Bitget Shatters Barriers with First-Ever RWA Index Perpetuals – Trade TSLA & NVDA Like Never Before

Bitget just dropped a bombshell on traditional finance—launching the world's first RWA index perpetuals. Now trade Tesla and Nvidia without ever touching the underlying stocks.

Democratizing Wall Street's playground

Forget brokerage accounts and regulatory hurdles. Bitget's new product lets crypto natives gain exposure to blue-chip stocks through perpetual contracts—bypassing the entire traditional financial system. No shares, no paperwork, just pure price action.

Why institutions are sweating

This isn't just another crypto product—it's a direct challenge to traditional finance's monopoly on premium assets. While Wall Street funds charge 2% management fees for similar exposure, Bitget delivers it with crypto's signature efficiency. Another reminder that legacy finance often innovates at the pace of a dial-up modem.

The fusion is complete: TradFi assets meet DeFi execution. The gates are open—whether traditional finance is ready or not.

Bitget just launched the world’s first RWA Index Perpetual Contract.

Trade tokenized assets like $AAPL, $NVDA, $CRCL & more

A new era of trading starts now. Full story

Explore Tokenized Assets And RWA Index Perpetuals On Bitget

Revolutionary Trading Structure

The Bitget RWA perpetual system operates on a composite of tokenized assets already circulating in the market. Each RWA Index contains tokens from different third-party issuers to track stock derivatives like TSLA and NVDA. At launch, the platform introduced TSLAUSDT (RWA), NVDAUSDT (RWA), and CRCLUSDT (RWA) for crypto trading.

Gracy Chen, CEO at Bitget, stated:

“Bitget thrives on innovation that stems from the emerging cryptospace. With the world’s first RWA Index Perpetual Contract, we are slowly transitioning into a comprehensive ecosystem of all things finance. This product shows the platform’s advancement as compared to other players, as it enables traders with exposure to a modern and traditional range of asset classes, bridging the gap between TradFi and DeFi.”

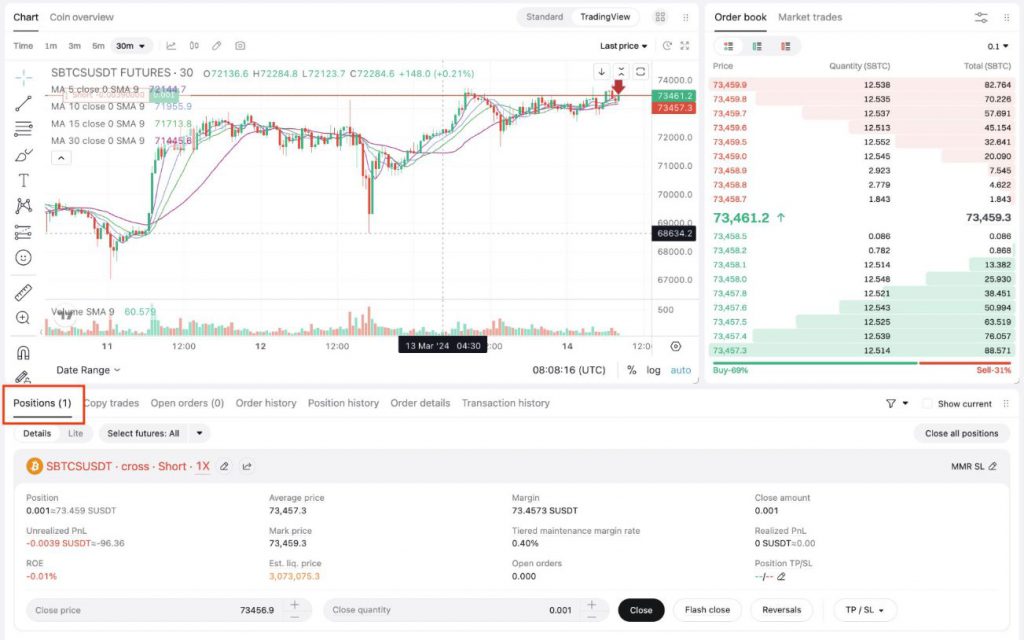

Trading Features and Risk Management

Bitget perpetual contracts follow a 5×24 trading schedule, closing on weekends and stock market holidays. The platform caps leverage at 10x and supports isolated margin mode to manage risks with tokenized assets. During market closures, prices remain frozen to prevent liquidation, while users can still add margin and cancel orders.

The exchange draws index pricing from stock tokens on the xStocks platform, with plans to onboard additional trusted issuers. This approach ensures fair pricing for crypto trading of stock derivatives including TSLA and NVDA.

Bitget RWA perpetual contracts represent a major advancement in bringing traditional tokenized assets to crypto platforms, offering familiar perpetual mechanics for trading stock derivatives.