SHIB Showdown: Long or Short Shiba Inu? Master Both Sides of the Trade (If You Dare)

Shiba Inu isn’t just barking up the meme-coin tree—it’s tearing through the crypto jungle with volatility that’ll make your portfolio sweat. Here’s how to play both sides.

### The Long Game: Betting on the Dog

SHIB’s cult following and ecosystem growth (Shibarium, anyone?) keep bulls wagging their tails. But let’s be real—this isn’t a “set and forget” asset. It’s a high-octane trade dressed in a dog costume.

### The Short Play: When the Meme Fades

Every pump has its dump. SHIB’s 90%+ drawdowns from ATHs are legendary. If you’ve got the stomach, shorting the hype cycles can be as profitable as riding them—just watch for Elon’s tweets.

### Hedge Like a Degenerate

Why choose? Pair long positions with strategic shorts to exploit SHIB’s mood swings. Pro tip: leverage is a double-edged sword—don’t let it gut you like a bad margin call.

### The Bottom Line

SHIB trades aren’t investments; they’re adrenaline shots. And remember: in crypto, the only thing sharper than the rallies are the corrections—and the egos of ‘traders’ who lucked into one good call.

Shiba Inu: Long and Short Positions Explained

Long and short positions in cryptocurrency refer to nuanced trading techniques. As BitStamp explains about opening short positions in an asset, this would simply mean earning a profit from an asset’s falling price. On the other hand, going long would refer to earning a profit from an asset’s rising price.

Long positions are often more favored and desired by seasoned crypto investors due to their low risk and volatility. Shorting comes with a little risk but has a tendency to deliver a profit with a unique approach and methodology.

Can One Open Both Long and Short Positions for This Asset?

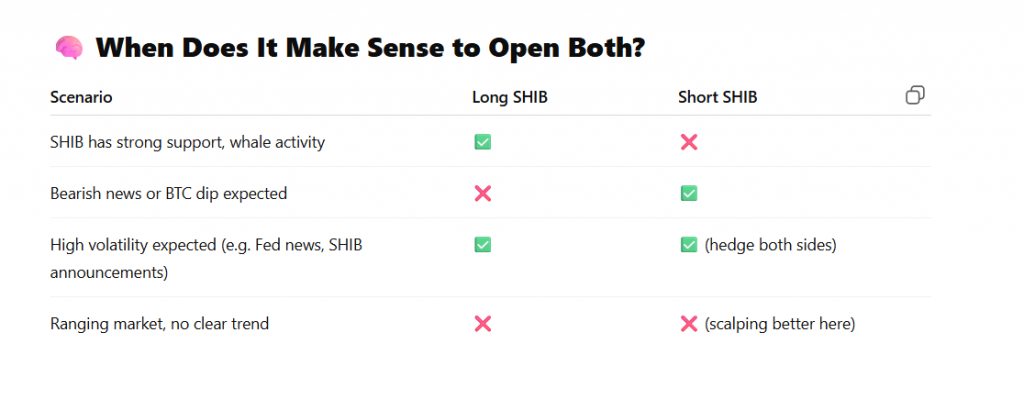

The answer is yes. Investors keen on pursuing both positions can open long and short-term SHIB positions under these circumstances.

For instance, a long SHIB position WOULD be favorable when the token shows rising momentum and increased whale activity. Opening a short position during this time will incur extra losses for investors.

When the market is riddled with bearish news or is showing signs of a potential collapse, then opening short positions on SHIB may help investors greatly.

In addition to this, an investor can open both a short and long-term position with SHIB only when circumstances favor high volatility (FED or SHIB announcements), helping the token skim through both scenarios. For example, rising SHIB burns and its ascent to $1 could be one of the most bullish times to open a long and short position.

Lastly, if the market is ranging, showing no clear trends, then it’s best to avoid opening any position on Shiba Inu.