Quantum Solutions Set to Dominate Japan’s Crypto Market with 3000 Bitcoin Purchase

Tokyo’s Quantum Solutions just made a power play—announcing plans to scoop up 3,000 BTC, catapulting it to Japan’s #1 Bitcoin holder. Move over, traditional finance—this is how you stack sats in 2025.

Why it matters: While banks fiddle with fractional reserves, Quantum’s all-in bet on Bitcoin screams confidence in crypto’s endgame. The FSA might need a new rulebook.

The kicker: In a world where CEOs still pretend to understand blockchain, Quantum’s vault just got a whole lot heavier. Guess who’s laughing when the next halving hits?

Japan To Join Global Bitcoin Hoarding Spree?

There has been a significant rise in corporate bitcoin (BTC) investments over the last year. Public companies seem to be hoarding BTC as a strategic reserve. The pivot towards digital currencies is fairly new. The shift could be traced to the US SEC approving 11 spot BTC ETFs in 2024. The move opened the doors for financial giants to enter the digital currency race. BlackRock, the world’s largest asset manager, has highlighted BTC’s potential as a global currency on multiple occasions.

Quantum Solutions’ latest BTC accumulation plan aligns with the global paradigm shift. BTC’s recent rally to a new all-time high was also likely due to increased inflows from ETF products and corporate purchases.

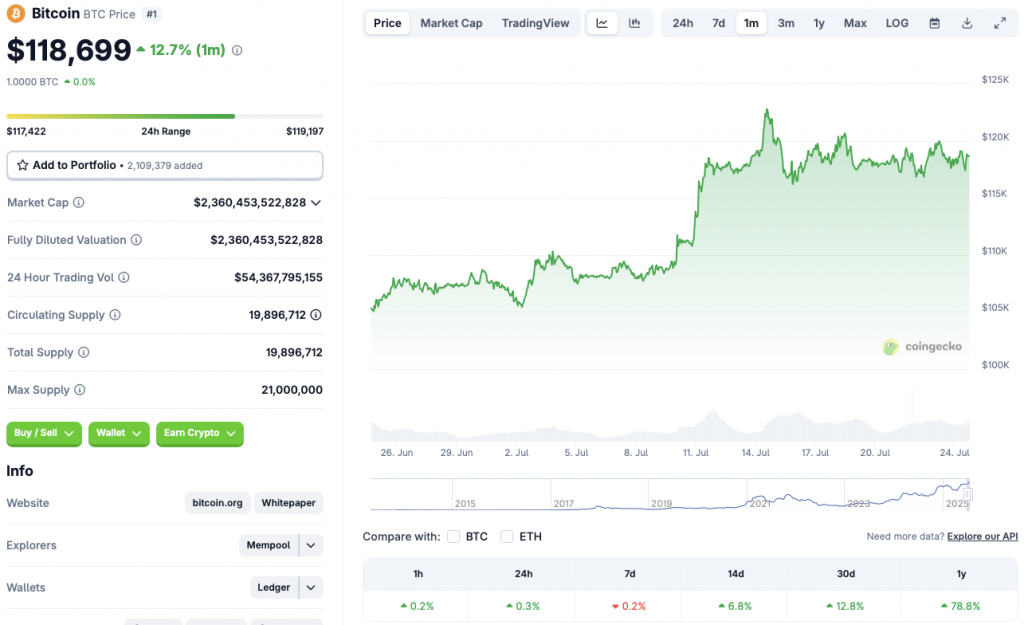

The bullish developments have undoubtedly led to quite a rally over the last few weeks. The crypto market seems to be facing a correction today, July 24, 2025. Bitcoin (BTC) faced a dip to the $117,000 level earlier today, but has since made some gains. According to CoinGecko’s BTC data, the original crypto is up 0.3% in the daily charts, 6.8% in the 14-day charts, 12.8% in the monthly charts, and 78.8% since July 2024. The asset continues to show a 0.2% correction in the weekly charts.

There is a chance that Bitcoin (BTC) could fall to the $110,000 level. BTC seems to have a supply gap at the $110,000 price point. Spot BTC ETFs have seen $85.8 million in outflows over the last 24 hours. The development could spark concern among investors. The asset could face another correction if demand falls.