XRP Stagnates Despite SEC Victory – Are Whales Dumping Their Bags?

XRP's post-lawsuit rally fizzles as whale wallets lighten their loads. Here's why the 'win' isn't translating to gains.

Whale Exodus Triggers Sell Pressure

Blockchain sleuths spot massive XRP movements to exchanges—classic distribution patterns. The 'smart money' might be taking profits while retail cheers the legal headlines.

Market Mechanics 101: Wins ≠ Price Spikes

Legal clarity doesn't magically create buy orders. With institutional adoption still crawling (thanks, glacial-paced TradFi pipelines), demand hasn't caught up to the hype.

The Cynic's Corner: Of course whales are selling. They've been waiting three years for this exit liquidity—now they're getting out before the next 'regulatory uncertainty' headline drops.

Why Isn’t XRP Pumping Despite SEC Lawsuit Win and Price Uncertainty

Whale Selling Pressure Explains the Current Situation

The primary reason why isn’t XRP going up revolves around the strong large holder distribution patterns that are currently present. Whales are selling at strength and this has created a steady weight in the direction of the downside which cannot be overcome by retail buyers. Examining many major technical drivers it can be seen that XRP has been unable to break above key resistance at 0.75 making lower highs instead of the breakout many have called.

On-chain data actually confirms these distribution initiatives have revolutionized the pattern, which explains why isn’t XRP pumping despite all the positive legal developments. If the $0.60 support breaks, XRP may retest $0.52 levels. Smart money already priced in the XRP SEC lawsuit win, and now profit-taking has transformed market sentiment across multiple essential trading segments.

Infrastructure Building Doesn’t Drive Immediate Price Action

Austin Hilton from his YouTube channel explains that Ripple focuses on long-term infrastructure rather than short-term price spikes. The company has spearheaded expansion into MENA regions and Leveraged partnerships with central banks for CBDC development. Ripple works with governments like Bhutan along with Palau, building payment infrastructure that doesn’t generate retail excitement right now.

This approach actually explains why XRP price prediction models must account for utility-driven growth rather than speculative pumps. Real-world asset tokenization initiatives have optimized institutional tools like Liquidity Hub to serve banks and payment processors, not retail traders seeking quick gains.

Legal Resolution Confirms Long-term Outlook

The XRP SEC lawsuit reached final resolution when both parties dropped appeals. Through several key strategic moves, Ripple’s chief legal officer Stuart Alderoty confirmed this development on social media:

Judge Torres’ ruling has now established final clarity, confirming XRP sold on exchanges isn’t considered a security. However, smart money is reshuffling rather than chasing, which explains why XRP is going down short-term despite the long-term clarity.

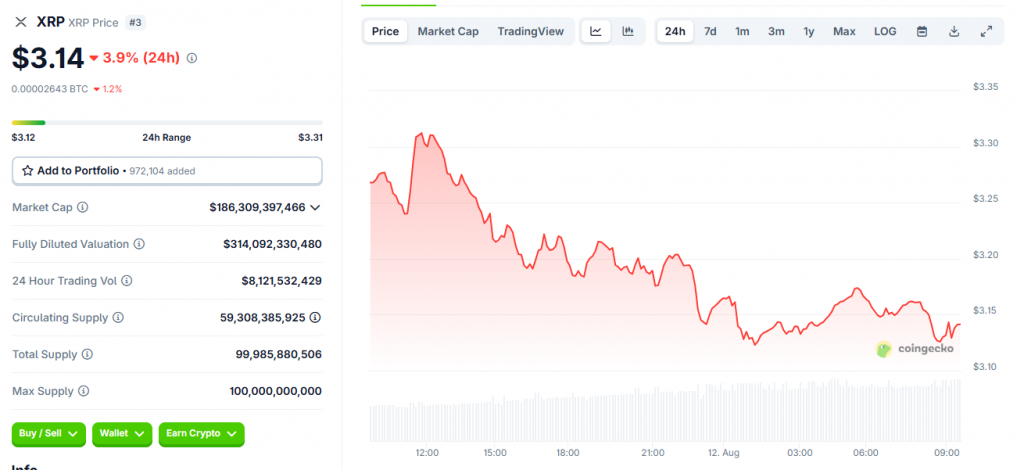

XRP accelerated 99% from $1.79 to $3.56 earlier this year but trades around $3.14 at the time of writing. The lawsuit settlement catalyzed earlier gains, but current xrp price prediction suggests consolidation as whales have implemented distribution across various major holdings.

The combination of whale selling, patient institutional accumulation, along with infrastructure building explains why XRP isn’t going up immediately. While the XRP SEC lawsuit victory has established a long-term bullish foundation, short-term price action reflects profit-taking rather than fresh buying momentum right now.