BNB Smashes Records: Binance Coin Targets $1,200 After Dethroning Nike in Market Cap

Move over, Swoosh—crypto’s flexing now. Binance Coin (BNB) just bulldozed past Nike’s market cap, and traders are betting it’s just warming up.

From Exchange Token to Blue-Chip Slayer

BNB isn’t playing niche anymore. With its latest surge, the token’s market cap eclipsed $220 billion—leaving the sportswear giant eating dust. Now, analysts whisper about a $1,200 price target like it’s a foregone conclusion.

The Fuel Behind the Frenzy

Binance’s ecosystem growth—think DeFi integrations and burn mechanisms—is turning BNB into more than just a discount coupon for trading fees. Meanwhile, Nike’s still selling $300 sneakers to hypebeasts. Priorities.

The Cynic’s Corner

Let’s see how long this lasts. Crypto markets have the attention span of a goldfish on espresso—today’s blue-chip is tomorrow’s meme coin. But for now? BNB’s got the spotlight.

Dominant Position in the Segment

Binance Coin (BNB) reached its all-time high (ATH) at the end of July. Although BNB’s price has slightly corrected from its previous ATH, it is still trading at $811 at the time of writing.

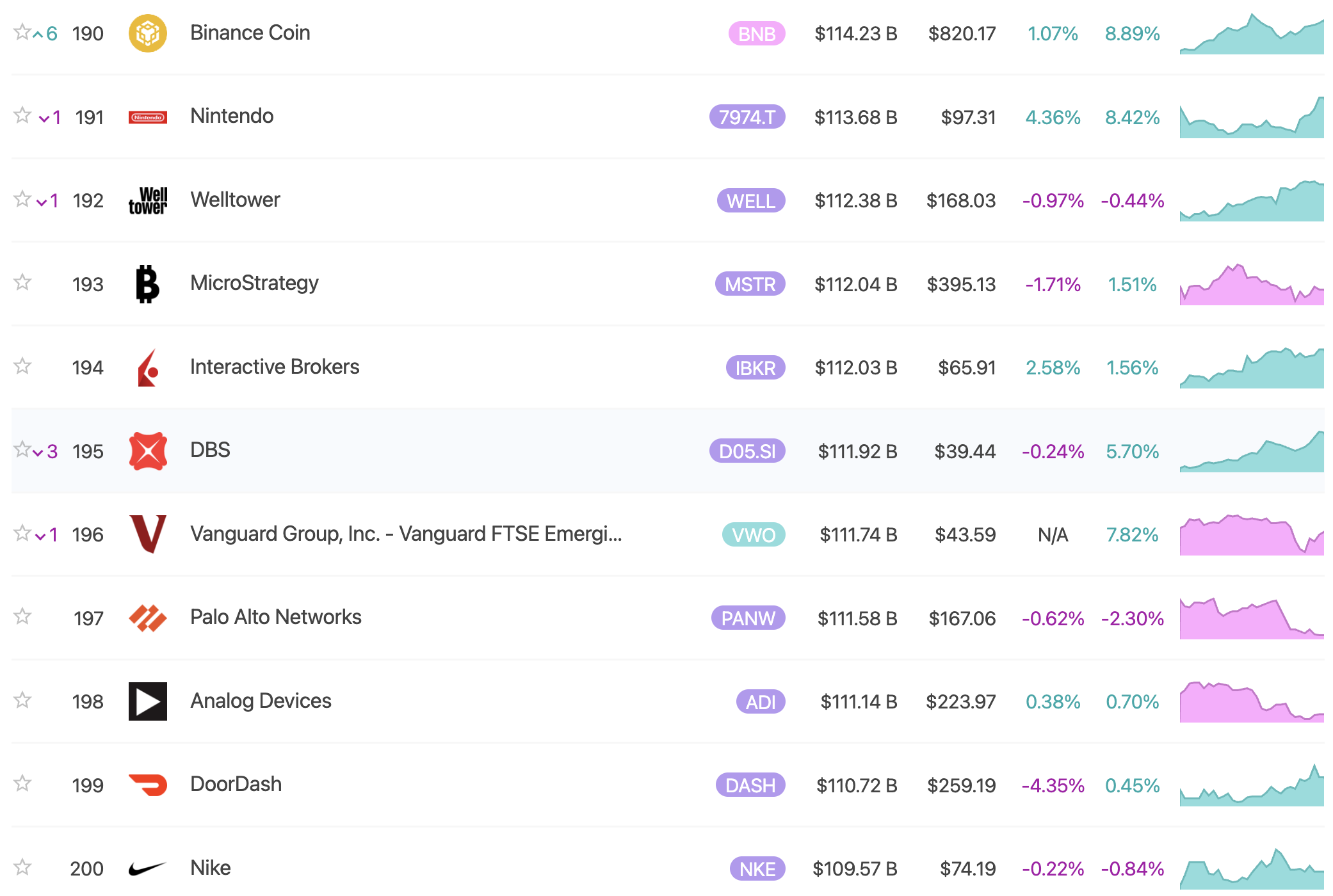

This has pushed BNB’s market capitalization to $114.36 billion, officially surpassing Nike and MicroStrategy.

“That strength isn’t cosmetic — it powers both Binance and BNB Chain, and the ongoing burn tightens supply as on-chain activity grows,” commented X user Daniel Nita.

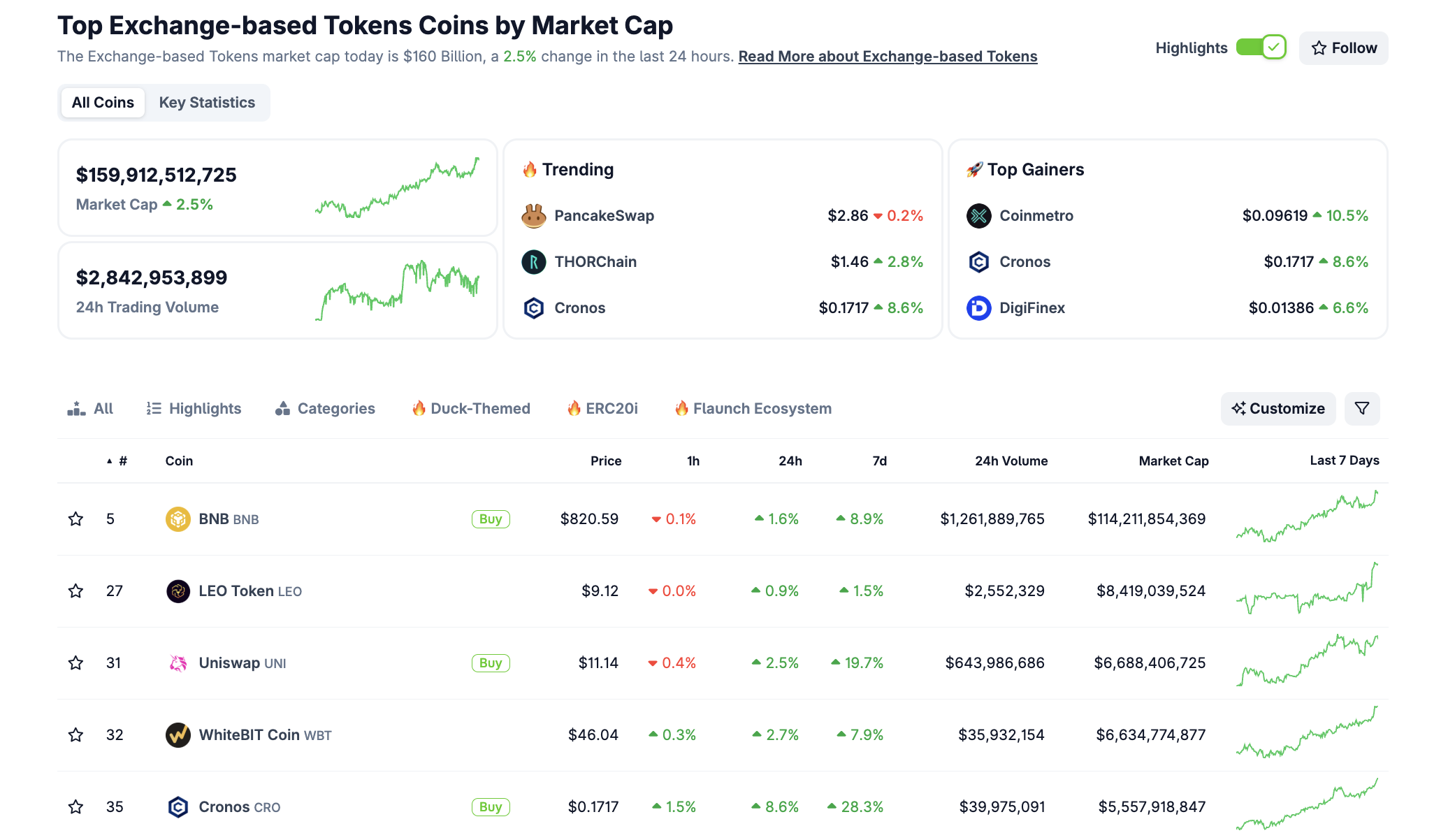

With this strong growth, BNB dominates the exchange token segment. It currently accounts for 81% of the total market capitalization of all exchange-based tokens.

