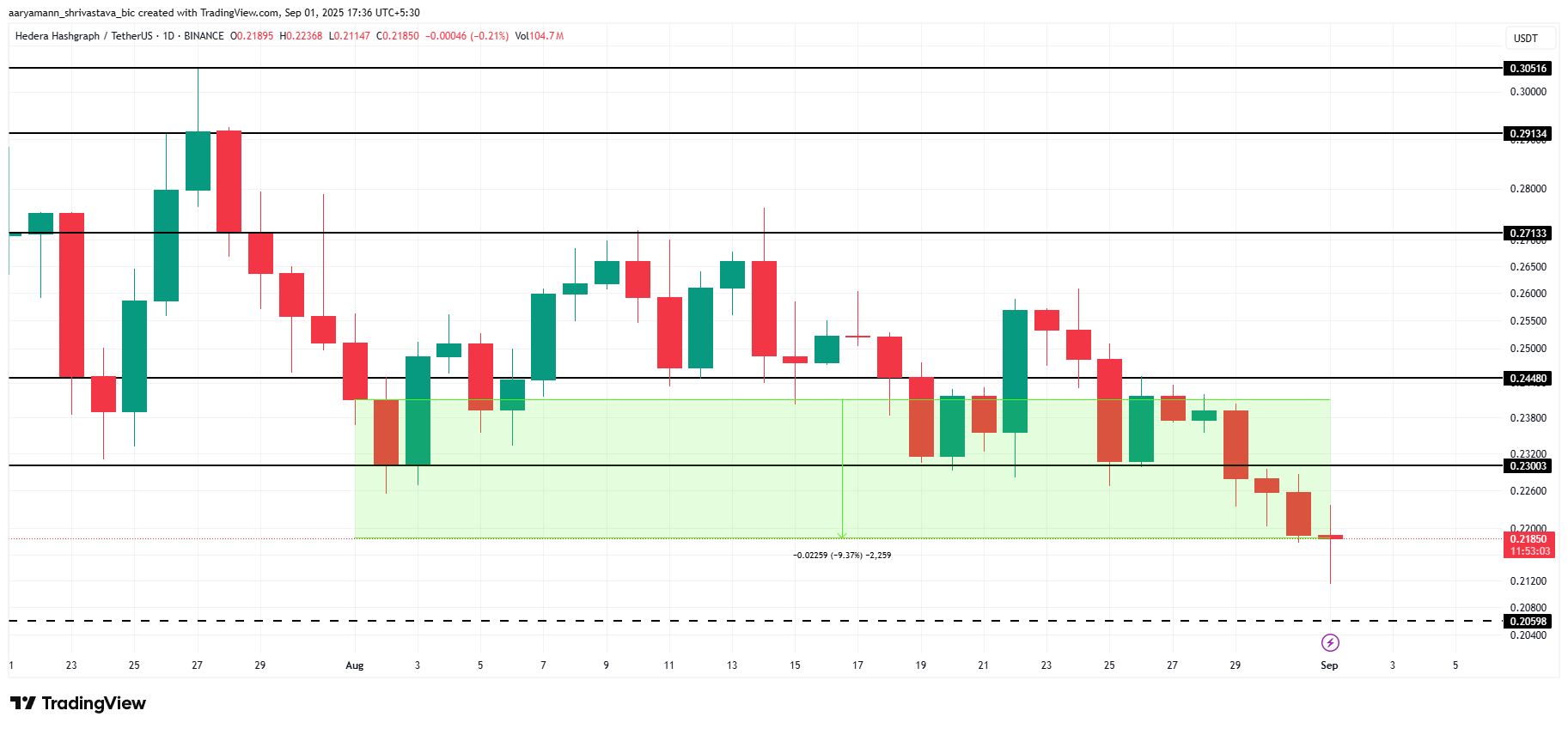

Technical indicators point to challenges ahead. The Chaikin Money FLOW (CMF) shows strong outflows dominating HBAR for the past two months. This sustained selling pressure has been one of the key reasons for the token’s decline, limiting any momentum that might have emerged from network growth or broader adoption.

Outflows indicate two key concerns: rising investor skepticism and broader market-driven selling. Bitcoin’s sharp decline has amplified pressure, as HBAR maintains a high 0.92 correlation with BTC. This close connection means Hedera’s performance is heavily influenced by Bitcoin’s trajectory, making September’s outlook dependent on BTC’s ability to stabilize.

HBAR Price Faces Challenge

At the time of writing, HBAR trades at $0.218, down 9% over the past month. The persistent outflows suggest continued weakness, leaving the altcoin vulnerable to further decline. Should selling continue, HBAR could slip to $0.205, extending its drawdown and reinforcing bearish momentum in the short term.

Historically, September has been a poor month for HBAR. On average, the token has declined 10% during this period, with a median drop of 5%. Based on this pattern, the probability of another drawdown remains elevated, aligning with current technical signals that highlight weakening support levels.

If inflow returns and investor sentiment improves, HBAR could bounce back to reclaim the $0.230 support. Holding this level would be crucial for triggering recovery. A complete reversal would require the token to climb toward $0.271 or higher, signaling renewed strength after months of bearish market activity.