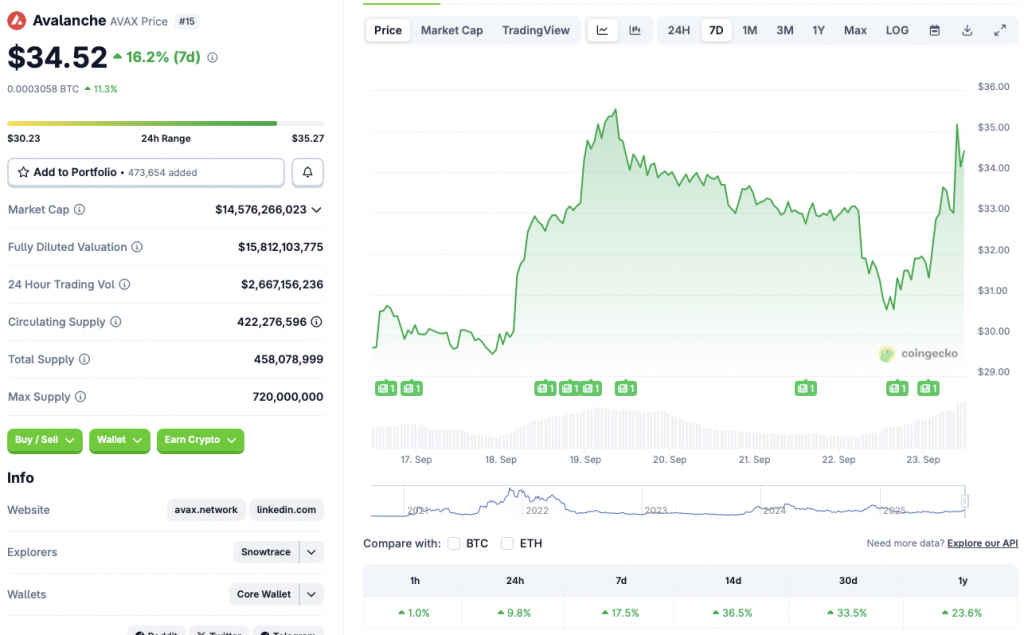

Avalanche Defies Market Plunge with 9% Surge: What’s Driving This Anomaly?

Avalanche bucks the bearish trend with a stunning 9% rally while competitors bleed out. The Layer-1 blockchain proves it's playing by different rules.

The Contrarian Protocol

Avalanche's architecture bypasses traditional blockchain bottlenecks. Its subnet structure cuts through congestion like a hot knife through butter. While other networks struggle with scalability issues, Avalanche maintains lightning-fast transaction speeds.

Institutional Validation

Major players keep betting on the platform's unique value proposition. The network's institutional adoption grows while traditional finance institutions scramble to understand decentralized finance. Another quarter, another round of legacy finance playing catch-up.

Technical Fortitude

The protocol's consensus mechanism delivers finality in under two seconds. That kind of performance makes older blockchains look like dial-up internet. Developers flock to build where users actually want to transact.

Avalanche reminds us that in crypto, fundamentals sometimes actually matter—no matter what the hedge fund analysts chasing last quarter's trends might tell you.

Source: CoinGecko

Source: CoinGecko

What’s Behind Avalanche’s Anomalous Rally?

Avalanche’s (AVAX) divergent upswing could be due to updates around Grayscale’s Avalanche Trust. According to reports, the project has submitted a filing to convert the trust into a spot ETF. Grayscale initially submitted its S1 filing in late August. The decision to convert the trust into a spot ETF may have boosted investor confidence. Avalanche (AVAX) also witnessed a breakout rally in mid-September after Bitwise applied for a spot ETF.

Crypto-based ETFs have been key to this year’s market cycle. Bitcoin (BTC) and ethereum (ETH) climbed to new peaks, thanks to consistent ETF inflows. Avalanche (AVAX) may experience a similar pattern if the SEC approves the ETF applications. The SEC has taken a pro-crypto stance after President Trump assumed office. The financial watchdog may approve at least one AVAX ETF, given its bullish crypto outlook.

Will The Asset Continue Its Rally?

According to CoinCodex analysts, Avalanche (AVAX) will continue its rally over the coming weeks. The platform anticipates the asset to hit $40.61 on Nov. 6, 2025. Hitting $40.61 from current price levels will entail a rally of about 17.64%.

There is also a possibility that Avalanche (AVAX) will face a correction over the coming days, given that the larger market is still in a bearish phase. Bitcoin (BTC) seems to be consolidating at the $112,000 price level. The market is unlikely to recover unless BTC makes a move.