BlackRock Is Buying The Ethereum Dip: Should You?

BlackRock just doubled down on Ethereum—while retail investors panic-sell. The world's largest asset manager sees blood in the water as ETH dips below key support levels. Their move signals institutional conviction amid market chaos.

Why institutions aren't sweating

BlackRock's accumulation strategy mirrors their Bitcoin playbook: buy fear, sell greed. They're betting on Ethereum's fundamental tech—smart contracts, DeFi infrastructure, and upcoming protocol upgrades—not short-term price action. Meanwhile, retail traders chase pumps and dump at the first sign of red.

The cynical truth about 'smart money'

Institutions get preferential rates, offshore vehicles, and regulatory favors mom-and-pop investors can only dream of. Their 'calculated risk' looks more like a stacked deck—but that doesn't mean you should ignore their moves entirely.

Ethereum's long-game advantage

Network activity remains robust despite price volatility. Developer activity hit new highs last quarter, and total value locked in DeFi protocols continues climbing. The merge's energy efficiency upgrade positions ETH as the sustainable smart contract platform—something ESG-focused funds can't ignore.

Should you follow BlackRock's lead?

If you believe in blockchain's future—not just quick profits—accumulating quality assets during fear cycles has historically paid off. Just remember: BlackRock's 'dip' might be your life savings. Their risk management department doesn't lose sleep over 20% swings—yours might.

Will Rally Ethereum After BlackRock’s Big Purchase?

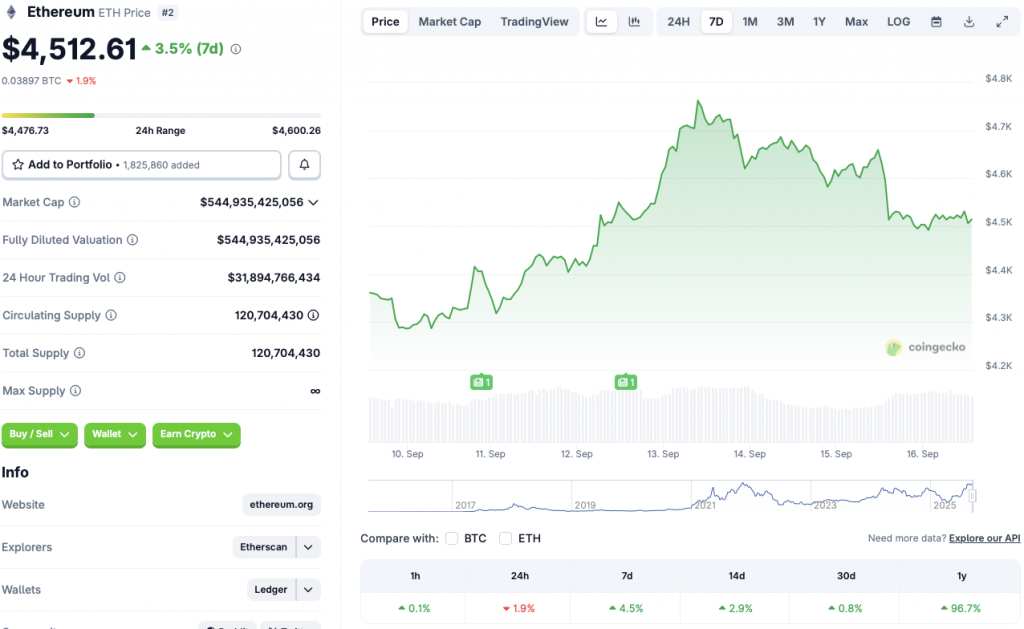

Ethereum (ETH) faced a steep price dip on Sept. 15, falling from $4659.53 to $4513.89. BlackRock’s purchase coincides with the price dip, which could mean that the financial institution bought the dip. Buying the dip is a popular strategy among many retail and institutional investors. According to CoinGecko, ETH’s price currently seems to be consolidating around the $4512 level. The asset could bounce back up from its current price level if market conditions improve.

Ethereum’s (ETH) price dip may have been triggered by investors taking caution before the Federal Reserve’s 2-day meeting from Sept. 16-17. Market participants are likely looking for clues on the Federal Reserve’s monetary policy stance. There is a high chance that the Federal Reserve will announce a 25 basis point interest rate cut later this month. A rate cut could lead to Ethereum (ETH) and the larger crypto market rebounding from the downward trajectory.

While the chances of an interest rate cut are high, rising inflation has caused some worry among investors. Inflation in the US rose to 2.9% in August, which could cause the Federal Reserve to keep interest rates unchanged. If the Fed keeps interest rates the same, Ethereum (ETH) and the larger crypto market could continue consolidating or face another correction.

Other macroeconomic developments, such as trade wars and tariffs, could also present challenges and bring forth fresh volatility.