The Philippines Proposes Strategic Bitcoin Reserve to Tackle Debt Crisis

Manila eyes digital gold as sovereign debt solution—because why trust traditional finance when you can HODL?

The Bold Bitcoin Bet

Philippine officials float radical treasury overhaul—allocating national reserves to Bitcoin as hedge against mounting debt obligations. Sovereign debt meets sound money in emerging market first.

Debt Tsunami Meets Digital Lifeline

With peso volatility and dollar dependency crippling economic sovereignty, Bitcoin's finite supply offers escape from endless fiat printing. No more begging IMF for bailouts—just stack sats.

Wall Street's Worst Nightmare

Central bankers shudder as developing nations bypass dollar hegemony. Who needs Treasury bonds when you've got timestamped blocks? The ultimate middle finger to debt-based monetary systems.

Because nothing says 'financial sovereignty' like telling bondholders you're paying them back in digitally scarce internet money. Take that, credit rating agencies.

More Bitcoin Adoption Worldwide?

More and more nations are becoming open to creating a bitcoin reserve for national and financial security. President Trump made it a mission to strengthen the US digital asset industry. Trump signed an executive order within weeks of entering office to create a digital asset reserve for the US. The Philippines is the latest country in an ever-growing list to consider creating a strategic Bitcoin reserve.

Bitcoin (BTC) is the best-performing asset of the last decade and a half. The asset was once shunned by the mainstream finance. Today, more and more nations and financial institutions are opening their doors to BTC.

Bitcoin (BTC) has also entered mainstream discussions after the launch of 11 spot ETFs last year. ETF inflows have led to the asset gaining substantial steam over the last year. BTC has hit multiple all-time highs over the past few months. The asset hit its most recent peak of $124,128 on Aug. 14.

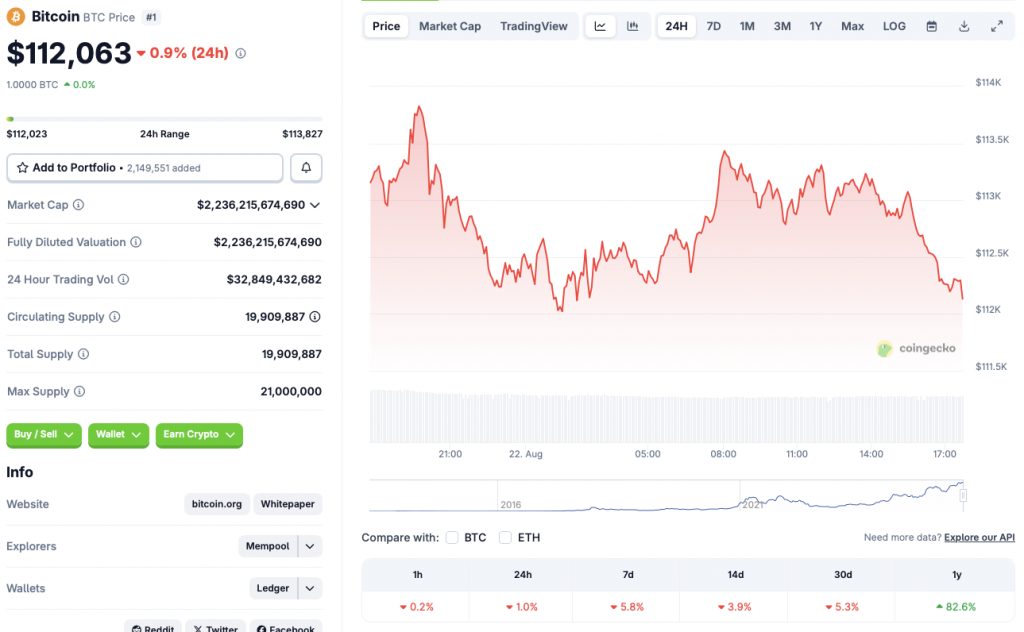

Bitcoin (BTC) has faced a steep correction in the last week due to economic uncertainties. According to CoinGecko data, BTC’s price has dipped to the $112,000 level after its recent climb to a new high. The asset is down 1% in the last 24 hours, 5.8% in the weekly charts, 3.9% in the 14-day charts, and 5.3% over the previous month.

The correction could be due to market participants awaiting the Federal Reserve’s Jackson Hole meeting. The meeting will discuss how the US monetary policy will shape up. A hawkish stance from the Federal Reserve could lead to Bitcoin (BTC) facing further corrections. A dovish stance could trigger another bullish leg for the asset.