Stock Futures Soar: Nasdaq & Dow Stage Dramatic Rebound From August Lows

Wall Street's wounded bulls just got a shot of adrenaline.

Futures roar back as tech leads charge

Nasdaq and Dow futures are ripping higher in premarket trading—proof that even the most battered indexes can find buyers when shorts get greedy. The rebound comes after institutional traders spent weeks whispering about 'oversold conditions' (translation: they needed bagholders).

Dead cat or new bull run?

Market mechanics suggest this could be more than a technical bounce. Volume patterns show real money moving, not just algo-driven noise. Though let's be honest—with the Fed still playing interest rate roulette, every rally deserves side-eye until proven otherwise.

Funny how these 'rebounds' always seem to hit right before quarterly window dressing...

Stock Futures Market Moves Amid Tariffs, Jobs Data, and Market Volatility

Major Recovery After Weekly Losses

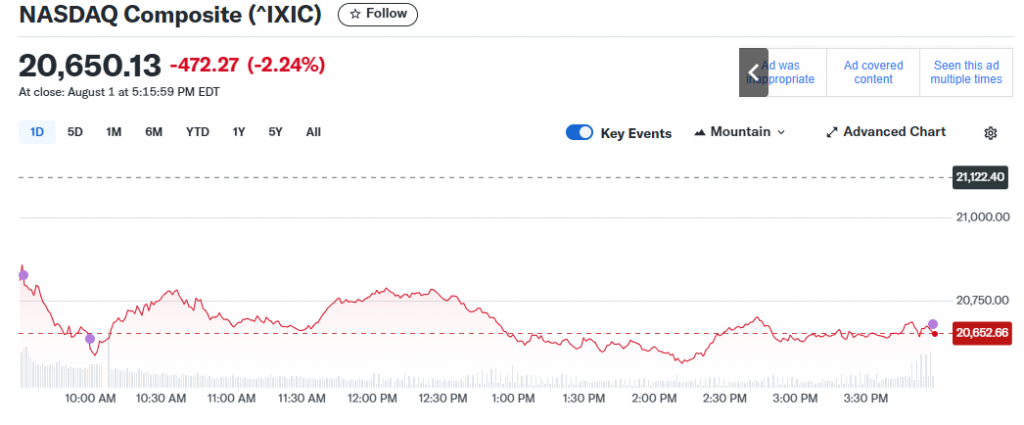

The stock futures market gains follow brutal weekly declines across major indices. Nasdaq futures posted their worst weekly performance since May, while Dow Jones futures suffered alongside the broader market. Stock market futures are attempting to recover after the S&P 500 fell 2.4%, the Dow slumped 2.9%, and the Nasdaq shed 2.2% during the week.

Friday’s selloff was driven by July’s jobs report coming in weaker than expected, with previous months’ tallies revised sharply lower. This led President TRUMP to fire the Bureau of Labor Statistics commissioner, creating additional market uncertainty.

Tariffs and Fed Policy Impact Stock Futures Market

The market faces pressure from Trump’s updated tariffs ranging from 10% to 41% on various trading partners. These tariffs impact on stocks has raised concerns about rising costs and broader inflationary pressures affecting the Nasdaq futures and Dow Jones futures outlook.

Amrita Sen, co-founder of Energy Aspects, had this to say:

Trump’s ongoing battle with Fed Chair Jerome Powell remains in focus. After weak jobs data, almost 90% of trader bets are now on a September rate cut, which could support market performance.

Earnings and Commodities Affect Stock Futures Market Outlook

The stock futures market will face earnings season pressure with over 100 S&P 500 companies reporting this week. Nasdaq futures and Dow Jones futures will be influenced by results from Palantir, Eli Lilly, and Disney.

Commodity movements also impact stock market futures sentiment. Oil prices declined with Brent crude down 0.2% to $69.53 per barrel, while spot Gold fell 0.22% to $3,355.37 per ounce despite previous gains following the weak jobs report.

August historically represents the worst month for the Dow and second-worst for the S&P 500 and Nasdaq, according to Stock Trader’s Almanac data. This seasonal weakness adds pressure to the current market recovery attempt.

Right now, the stock futures market rebound depends on earnings results, tariff implementation effects, and Federal Reserve policy decisions. The combination of these factors will determine whether Nasdaq futures today’s gains and Dow Jones futures recovery can be sustained through the challenging August trading period.