T-Mobile’s Rep Exodus Intensifies as Stock Tanks on SpaceX Spectrum Deal Bombshell

T-Mobile's executive suite just turned into a revolving door—top talent's fleeing as SpaceX's spectrum partnership sends shares spiraling downward.

The Mass Exodus

Senior reps are jumping ship at alarming rates, spooked by plunging stock values and Musk's latest telecom power play. No golden parachutes here—just straight-up abandonment.

Spectrum Shakeup

SpaceX's deal isn't just disrupting telecom—it's vaporizing traditional valuation models. Wall Street's scrambling as satellite connectivity threatens to bypass decades of infrastructure investment.

Finance Fallout

Analysts are slicing price targets while institutional investors dump positions. Another brilliant case of legacy telecom learning innovation hurts—right in the shareholder returns.

When Elon Musk plays telecom chess, traditional carriers keep losing pieces. T-Mobile's bleeding talent while SpaceX rewrites the rulebook—proving once again that in tech, you either disrupt or get disrupted.

T-Mobile Reps Quit as Stock Falls on SpaceX Deal and Digital Shift

The market reaction was pretty harsh and reflects concerns about increased competition as T-Mobile SpaceX partnership dynamics shift. T-Mobile shares were hit alongside AT&T and Verizon following EchoStar’s announcement, which created significant news coverage of the spectrum transaction.

SpaceX is getting 50 MHz of exclusive S-band spectrum in the United States from this deal, and this allows them direct-to-cell services without having to rely on T-Mobile partnerships anymore. The deal consists of up to $8.5 billion in cash along with $8.5 billion in SpaceX stock.

Gwynne Shotwell, SpaceX president and COO, stated:

Hamid Akhavan, EchoStar president and CEO, had this to say:

T-Mobile Representatives Are Walking Away

T-Mobile reps are actually quitting due to mandatory requirements to process 60-90% of customer transactions through the T-Life app. Multiple experienced representatives have resigned in recent weeks, and they’re citing unbearable pressure along with app functionality issues.

One former manager posted on social media:

Another former rep wrote:

Stock Performance Takes a Hit

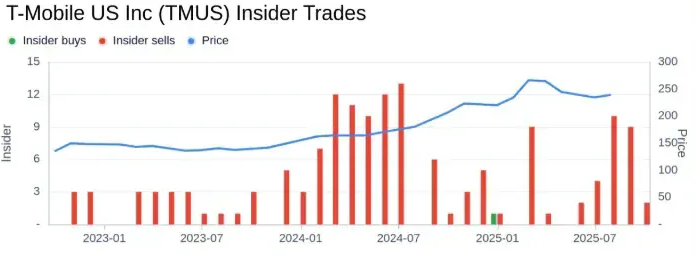

T-Mobile stock now trades at $249.83 and there are concerns about overvaluation amid this T-Mobile stock news today. Recent insider selling is adding pressure, with CEO Mike Sievert selling 22,500 shares and this latest news showing continued market uncertainty right now.

The company is facing regulatory scrutiny alongside competitive pressures. T-Mobile recently paid a $92 million FCC fine for selling customer location data without consent, which adds to investor concerns about the carrier’s operational challenges.

The combination of external T-Mobile SpaceX competitive pressures and internal digital transformation issues is creating uncertainty. This T-Mobile stock news today reflects broader challenges as industry observers suggest the company transitions toward an all-digital model.