GENIUS Act Exposed: Experts Reveal Its Stealthy CBDC Agenda

Beneath the bureaucratic veneer of the GENIUS Act lies what critics call a Trojan horse for centralized digital currency control.

Decoding the fine print

Policy analysts are sounding alarms about clauses buried in Section 4.2 that could grant Treasury unprecedented access to transaction layers—without calling it a CBDC. The loophole? A vague 'interoperability mandate' that just happens to require Fed-approved validation nodes.

Wall Street's worst-kept secret

Banking insiders whisper about backchannel meetings where Fed officials allegedly mapped out phase-in timelines. Coincidentally, three major payment processors suddenly upgraded to 'GENIUS-compatible' systems last quarter—at taxpayer expense, naturally.

The crypto community isn't buying it

DeFi builders are already forking contingency protocols, with one anonymous developer quipping: 'They want a digital dollar? Fine. We'll make 500 better ones.' Meanwhile, Bitcoin maximalists are having their 'I told you so' moment—golden bull statues optional.

As always in Washington, the real innovation is in creative accounting—turning monetary policy into legislative sleight-of-hand while pretending it's for 'consumer protection.'

GENIUS Act and CBDCs Raise Alarms on Privacy, Control, and Trust

The GENIUS Act CBDC system controversy actually intensified when Republican Representative Marjorie Taylor Greene publicly condemned the legislation. Through her social media post, Greene warned that the hidden digital dollar agenda operates without proper CBDC prohibition language, and even goes further to question the bill’s true intentions.

Rep. Marjorie Taylor Greene stated:

Financial Privacy Risks Under New Framework

Jean Rausis, co-founder of Smardex, described the US CBDC regulation as a deceptive measure that actually achieves Central Bank surveillance through private entities rather than direct government control. At the time of writing, many experts share similar concerns about this approach.

Jean Rausis stated:

The GENIUS Act CBDC system creates the same financial privacy risks as traditional central bank digital currencies by requiring comprehensive monitoring and also reporting mechanisms from stablecoin issuers.

Surveillance Capabilities Through Stablecoin Control

Critics argue the hidden digital dollar agenda operates through mandatory compliance requirements that actually mirror CBDC functionality. The US CBDC regulation framework established by the GENIUS Act enables government agencies to track and control digital transactions through private stablecoin issuers, along with various other oversight measures.

Treasury Secretary Scott Bessent emphasized the strategic importance of the legislation for maintaining dollar dominance globally while implementing comprehensive oversight mechanisms. Some observers believe this approach was chosen deliberately to avoid direct CBDC opposition.

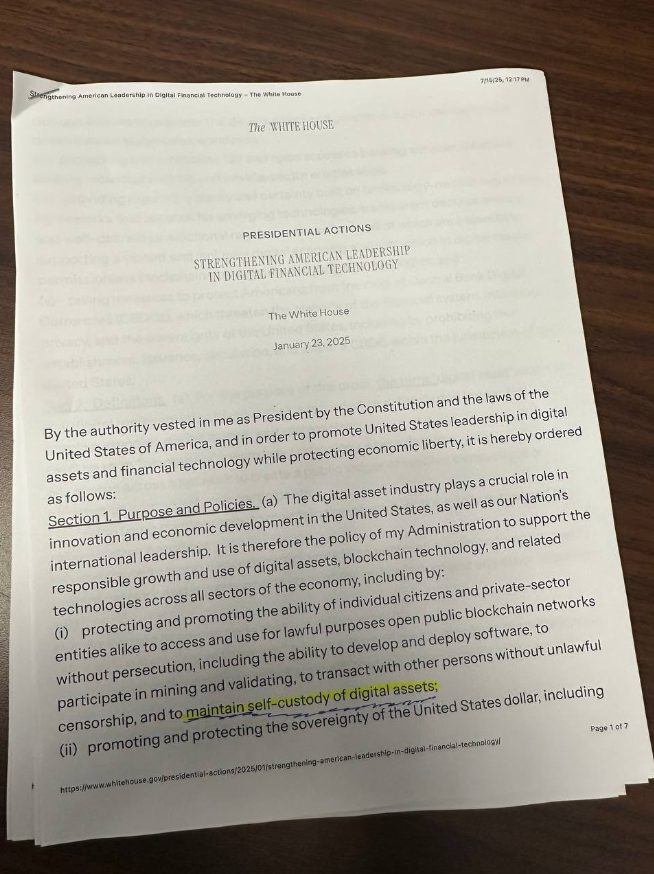

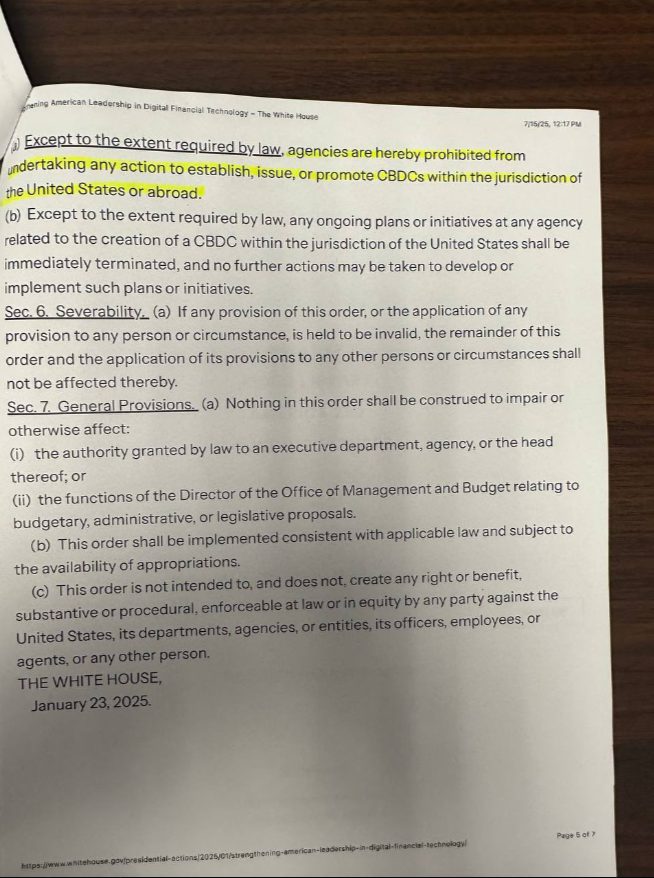

The final provisions of Trump’s executive order explicitly prohibit traditional CBDC development, yet the GENIUS Act CBDC system actually achieves similar Central Bank surveillance capabilities through regulated stablecoins, creating the same financial privacy risks through alternative means right now.