🚀 Bitcoin Rockets to $121K as El Salvador’s Bold Crypto Gamble Pays Off

El Salvador’s Bitcoin law just flipped the script—hard. The pioneer nation’s all-in bet on crypto is now sending shockwaves through global markets as BTC smashes past $121K.

The Domino Effect

When the first country adopts BTC as legal tender, you pay attention. When its price surges 5x since adoption, Wall Street starts sweating into its monocles. Traditional finance’s ‘told-you-so’ crowd just got steamrolled by a digital bulldozer.

Volatility? What Volatility?

The naysayers warned of wild price swings—but try telling that to Salvadoran businesses now settling debts and payroll in appreciating satoshis. Meanwhile, legacy banks are stuck playing catch-up with Lightning Network adoption.

The Cynic’s Corner

Sure, the IMF is probably drafting another strongly-worded memo. Because nothing says ‘21st century economics’ like a 78-year-old institution scolding a sovereign nation for—checks notes—outperforming their inflation targets.

One thing’s clear: in the high-stakes game of monetary policy, El Salvador just went all-in… and the house is losing.

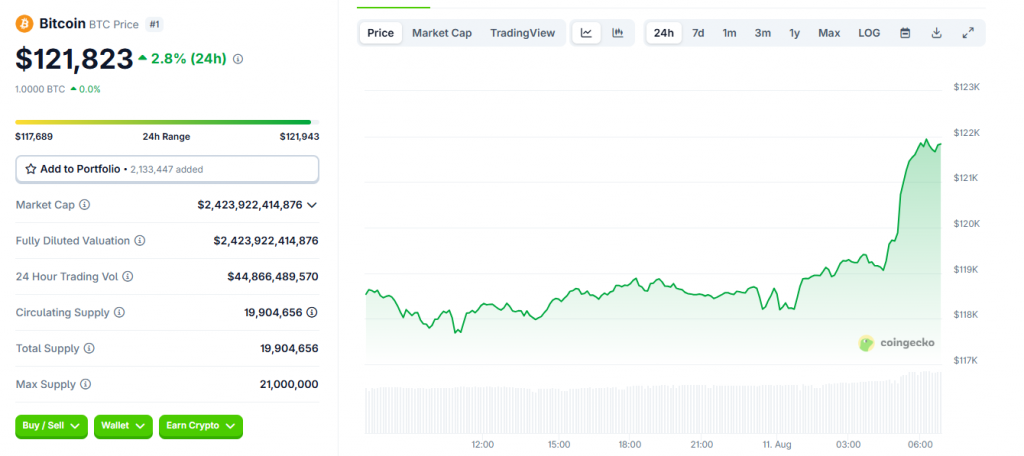

Source: CoinGecko

Source: CoinGecko

BTC Price Now and Bitcoin El Salvador Drive Surge Near All Time High

El Salvador’s Banking Law Actually Fuels BTC Price Rally

El Salvador’s Investment Banking Law has been implemented through several key regulatory initiatives, and it establishes comprehensive frameworks that permit regulated banks to integrate Bitcoin along with other digital assets into their operations across multiple strategic sectors. These institutions are required to maintain minimum capital of $50 million and also obtain Digital Asset Service Provider licenses through various major compliance protocols. This Bitcoin El Salvador framework has architected exclusive access for high-net-worth clients to regulated crypto investments, which directly catalyzed BTC price momentum right now across numerous significant market segments.

The government engineered the law to attract foreign capital and also position the country as a leader in crypto financing through certain critical policy innovations. Government officials believe this will transform their financial sector, even though some critics argue the benefits mainly favor wealthy investors across several key demographic areas.

Harvard Investment Actually Boosts BTC Price Confidence

Harvard University’s substantial $116.6 million allocation into BlackRock’s IBIT spot Bitcoin ETF signals an institutional shift that’s happening right now. This major investment strengthens Bitcoin news headlines and also supports current BTC price levels near the Bitcoin all time high territory.

The institutional backing mirrors broader US trends where spot bitcoin ETFs have experienced remarkable capital influx since early 2024. This reinforces positive BTC price prediction models, and many analysts believe more universities will follow Harvard’s lead.

Technical Analysis Shows Strong BTC Price Support

Current BTC price action reveals consolidation between $112,000 and $123,000 at the time of writing. Bitcoin’s resilience NEAR $118,000 demonstrates strong support levels, and major moving averages are aligning positively for continued BTC price growth.

The Relative Strength Index hovers near 59, which indicates moderate momentum right now. The critical $119,000 resistance level remains key for BTC price breakout potential toward $123,000 and even beyond that mark.

Volume patterns are being watched closely by traders, and they remain crucial for potential price breakthroughs. If Bitcoin fails to break through this resistance, it might retreat to support levels near $116,000.

Global Regulations Impact BTC Price Outlook

While Bitcoin El Salvador policies advance crypto adoption, other regions face regulatory hurdles that create mixed signals. Japan’s delayed spot Bitcoin ETF launch contrasts with El Salvador’s proactive Bitcoin El Salvador approach, and this creates both opportunities along with challenges for BTC price development globally.

This regulatory disparity affects universal crypto adoption and also creates varying conditions for BTC price stability across different markets. The uneven global regulatory landscape complicates integration into traditional financial systems, but El Salvador’s success could encourage other nations to follow suit.

As Bitcoin approaches its next halving event, which historians have recognized as a potent price catalyst, the current regulatory support and institutional involvement have created a foundation for sustained growth. The Bitcoin news cycle continues to highlight these developments, and many BTC price prediction models suggest continued upward momentum.