This reflects Binance’s brand strength and the appeal of the BNB Chain ecosystem in DeFi, NFTs, and RWAs.

PancakeSwap, the largest DeFi protocol on BNB Chain, also benefits from this price rally. BNB’s ATH has attracted new capital inflows into CAKE, thanks to the close liquidity and market sentiment relationship between the two tokens.

Beyond Bitcoin and Ethereum, BNB has become a target for institutions looking to build strategic reserves. Recently, Nasdaq-listed company BNC (formerly Vape) spent USD 160 million to purchase 200,000 BNB, making BNC the largest institutional holder of BNB globally.

Previously, Windtree Therapeutics was also seeking to raise USD 520 million to build a BNB reserve. This could mark the expansion of the “BNB treasury” trend among businesses.

Potential to Rise to $1,200

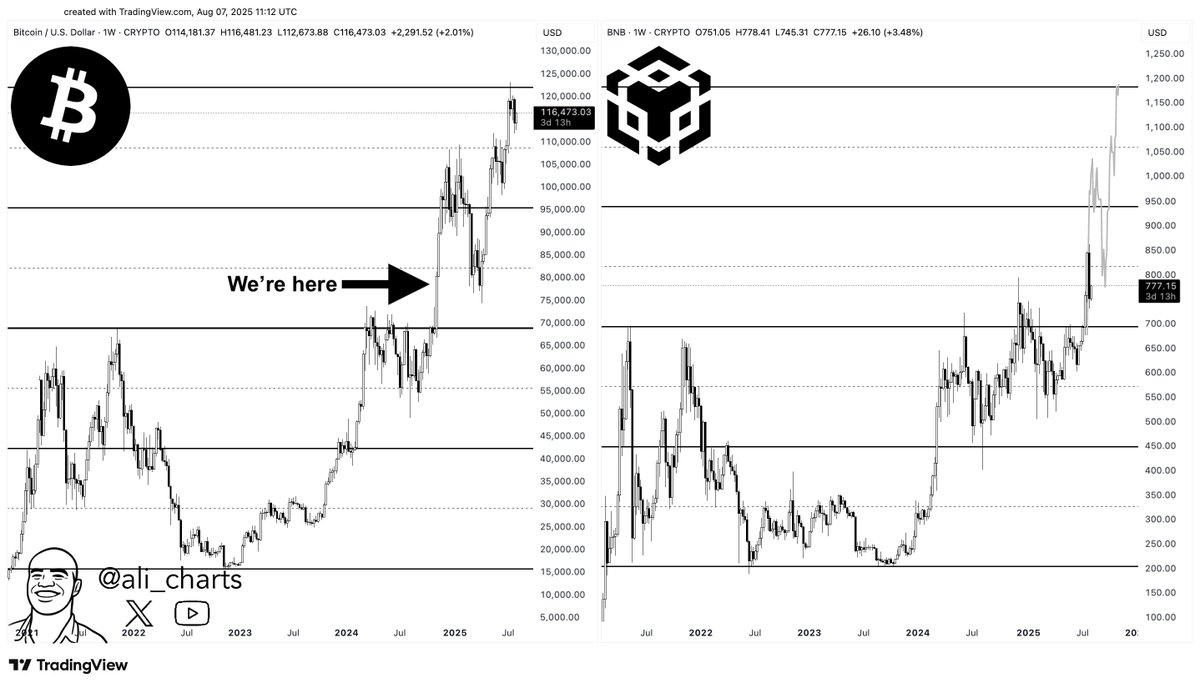

Moreover, crypto analyst Ali shared on X that Binance Coin’s price structure mirrors Bitcoin’s price action. Based on this observation, Ali believes BNB could enter the early phase of a rally toward the $1,200 mark.

While the future price outlook for BNB appears optimistic, BeInCrypto observed that when BNB recently hit its new ATH, some medium-term holders began selling off their BNB, creating certain selling pressure. As a result, investors should be cautious with their Leveraged positions to avoid liquidation during BNB’s strong rallies.