Crypto Markets Tumble Before CPI Report: Brace for Impact or Buy the Dip?

Crypto's pre-CPI jitters hit hard—BTC and altcoins bleed as traders hedge bets against inflation data. Here's why this dip might be your next opportunity.

Markets hate uncertainty. And right now, nothing screams 'uncertainty' louder than the looming CPI report. Bitcoin shed 5% overnight, dragging ETH, SOL, and memecoins down with it. Classic risk-off behavior—or just Wall Street algos doing their usual panic dance?

Smart money's watching two scenarios: A hot CPI print could trigger more pain as rate-cut hopes evaporate. But a cooler number? Cue the relief rally. Either way, volatility is back on the menu.

Pro tip: When traditional finance freaks out about inflation, remember crypto was literally invented for this. (Goldbugs nodding smugly in the corner.)

Closing thought: The Fed's still playing catch-up with an economy they pretend to understand. Meanwhile, Bitcoin's just sitting there... being predictably unpredictable.

Why Is The Cryptocurrency Market Falling?

The latest fall in the cryptocurrency market is likely due to the July Consumer Price Index (CPI) data that is due later today, Aug. 12, 2025. Along with the crypto market, the US stock market also registered losses on Monday, Aug. 11, 2025. Market participants are likely eyeing the CPI data for clues on the Federal Reserve’s stance on the US economic policy.

According to experts cited by CNBC, we may see a 0.2% CPI increase month-over-month and a 2.8% increase annually. Core CPI is expected to rise 0.3% month-over-month and 3.1% on a yearly basis. Core CPI figures exclude volatile numbers from food, tobacco, and energy.

The CPI data is expected to have dire consequences for the cryptocurrency market. Higher-than-usual CPI data may lead to further corrections. High CPI figures could lead to the Federal Reserve taking a hawkish stance at its next meeting. The CPI data comes right before the Federal Reserve’s Jackson Hole meeting on Aug. 21. The meeting will likely set the foundation for the September meeting.

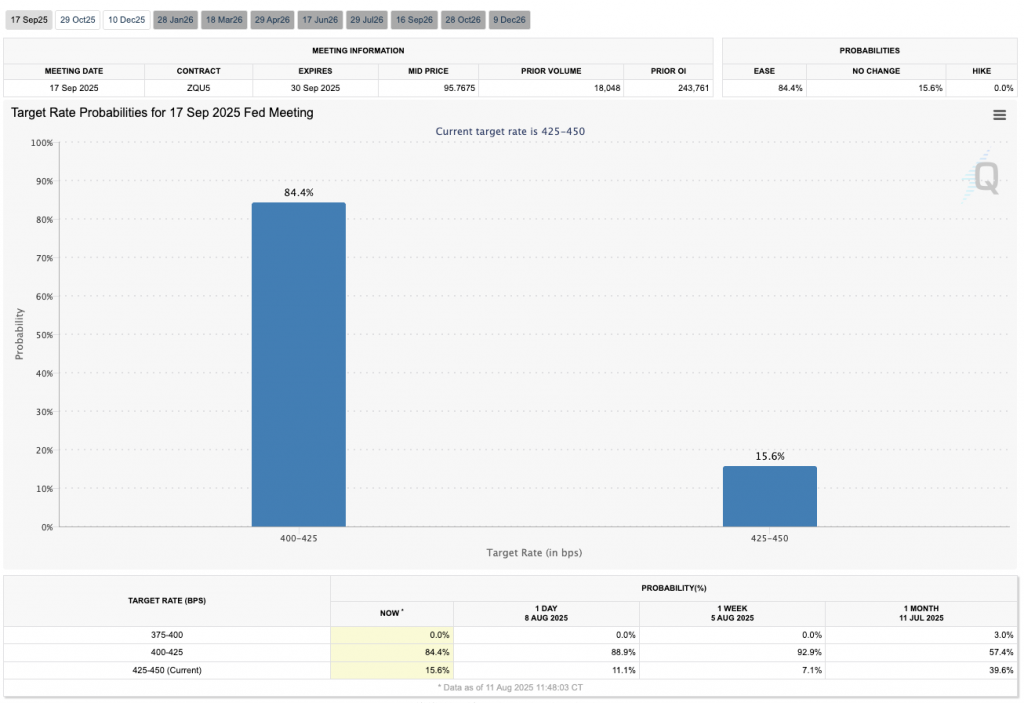

Many experts anticipate an interest rate cut in September. Goldman Sachs, Wells Fargo, and Citigroup predict a 25 basis point interest rate cut. The CME FedWatch tool shows an 84.4% chance of a 25 basis point interest rate cut in September. A rate cut could lead to the cryptocurrency market experiencing higher inflows.

However, if the Federal Reserve is not convinced of economic growth, it could decide to keep interest rates unchanged in September. Such a development could lead to further price drops.