Apple Soars to $94B Q3 Earnings as iPhone Sales Defy Market Gravity

Tech giant's profit rocket leaves analysts scrambling to upgrade targets.

Cupertino prints money—again

Another quarter, another obscene cash haul. Apple's iPhone division—now roughly the GDP of a mid-sized country—drove record revenues as consumers shrug off inflation fears. Because nothing says 'recession proof' like a $1,399 status symbol with 87% profit margins.

Wall Street's love affair continues

Traders piled into AAPL shares post-announcement, desperate for any growth story in a shaky market. Because when the apocalypse comes, we'll all be trading canned goods via Apple Pay.

Apple Earnings Beat, Stock Price Climbs, AAPL Reacts After Hours

iPhone Revenue Drives Apple Stock Performance

iPhone sales powered the Apple stock surge with $44.58 billion in revenue, significantly above the $40.06 billion estimate. CEO Tim Cook attributed part of the Apple earnings beat to customers purchasing ahead of potential tariffs, and he noted this timing factor as particularly important.

Cook stated:

The company also set seasonal records for iPhone upgrades across all geographies, with Cook noting that the active user base hit record highs worldwide. Right now, analysts view this iPhone sales growth as a key driver for Apple stock performance going forward.

China Recovery Boosts Apple Stock Outlook

Greater China revenue reached $15.37 billion, which actually exceeded estimates and marked a turnaround from previous declines. This improvement supported the Apple stock price despite ongoing regulatory challenges that are being faced in Europe.

Cook had this to say:

The CEO credited a Chinese government subsidy program for helping revive smartphone demand in the region, and analysts believe this trend could continue supporting Apple earnings in future quarters.

Tariff Impact and Future Apple Earnings Guidance

Despite strong Apple earnings, Apple warned of $1.1 billion in tariff costs for the current quarter. CFO Kevan Parekh projected “mid to high single digits” revenue growth, which exceeded analyst expectations and supported the Apple stock outlook for the NEAR term.

The company has already absorbed $800 million in tariff costs during the June quarter, and this has prompted supply chain diversification to India along with Vietnam. At the time of writing, these moves are being seen as strategic responses to trade pressures.

Cook was clear about the timing effects:

He also noted that some customers were making early purchases due to tariff uncertainty, which boosted iPhone sales growth beyond normal seasonal patterns.

AAPL After Hours Performance and Market Response

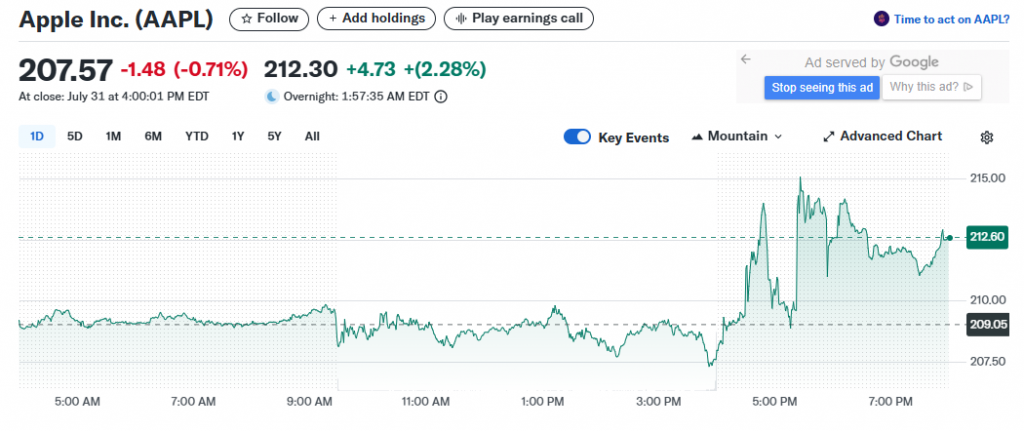

The AAPL after hours movement showed initial gains of 3% before moderating to current levels around $212.30. Trading volume reached 64.7 million shares, which was well above the average of 53.5 million, and this indicated strong investor interest in the Apple earnings results.

Services revenue hit $27.42 billion, topping estimates of $26.8 billion and supporting long-term Apple stock fundamentals. Gross margins of 46.5% also exceeded expectations of 45.9%, and analysts tracking the company viewed this positively.

Emarketer analyst Jacob Bourne commented:

The AAPL after hours gains reflect investor confidence despite the stock’s 17% year-to-date decline. Apple stock continues to face headwinds from AI competition and tariff concerns, but the strong Apple earnings performance suggests underlying business resilience. The company’s forecast for continued growth in the current quarter has helped maintain positive sentiment in AAPL after hours trading, even as some investors remain cautious about future challenges.