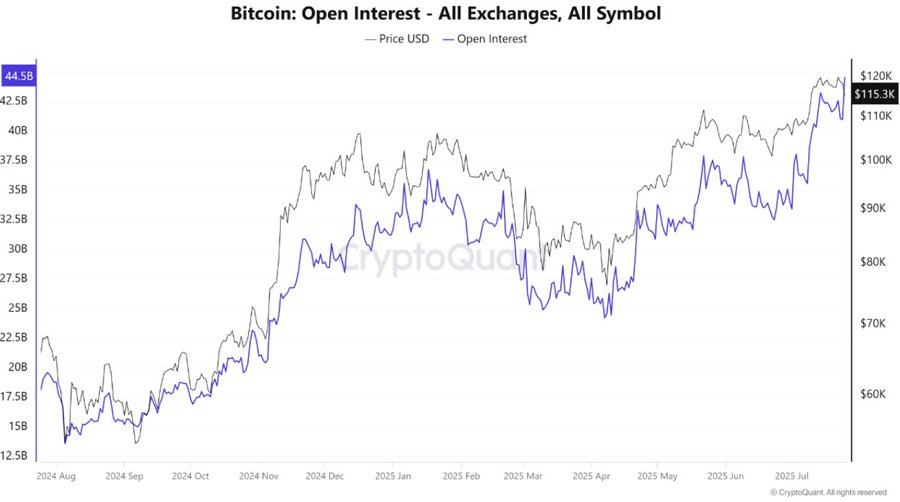

Bitcoin Open Interest Hits Record High—Bullish Signal or Bubble Warning?

Futures markets just flashed a historic signal—but is it a green light or a stop sign?

Open interest in Bitcoin derivatives just smashed its all-time high. Traders are piling in, leverage is stacking up, and liquidity pools are deeper than ever. The question isn't whether the market's heating up—it's whether we're looking at rocket fuel or nitroglycerin.

When Wall Street smells volatility, they don't bring measuring cups—they bring buckets. The same institutions that called crypto a 'fraud' in 2018 are now building positions big enough to crash a small nation's economy (not that they'd ever admit it).

One thing's certain: When open interest peaks, someone's about to get rekt. The only question is whether it'll be the shorts crying into their spreadsheets or the longs learning the hard way that ATHs make terrible exit liquidity.

Source: CryptoQuant

Source: CryptoQuant

Will BTC Face A Correction?

While historically, bitcoin (BTC) has faced corrections when similar events have taken place, a lot has changed over the last year. The ETF products have brought a lot of institutional money into BTC. This aspect of the equation was absent during the 2017 dip. BTC’s recent rise to a new all-time high could be attributed to increased ETF inflows.

Despite the changing times, there is still the possibility of fresh volatility entering the market. Bitcoin’s (BTC) rising open interest could become a point of worry for market participants. It remains unclear how the market may MOVE over the coming days. The FOMC (Federal Open Market Committee) meeting on the 29th will likely give clues on the Federal Reserve’s stance on the US monetary policy. A hawkish stance could lead to another market dip. On the other hand, a dovish move could propel the market into another bullish phase.

Investors are still waiting for the Federal Reserve to announce an interest rate cut for 2025. A rate cut will likely lead to investors making more risky investments as borrowing becomes easier.