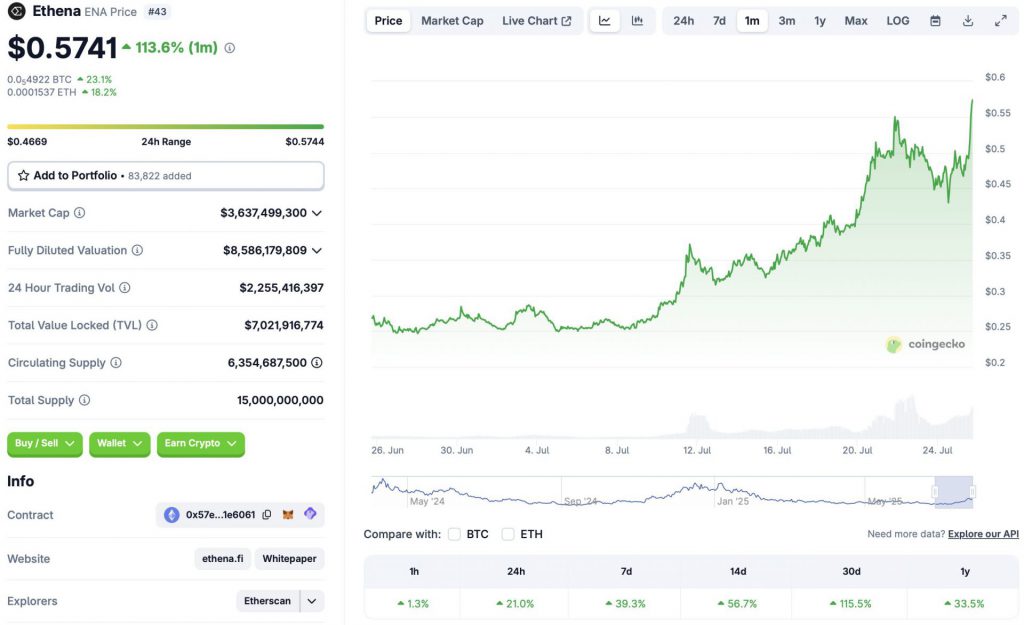

Ethena Defies Market Slump with Stunning 115% Rally—Here’s Why

While the crypto market bleeds red, Ethena laughs in the face of gravity—soaring 115% as traders flock to its synthetic dollar protocol. Who needs Bitcoin when you've got a stablecoin disruptor mooning during a downturn?

The anti-fragile anomaly

Most altcoins crumble when BTC dips below key support. Not Ethena. Its USDe token—pegged to the dollar through delta-neutral hedging—just posted DeFi's most defiant green candle this cycle. The protocol's $1.4B TVL suggests institutions might finally be getting their 'hedge' on.

Wall Street's worst nightmare

Traditional finance clings to 5% yield like it's manna from heaven. Meanwhile, Ethena's stakers pocket 15% APY—paid in actual crypto, not banker IOU slips. The kicker? This yield comes from shorting ETH futures (take that, SEC).

As the Fed flip-flops on rate cuts, one thing's clear: the smart money isn't waiting for Powell's permission to print. They're building the damn printer.

Source: CoinGecko

Source: CoinGecko

Why Is ENA Rallying?

While Ethena (ENA) rallies, a majority of the assets in the market are facing a dip. ENA’s surge could be due to developments around the project’s stablecoin. The project’s synthetic dollar, USDe, seems to be causing quite a buzz in the crypto community. The stablecoin does not back the coin with dollar reserves. Instead, USDe uses long positions on spot ethereum (ETH) combined with short positions on futures contracts to maintain its dollar peg.

12% sUSDe APY with $7 billion USDe in circulation

The future is so bright https://t.co/UVC2dDAXWQ pic.twitter.com/FJdyYpKWPM

ENA’s rally may fade out as the hype around its stablecoin dies down. It is unlikely that ENA will continue its rally, given the bearish market environment. The cryptocurrency market has faced a substantial selloff over the last few days. Market participants are likely keeping their eyes glued to the upcoming FOMC meeting on July 29. They will most likely look for clues regarding the Federal Reserve’s next move on the US monetary policy.

The Federal Reserve may decide to finally cut interest rates after its next meeting. President Trump has repeatedly asked Fed Chair Jerome Powell to cut interest rates. Trump has gone as far as to say that he’d fire Powell if given the chance. A rate cut could lead to money re-entering the crypto market. Such a scenario could lead to ENA continuing its rally.