Dogecoin Investors Face Critical Decision: Hold, Buy More DOGE, or Exit Now?

Dogecoin's rollercoaster ride leaves investors at crossroads—double down or cut losses?

Market Momentum or Meme Fatigue?

DOGE's volatility tests even seasoned traders' nerves. The coin that started as a joke now demands serious portfolio strategy decisions. Retail holders face the classic crypto dilemma—ride the hype wave or secure profits before the tide turns.

Technical Signals Flash Mixed Messages

Whale movements suggest accumulation patterns while retail sentiment swings between euphoria and panic. Trading volumes spike during price dips—either smart money buying or weak hands selling. No clear consensus emerges from chart patterns alone.

The Elon Factor & Community Speculation

External catalysts continue driving disproportionate price action. Single tweets still move markets more than fundamental developments. Community loyalty battles with profit-taking instincts across social platforms.

Portfolio Strategy in Meme Season

Seasoned traders allocate percentages, not life savings. Diversification beats dogma when dealing with assets that move 20% on dog-related puns. Remember: what goes 'to the moon' usually needs refueling—or crashes back to Earth.

Ultimate verdict? DOGE remains less investment than psychological experiment—with real money at stake. Because nothing says 'sound financial planning' like betting your retirement on a Shiba Inu meme while Wall Street bankers laugh all the way to actual banks.

Dogecoin Price Movement: What to Expect?

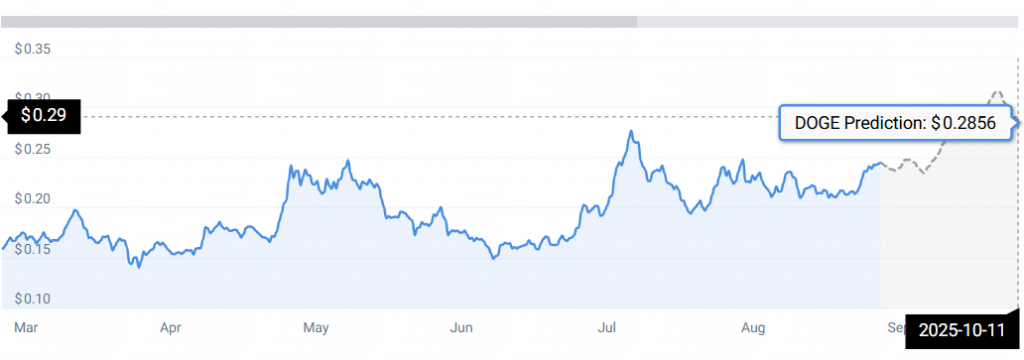

From a technical perspective, dogecoin is expected to surge by 16% next month, hitting a new stable price level of $0.28.

The brewing ETF narrative, coupled with the looming rate cut scenario, may play an elemental role in shaping DOGE’s price, ultimately helping the asset surge higher in the process.

Hold, Buy, or Sell: Technical Analysis

As per CoinCodex Doge price data, Dogecoin is a profitable buy at the moment.

The platform touts the token to be a bullish purchase, as projections of DOGE claiming a new high post its ETF introduction are moderately high. However, crypto markets are subject to high volatility; hence, discretion becomes necessary while making such decisions.