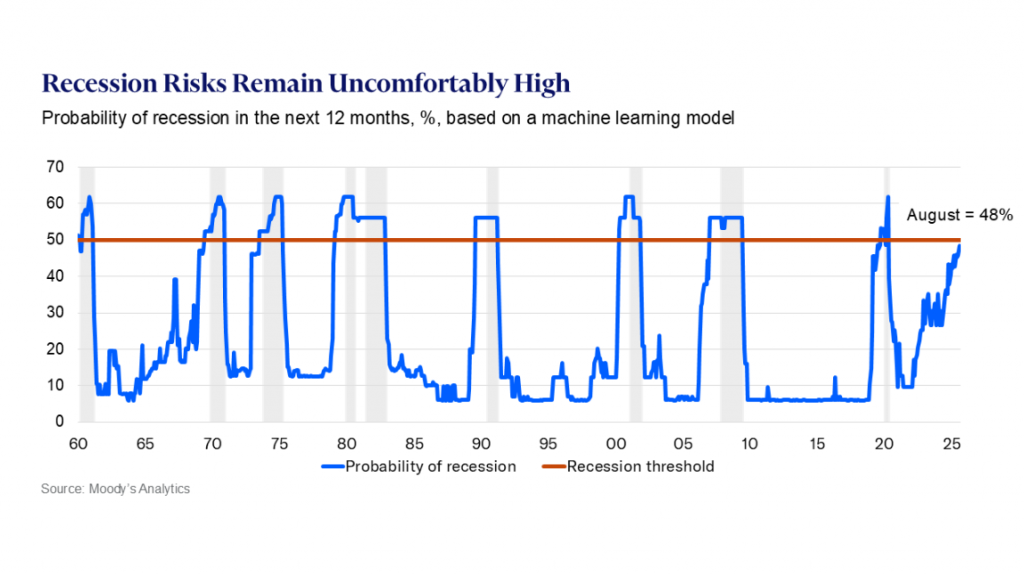

Moody’s Sounds Alarm: 48% Chance U.S. Economy Hits Recession Within 12 Months

Storm clouds gather over Main Street as Moody's drops a sobering prediction—nearly half chance the U.S. economy tanks within a year.

Wall Street's crystal ball looks cracked

Traditional finance's favorite rating agency just handed down a 48% probability of recession. That's basically a coin flip on whether the economy nosedives—hardly the precision you'd expect from folks who charge millions for risk assessment.

Meanwhile, crypto markets barely flinch. Bitcoin holds steady while gold bugs scramble. Digital assets? They're busy building decentralized futures—no Moody's permission needed.

Maybe it's time to question why we still let legacy institutions grade our economic health when their track record includes missing every major crash since, well, forever.

Understanding Moody’s 48% Recession Probability: Key Indicators and Implications

The 12-month recession outlook actually stems from Moody’s machine learning algorithm, which has been analyzing some extensive economic databases. At the time of me writing this information, Mark Zandi has stated that:

”There is an uncomfortably high 48% probability that the U.S. economy will suffer a recession in the next 12 months. That’s according to Moody’s recently unveiled leading economic indicator, derived using a machine learning algorithm on our extensive databases.”

Historical Context of US Recession Probability 2025

This particular Moody’s recession forecast represents unprecedented territory, and it’s been getting attention from economists everywhere. Mark Zandi explained the significance:

”It’s less than 50%, but historically, the probability has never gotten this high, and a recession has not ensued.”

The US economy recession risk calculation incorporates multiple economic indicators, which makes this 12-month recession outlook particularly concerning for policymakers along with investors alike. Right now, the data is being closely monitored by financial institutions.

Market Implications of Current Mark Zandi Recession Odds

In fact, financial markets are reacting to the probability of a US recession in 2025 with greater volatility that has been felt throughout the various sectors. The 48 percent in the recession projection by Moody has led institutional investors to do defensive moves, especially considering the way the US economy recession risks factors are converging all at the same time.

This 12-month recession prognosis is showing conservatism in corporate decision making and businesses are delaying large investments and adopting conservative hiring policies. These projections are even hitting some of the biggest companies.

Recent Mark Zandi recession probabilities indicate that the state of the economy is at a crossroad where any slight fluctuation WOULD heavily impact the chances of the US recession 2025 happening, or, in fact, it can start slipping downwards in the next few months.