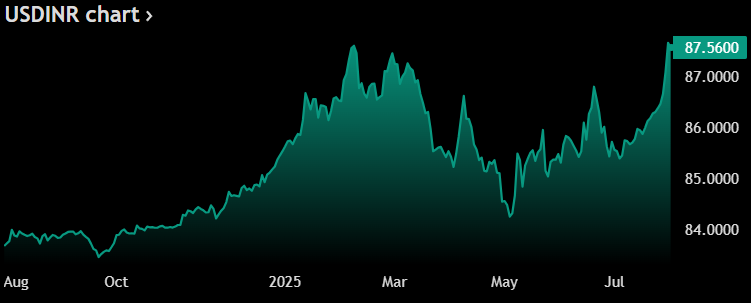

Trump’s 25% Tariff Shockwave: India Ditches Dollar as Rupee Crashes to 87, RBI Loses $3B

Trade war escalation triggers currency chaos—India's rupee plunges to historic lows while central bank bleeds reserves.

The 25% hammer drops

Trump's latest tariff salvo isn't just rewriting trade rules—it's accelerating the global dash from dollar dominance. India becomes the latest domino to fall as its currency tanks to 87 against the greenback.

RBI's $3 billion band-aid

The Reserve Bank of India scrambles to stabilize markets, burning through foreign reserves at alarming speed. Meanwhile, Mumbai's trading floors buzz with de-dollarization strategies—because nothing says 'financial sovereignty' like panic-selling USD reserves.

Goldman analysts would call this 'currency realignment.' Traders know better—it's the sound of emerging markets building lifeboats as the Titanic of dollar hegemony hits an iceberg of political ego.

Rupee Falls as Trump India Tariff Spurs RBI Move, De-Dollarization Surge

The Rupee vs Dollar exchange rate actually plummeted following Trump’s announcement, which cited India’s military and energy cooperation with Russia as justification. The RBI Dollar intervention was swift and also substantial, with two separate market interventions conducted at 87.95 and even at 87.60 levels.

A dealer at a state-owned bank stated:

Indian Export Tariffs Drive Trade Policy Shift

The announcement of Indian export tariffs actually represents an escalation from the previous 26% rate that was imposed in April. India is among the top sources of US imports right now, with nearly $90 billion in goods that flowed last year. Apple alone exported $17 billion of iPhones from India.

Trump stated on Truth Social:

De-Dollarization Trend Accelerates

The TRUMP India tariff impact has actually accelerated the de-dollarization trend across emerging markets. India has permitted 18 countries to transact in rupees instead of US dollars, including Kenya, Sri Lanka, and also Singapore. The RBI Dollar intervention along with Indian export tariffs signal a broader shift away from dollar-dominated trade systems.

The rupee was recovered to close at 87.48 per dollar after the central bank’s aggressive response. With the Rupee vs Dollar volatility expected to continue until the August 1 deadline, the de-dollarization trend appears to have gained irreversible momentum as countries seek alternatives to dollar transactions.