Tesla Board Drops $30B Gamble: Musk’s Payday Sparks 2.2% Stock Surge

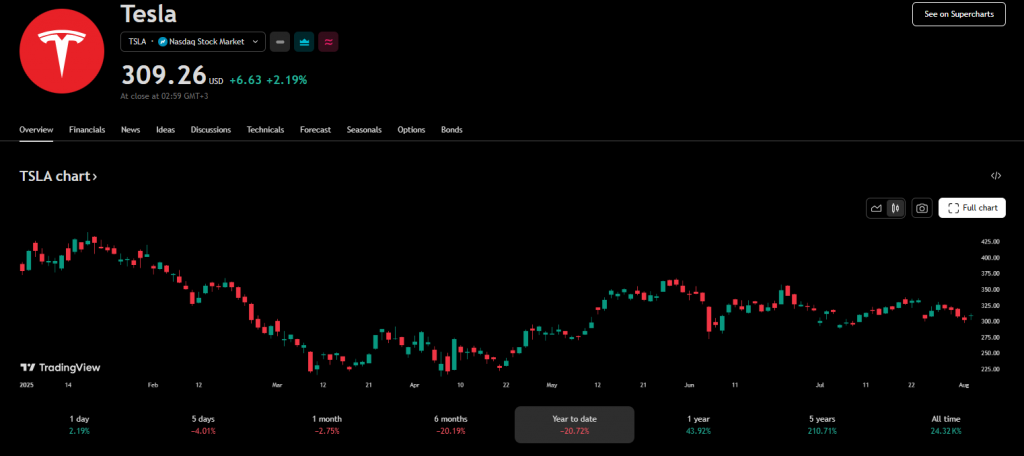

Tesla’s board just placed a $30 billion bet on Elon Musk—and Wall Street is eating it up. The EV giant’s stock jumped 2.2% after directors caved to the CEO’s demands, proving once again that shareholder value bows to cults of personality.

Ultimatum Accepted: No Exit Ramp for Musk

The board’s move smacks of desperation—throwing cash at a mercurial founder to keep him from wandering toward his next moonshot. Because nothing says 'stable leadership' like a billionaire hostage negotiation.

Market Reaction: Short-Term Sugar Rush

Traders cheered the news, but let’s be real: this is a band-aid on Tesla’s real problem. Without Musk, the company’s valuation looks as inflated as a 2021 meme coin. But hey—at least the board bought themselves another earnings cycle of plausible deniability.

Tesla & Musk’s Pay Deal Sparks Board Approval and Stock Reaction

The Tesla board’s decision basically centers around a 96 million share award that’s worth about $30 billion, and it was designed specifically to keep Musk around amid his growing business empire. This Tesla-Musk pay deal actually comes with some conditions attached – Musk has to forfeit the award if he ends up winning his legal battle over his previously voided 2018 compensation package.

Tesla’s board had this to say in their letter to shareholders:

Strategic Move Actually Addresses Leadership Concerns

The Elon Musk pay package directly responds to what Musk said back in January 2024 as an ultimatum. He had posted on X that he waswithout having more control over things. This Tesla Musk pay deal effectively calls his bluff by offering some substantial incentives to stay put.

Right now, Musk owns about 13% of Tesla through his 400 million shares, which are worth around $125 billion, and this new package brings him closer to his stated goal of 25% voting control. The Tesla stock reaction suggests that investors are actually supporting the MOVE to retain Musk, even with his other ventures like SpaceX, xAI, along with Neuralink taking up his time.

Market Response Actually Validates Board Decision

The positive Tesla stock reaction reflects investor confidence in this strategy, and it makes sense. Recent quarters have seen lower revenue that coincided with Musk’s divided attention, which probably prompted this decisive board action. The Elon Musk pay package represents Tesla’s commitment to keeping their visionary CEO focused on the company’s ambitious goals right now.

This Tesla Musk pay deal addresses those Musk leadership concerns while also positioning Tesla for future growth in AI and robotics. The board’s message was pretty clear – securing Musk’s attention is actually worth the substantial investment they’re making.