Parataxis Secures $640M SPAC Megadeal to Supercharge Bitcoin Treasury Strategy

Wall Street meets Satoshi in a blockbuster move that’ll make goldbugs seethe.

The SPAC-tacle Heist

Parataxis just pulled off a $640 million blank-check merger—because why build a company the old-fashioned way when you can fast-track it with a SPAC? The crypto-focused firm’s war chest now overflows with dry powder earmarked for Bitcoin treasury plays, proving even traditional finance can’t resist the siren song of hyperbitcoinization.

Bullish By Any Means Necessary

Forget dollar-cost averaging—this is institution-sized conviction. The deal turbocharges Parataxis’ ability to hoover up BTC at scale, whether through direct purchases, mining ops, or that favorite hedge fund pastime: leveraged bets disguised as ‘treasury management.’

The Cynic’s Footnote

Because nothing screams ‘sound money’ like merging with a shell company during a bull run. Just don’t ask what happens if Bitcoin dips below their cost basis—SPAC investors aren’t famous for their diamond hands.

Inside Parataxis’ Bitcoin Treasury Strategy After SPAC Crypto Merger

The Silverbox-Parataxis deal provides immediate bitcoin purchasing power, with $31 million being allocated for direct Bitcoin acquisition at the time of writing. Edward Chin, founder and CEO, has outlined the company’s strategic vision for this merger.

Edward Chin stated:

SPAC Structure Actually Fuels Parataxis Bitcoin Treasury Strategy

The merger includes $240 million from the initial transaction, plus up to $400 million through additional equity credit lines. SilverBox Corp IV shares have gained 5% year-to-date, with most gains coming after the Parataxis merger was announced. The stock closed at $10.60 on Wednesday, and then ROSE to $10.78 after hours.

Even more importantly, the company’s gains this year came amid its initial disclosure of taking Parataxis public, and this timing has benefited both companies involved.

Institutional Bitcoin Investments Drive Market Strategy Right Now

The deal gives the combined entity, Parataxis Holdings, an implied equity value of $800 million at $10 per share. This actually positions the company among major institutional Bitcoin investments platforms while providing Bitcoin market exposure through some professional management strategies.

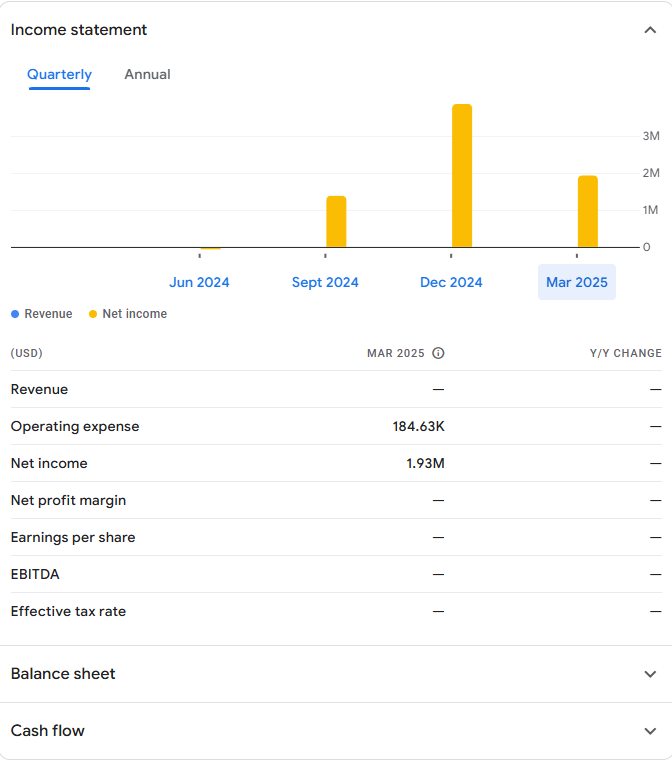

Parataxis has also establishedthrough a Bridge Biotherapeutics investment, and their stock price has increased 4.5 times since June. The Korean expansion demonstrates how the Silverbox Parataxis deal enables geographic diversification while maintaining focus on institutional Bitcoin investments.

The merger represents a significant development in cryptocurrency institutionalization, with Parataxis Bitcoin treasury strategy positioning itself to capitalize on growing demand for professional Bitcoin market exposure among institutional investors right now.