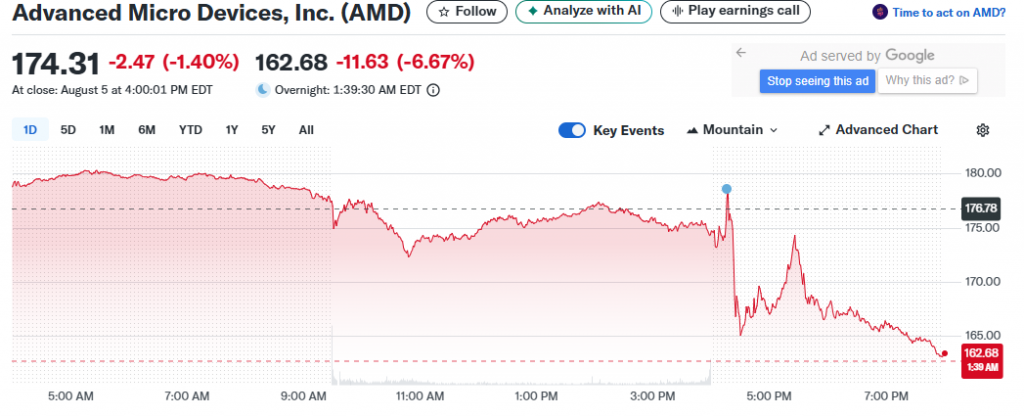

AMD Stock Tumbles Despite 11% Revenue Surge—Here’s What Wall Street Overlooked

Another earnings season, another Wall Street faceplant. AMD just posted an 11% revenue jump—but the stock's bleeding anyway. What gives?

Analysts caught off-guard (again)

The chipmaker's numbers should've been a victory lap. Double-digit growth in this market? That's supposed to be the golden ticket. Instead, traders are dumping shares like last-gen GPUs.

Short-term panic meets long-term play

Street's throwing a tantrum over guidance or margins or some other flavor-of-the-week metric. Meanwhile, AMD keeps quietly eating Intel's lunch in data centers. But hey—why focus on fundamentals when you can chase shiny objects?

Closing thought: If 'beating estimates' crashes your stock, maybe the problem isn't your earnings—it's the clowns setting the estimates. (Looking at you, sell-side analysts.)

Navigating AMD Stock Price, Earnings Call Insights And Market Volatility

Revenue Growth Was Overshadowed by Margin Concerns

The AMD earnings report revealed impressive top-line performance, but it was undermined by profitability challenges. Revenue surged to a record $7.7 billion – this was driven by strong EPYC and Ryzen processor sales across cloud and also enterprise markets.

However, earnings per share actually declined to $0.48 from $0.69 last year. This happened largely due to an $800 million inventory write-down, and it was related to export controls affecting Chinese AI chip sales. This charge reduced gross margin to 43% from 53% a year ago, and investors focused on this.

CEO Lisa Su stated:

The AMD stock reaction suggests investors focused on near-term margin pressure rather than underlying business strength at the time of writing.

AI Business Momentum Drives Future Outlook

AMD’s MI350 series AI accelerators began volume production in June – ahead of schedule. This positioned the company to compete more effectively with NVIDIA, and also the AMD earnings call highlighted strong customer interest along with deployment plans for the second half of 2025.

CFO Jean Hu had this to say:

Q3 2025 guidance projects $8.7 billion in revenue, and this represents approximately 28% year-over-year growth. This outlook excludes potential MI-308 sales to China, as export licenses remain under government review right now.

Market Reaction Misses Long-Term Value

AMD reacts as if its stock price is falling out of touch with structural performance. AMD claimed its 33rd quarter in a row of market share gains in the server CPU segment and this extends to robust FORM factor penetration among hyperscalers and even enterprise clients.

Technical indicators reveal that the AMD stock is trading close to its 52-week high of 182.50. The firm has a high P/E ratio of 127.12, which is based on high growth expectations. With a beta of 1.94, the company is more volatile than the markets.

Although the company has shown weakness of late, the AMD earnings call also indicated a widening market in sovereign AI projects and rack-scale deployments, which WOULD generate the proceeds to create meaningful revenue growth in 2026.

The short-term margin compression mindset on Wall Street fails to value AMD and its strategic positioning in the fast-growing AI infrastructure sector, and this presents a potential promise to investing actors that see it in the near term.