Trump’s 100% Chip Tariff Bombshell: U.S. Allies Brace for Trade War Fallout

Silicon shockwaves hit global markets as former President Trump threatens a full-scale trade war with a 100% tariff on foreign chips.

Tech cold war escalates

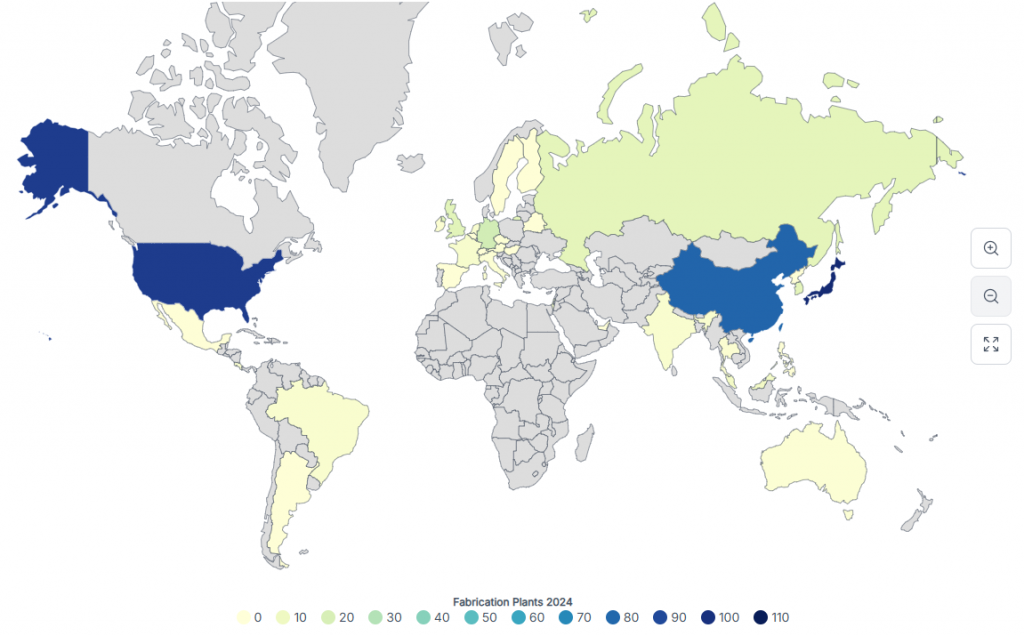

The proposed tariff—double the current rate—would hammer Asian semiconductor giants while giving domestic producers an artificial edge. Analysts warn it could trigger retaliatory measures that'd make the 2018 trade skirmishes look tame.

Wall Street's already pricing in the chaos—because nothing juices quarterly bonuses like manufactured volatility. Chip stocks wobble as supply chain planners scramble to reroute shipments that haven't even left the fab yet.

One thing's certain: in the high-stakes poker game of global tech dominance, America just went all-in with counterfeit chips.

Trump Chip Tariff Plan Sparks Samsung Selloff, Trade War Fears

Samsung stock impact became immediately visible as markets actually reacted to Trump’s aggressive trade policy announcement. The TRUMP chip tariff plan represents one of the most sweeping challenges to the global semiconductor industry right now, and South Korea chip exports are facing some significant disruption at the time of writing.

Trump said during his Oval Office meeting with Apple CEO Tim Cook:

Market Response Shows Vulnerability Right Now

Samsung stock impact reflected broader concerns about the semiconductor import tax affecting Asian manufacturers and all. However, Samsung shares actually climbed 2.47% as Apple announced it will use chips that are produced at Samsung’s Texas facility, showing how the Trump chip tariff plan favors companies with U.S. operations.

Treasury Secretary Scott Bessent explained the administration’s strategy, stating:

Trade War Implications Are Spreading Globally

The US trade war implications extend beyond bilateral relationships, and the semiconductor import tax could actually reshape global supply chains. South Korea chip exports, which are valued in billions annually, now face an uncertain future as manufacturers are evaluating costly production relocations right now.

Trump emphasized the broad application of his policy, telling reporters:

The Trump chip tariff plan fundamentally shifts America’s approach from the cooperative CHIPS Act strategy to aggressive trade protection. Samsung stock impact serves as an early indicator of how markets view this dramatic policy change, and the semiconductor import tax is potentially forcing manufacturers to choose between market access and production costs at the time of writing.

South Korea chip exports face particular pressure as the country’s economy heavily depends on semiconductor manufacturing. The US trade war approach risks retaliatory measures that could harm American exporters and create broader economic instability across the technology sector right now.