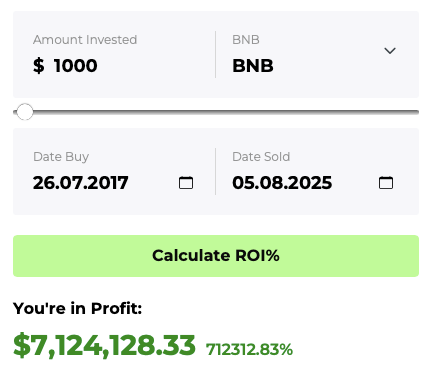

From $1,000 to $7M: Binance Coin (BNB) Delivers a 700,000% Rocket Ride in Just 8 Years

Talk about hitting the crypto jackpot. A modest $1,000 bet on Binance Coin (BNB) back in 2017 would now be worth a life-changing $7 million—no VC connections, no insider trading, just pure asymmetric upside.

How BNB defied the 'altcoin graveyard' narrative

While 99% of altcoins bled out during crypto winters, BNB kept printing. The exchange token leveraged Binance's explosive growth, burning mechanism, and utility across its ecosystem to deliver returns that make traditional finance look like a savings account.

The cynical take? Wall Street bankers are still charging 2-and-20 for hedge funds that can't outperform a damn exchange token.

One question remains: Which sleeping giant is next?

Source: Changelly

Source: Changelly

Can You Still Turn $1000 Into $7 Million With Binance Coin?

If you purchase $1000 worth of BNB today, you will receive about 1.319 coins. 1.319 coins to be worth more than $7 million, the price of each coin has to hit $5.3 million. This is a very unlikely scenario. BNB has a maximum circulating supply of 200 million coins. If the value of each coin hits $5.3 million, the project’s market cap WOULD reach unrealistic figures. Hence, it may be too late to turn $1000 worth of BNB into $7 million.

While a $1000 investment in BNB may not yield a $7 million return anymore, the asset is projected to continue rising over the coming years. BNB recently hit a new all-time high of $858.34 on July 28. Binance founder Changpeng Zhao‘s network increased to around $75 billion following BNB’s rise to a new peak. The rally was likely due to positive chain metrics and rising whale activity.

The coin’s price has since fallen by 11.6%, following the market-wide correction. The dip is likely due to global economic uncertainty following President Trump’s tariff impositions. The Federal Reserve’s decision to keep interest rates unchanged may have also spooked investors away from risky assets.

BNB’s price may pick up steam later this year. Many anticipate the Federal Reserve to cut interest rates in September of this year. A rate cut will likely lead to a surge in risky investments as borrowing becomes easier. BNB and the larger crypto market could experience a massive rebound under such circumstances.