EU Capitulates: Trump’s $1.35T Trade Deal Ignites Market Frenzy

Wall Street erupts as transatlantic tensions thaw—thanks to a deal so big it makes corporate lobbyists blush.

The Art of the (Trade) Deal

Trump’s $1.35 trillion hammer drops—tariffs slashed, quotas vaporized, and European exporters suddenly remembering why they love America. The DOW? Up 800 points before lunch. The euro? Briefly stopped crying in a corner.

Brussels Plays Ball

EU negotiators folded faster than a French farmer’s protest—handing over agricultural concessions that’ll have Wisconsin dairy farmers high-fiving combines. Meanwhile, German automakers are quietly recalculating how much they ‘overpaid’ in emissions fines last quarter.

Cynical Take

Somewhere in Zurich, a private banker just upgraded his yacht—and named it ‘Trickle-Down Economics.’

Trump-EU Trade Deal Triggers Rally, Tariff Fears, EU Concessions

Markets Surge on Trump EU Trade Deal Breakthrough

The Trump-EU trade situation has sparked an extraordinary global stock market rally, with investors celebrating the end of transatlantic trade tensions. European markets led the surge as the US-EU tariff agreement eliminated uncertainty around punitive tariffs that had threatened billions in commerce.

After a weekend of high diplomacy on the sidelines of Trump’s Scottish golfing trip, the EU and the US finally managed to agree on a trade deal.

But the bloc has a busy week ahead as it scrambles to lock in the agreement.

Brussels Playbook explains![]() https://t.co/RvqA5rCIEe

https://t.co/RvqA5rCIEe

POLITICO Europe reported on the weekend breakthrough:

Even more significant is that the deal was negotiated quickly, with Brussels facing pressure to finalize terms. At the time of writing, markets continue their upward trajectory.

European Trade Concessions Mark Strategic Retreat

The Trump-EU trade deal required substantial European trade concessions, marking a significant shift in European Union policy. Brussels officials worked frantically to finalize terms that WOULD satisfy Trump’s demands while the global stock market rally continued building momentum along with rising investor confidence.

The agreement comes as the bloc scrambles to lock in the deal, with officials acknowledging the urgency of avoiding a damaging trade conflict. Some analysts believe this represents a turning point in transatlantic relations.

$1.35 Trillion Agreement Ends Trade War Fears 2025

The massive Trump EU trade deal encompasses multiple sectors, effectively ending trade war fears 2025 that had plagued international markets. The US-EU tariff agreement covers agricultural products, manufacturing, and also technology services in a comprehensive package.

Bloomberg’s analysis highlighted Europe’s position:

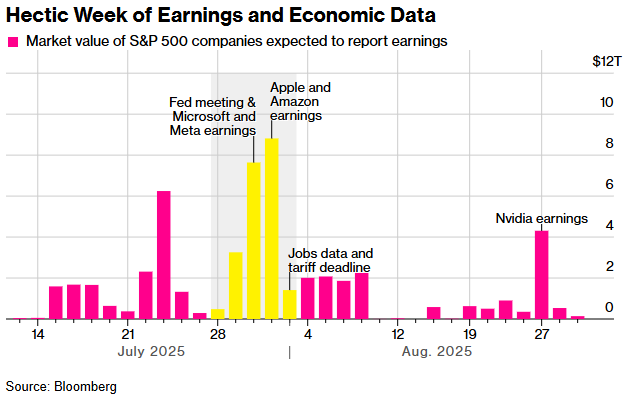

European officials were privately describing the negotiations as intense, with the bloc making significant adjustments to existing policies to secure the Trump-EU trade deal. The timing coincides with a busy earnings week that includes major tech companies.

The Trump’s EU trade negociations have demonstrated the effectiveness of Trump’s negotiating approach while also providing markets with the stability needed during this critical earnings period. The agreement’s resolution of trade war fears 2025 through strategic European trade concessions has created lasting momentum for the ongoing global stock market rally right now.