Russian Ruble Surges Past Dollar in Asian Trade—A New Financial Era Dawns

Move over, greenback—Russia's ruble just flipped the script in Asian markets. For the first time in modern history, the Kremlin's currency outpaced the dollar in regional trade deals. No small feat for an economy once tethered to petrodollars.

The De-Dollarization Domino Effect

Sanctions? What sanctions? Moscow's pivot to Asia has turbocharged ruble adoption, with trading partners ditching USD settlements faster than a hot potato. The financial shift mirrors a broader geopolitical realignment—one that's rewriting the rules of global commerce.

Currency Wars Get a Crypto Twist

While traditional finance scrambles to adapt, crypto markets smirk from the sidelines. After all, decentralized networks have been bypassing dollar hegemony for years—just ask the BRICS nations stacking Bitcoin reserves. (Take notes, SWIFT.)

The ruble's rise proves one thing: when fiat systems fracture, alternatives emerge. Whether it's CBDCs, stablecoins, or good old-fashioned gold, the dollar's exorbitant privilege looks shakier by the day. Of course, Wall Street will still find a way to charge 2% for currency conversions—some traditions never die.

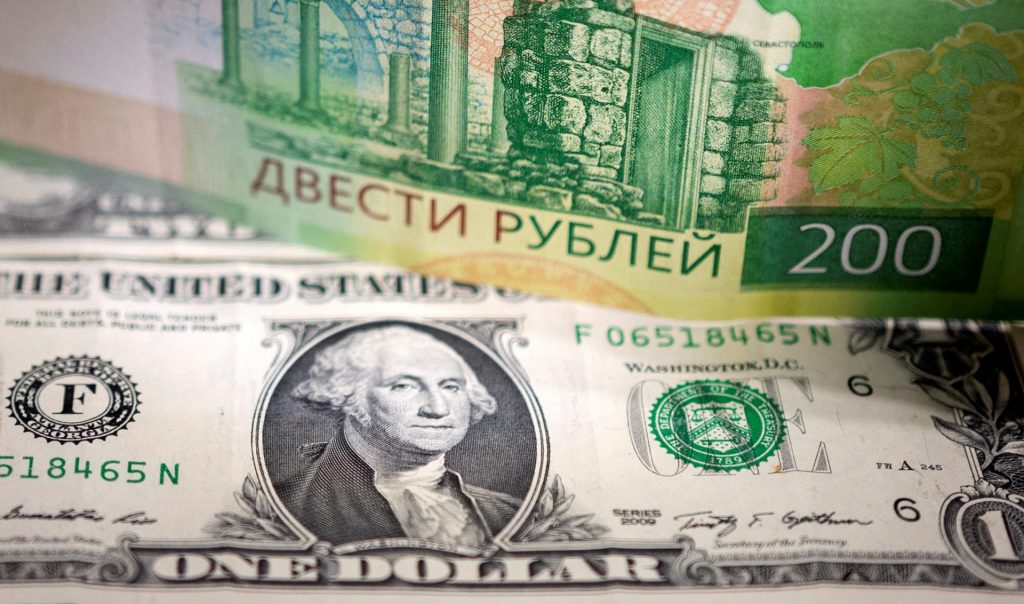

Ruble Is Winning, US Dollar Shrinks In A New De-Dollarization Trend

Per a recent trade report by the AA news, Russia is spearheading global trade deals in rubles, making new pathways for its currency to thrive on an international level. Russia’s ruble share on foreign trade with Asian countries has now reached a staggering 50.7%, showcasing the successful deployment of the currency in cross-border trade dynamics. This development has yielded results in light of the declining demand for the dollar and euro, with countries eager to explore USD alternatives to stabilize trade orders.

In addition to this, Russia’s ruble share in trade with North and South American regions has also spiked. The stats have increased by 2.3% to 3.1%, respectively. Experts state that Russia is becoming lucrative by implementing a ruble plan. It is cutting extra costs like conversion rates and commissions. The aim is to make the ruble appear more stable than ever.

US Dollar to Slow Down More?

The US dollar is predicted to show volatility in the near future as Trump’s tariff continues to batter the USD. Moreover, Trump’s policies have lately been a source of rapid criticism. The majority of the world leaders continue to berate TRUMP on his new tariff trends and systems.

In one of Brazil’s PM Lula’s latest speeches, he shared how he won’t be subordinate to the dollar. He later added that Trump has crossed a line by imposing new line of tariffs.

![]() LULA TO TRUMP: I WON'T SUBORDINATE TO DOLLAR

LULA TO TRUMP: I WON'T SUBORDINATE TO DOLLAR

Brazil is no longer as dependent on the US as it used to be

It won't let anyone dictate its economic policies

"While the president does have the right to impose tariffs, Trump has crossed the line," Lula declared pic.twitter.com/MuwKZiq6J9