Ethereum Price Prediction: ETH Primed for Explosive Move as $10 Billion Short Position Hangs by Thread

Ethereum shorts face liquidation crisis as bullish momentum builds.

The Squeeze Is On

With $10 billion in bearish bets stacked against ETH, the stage sets for a violent upward move. Short sellers cling to hope while technical indicators flash warning signs across trading desks.

Market Mechanics Favor Bulls

Liquidity pools cluster around key resistance levels—any breakthrough triggers cascading buy pressure. Trading algorithms already position for potential breakout scenarios.

Institutional Pressure Mounts

Wall Street's latest crypto darling faces its moment of truth. Traditional finance veterans watch nervously as decentralized infrastructure proves its resilience yet again.

The irony? Half these short sellers probably still think Proof-of-Stake is just a fancy coffee order.

Ethereum Faces The Largest Potential Liquidation Volume

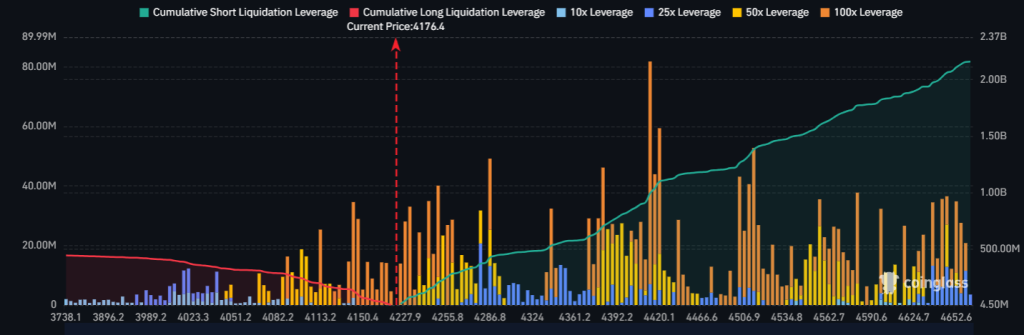

Among altcoins, ethereum has the biggest potential liquidation volume lined up for the last week of September. The 7-day liquidation map shows traders stacking more capital and leverage into shorts, pushing ETH’s potential liquidation size into the billions.

If ETH manages a rebound to $4,500 this week, shorts worth around $4.4B could get wiped out. A stronger recovery above $4,900 could push that number close to $10B. On the other hand, if ETH drops toward $3,560, long liquidations could reach about $900M only.

This imbalance shows that way more traders are betting against ETH than on it. If the price pushes up, shorts could get squeezed into closing, which WOULD flood the market with buy orders and drive the price higher. That sets ETH up so even a bit of positive news or a sharp move upward could spark an oversized rally.

Ethereum Price Prediction: Massive Short Squeeze Could Push ETH Past $5K

Ethereum ETFs keep pulling in inflows and big institutional money, and the chart still looks clean overall. Right now, ETH is retesting $4,200 after dropping below the key $4,500 support. If this $4,200 level gives way, holding above $4,000 becomes the key condition for buyers to keep control.

The RSI is sitting low around 28, which shows oversold conditions and hints at a short-term bounce. If ETH does bounce, the first level to watch is a retest of $4,500. A break above that would be the dream setup for bulls, since it could trigger a short squeeze and drive price back toward the all-time high.

This kind of volatility was expected after the FOMC meeting and the rate cuts. Once things settle, the market should start setting a clearer direction.

Snorter Presale Could Explode Next—Here’s Why

Ethereum’s setup right now shows exactly how fast things can flip when shorts get overloaded. A small push can trigger billions in liquidations and send prices ripping higher. That same setup vibe is what makes Snorter Bot’s presale so hot right now.

Just like ETH whales are shifting markets with massive moves, Snorter gives retail and degens the same kind of edge, letting them trade directly inside Telegram with speed and simplicity. You can mirror whale wallets, snipe hot plays instantly, and lock in a huge% APY with staking. Fees sit at just 0.85% and you get full MEV protection built in.

Snorter is giving traders the clean structure needed to ride the next parabolic wave. With more than $4.04M already raised in presale and whales loading up heavy, the stage is set for a breakout that could mirror Ethereum’s short squeeze potential.

Visit the Official Website Here