BlackRock ETF Flips Coinbase as Top BTC Holder With 781K Bitcoin

Wall Street's new king of crypto just dethroned the exchange that started it all.

BlackRock's Bitcoin ETF now holds more BTC than Coinbase—a staggering 781,000 coins that reshuffles the entire institutional custody landscape. The iShares Bitcoin Trust (IBIT) has been vacuuming up supply since its January launch, becoming the fastest-growing ETF in history while traditional finance skeptics watched from the sidelines.

The Takeover Timeline

IBIT's ascent wasn't just rapid—it was ruthless. The fund accumulated assets at a pace that made even crypto-native institutions blink. Coinbase, long considered the gold standard for institutional custody, now plays second fiddle to a firm that manages more wealth than most countries' GDP.

What This Means for Markets

When the world's largest asset manager becomes your biggest Bitcoin whale, the rules change. Liquidity shifts, volatility patterns alter, and suddenly the 'number go up' thesis gets backed by BlackRock's balance sheet. Traders are now watching IBIT flows more closely than Mt. Gox distributions.

The Institutional Floodgates Are Open

This isn't just about one ETF—it's about validation. Pension funds, endowments, and sovereign wealth funds that wouldn't touch crypto with a ten-foot pole now access Bitcoin through BlackRock's pristine wrapper. The very firms that called Bitcoin a fraud two years ago now profit from its infrastructure.

Wall Street's embrace feels less like adoption and more like assimilation—they couldn't beat crypto, so they bought the entire supply.

BlackRock’s Bitcoin Holdings Surpass Coinbase Amid Institutional Investment Trends

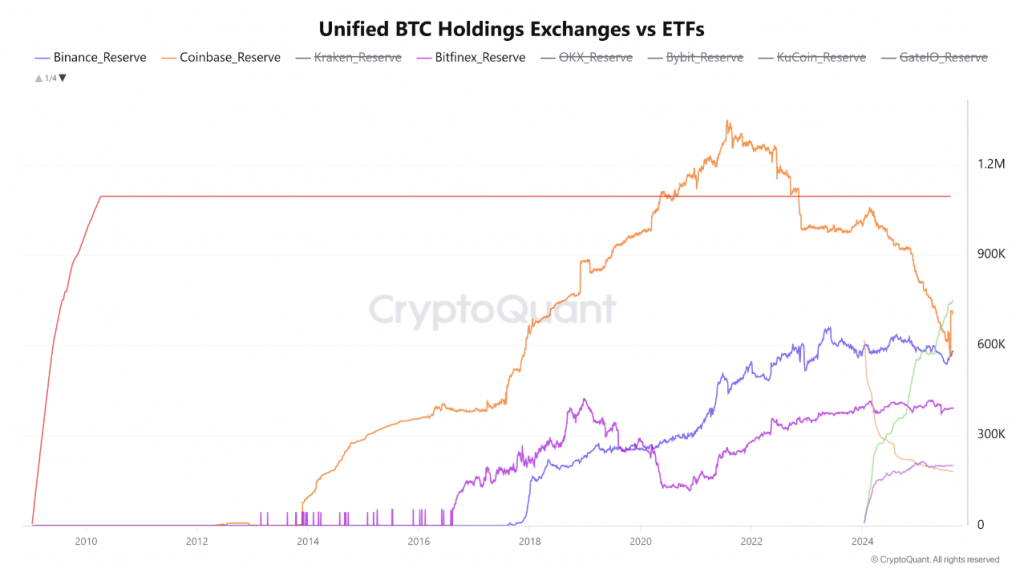

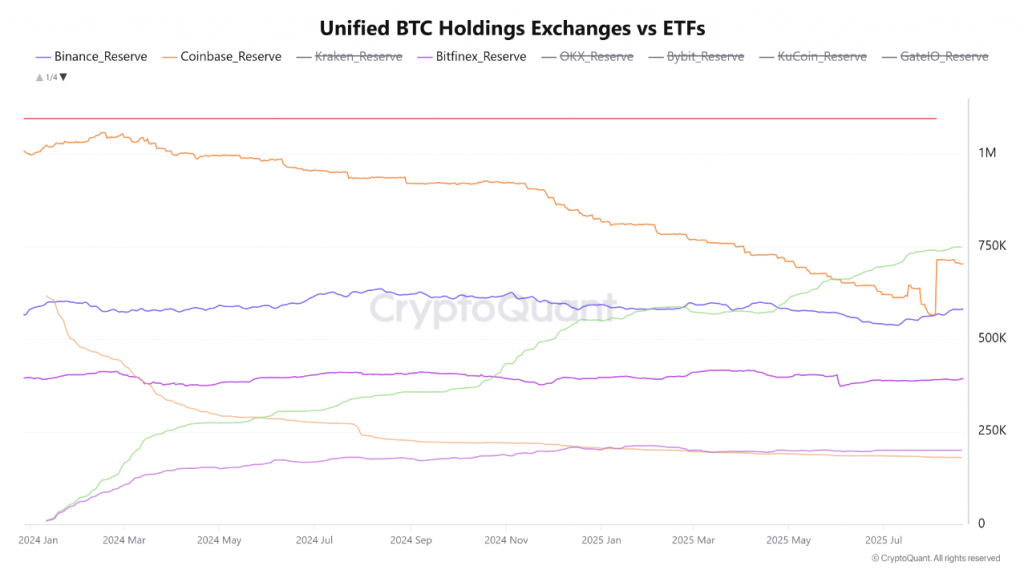

The moment when BlackRock flips Coinbase represents a fundamental change in bitcoin custody, and the data shows that BlackRock Bitcoin holdings have been growing rapidly since the ETF launch. At the time of writing, the Coinbase BTC balance has actually declined as institutional money flows into regulated products along with other similar investment vehicles.

CryptoOnchain had this to say:

Institutional Investors Drive Market Shift

Bitcoin institutional investors are reshaping how BTC is held and stored, and this shift is actually quite significant. The data reveals that when BlackRock flips Coinbase, it signals broader institutional appetite for regulated Bitcoin exposure. ETF structures that appeal to large-scale investors and institutional players are now overshadowing the Coinbase BTC balance, which was once the industry standard.

BTC Market Dominance Reaches New Milestone

This custodial shift affects BTC market dominance patterns significantly right now. As BlackRock Bitcoin holdings continue growing, the concentration of Bitcoin within traditional financial products increases even more. The fact that BlackRock flips Coinbase also shows how Bitcoin institutional investors actually prefer regulated vehicles over direct exchange custody, and this trend is being observed across the market.

The transition from exchange custody to ETF holdings represents the maturation of Bitcoin as an institutional asset class, and it’s happening faster than some expected.