IEX Stock Plummets 10% Overnight as CERC’s Market Shakeup Sends Shockwaves

Another day, another regulatory curveball—this time it's IEX investors left holding the bag.

CERC's power play triggers panic selling

The 'independent' energy exchange got a brutal reality check when shares cratered 10% in a single session. No fluffy corporate speak about 'long-term fundamentals' could stop the bleeding after regulators flipped the switch on market rules.

Wall Street's casino logic at work

Traders dumped positions faster than a hot potato—proving yet again that electricity markets have all the stability of a crypto meme coin. The so-called 'smart money'? More like herd mentality with Bloomberg terminals.

One thing's certain: in today's markets, the only constant is volatility. And the occasional regulator-shaped wrecking ball.

CERC Approval Sparks IEX Share Price Fall: Here’s What Investors Need to Know

What Is All About the Market Coupling Decision?

The Central Electricity Regulatory Commission has approved market coupling in the Day-Ahead Market, and they will implement this decision in phases by January 2026. Under this new framework, power exchanges will actually operate as Market Coupling Operators on a round-robin basis. Investors have perceived this regulatory change as a direct threat to IEX’s dominant market position, which explains why IEX share is falling so aggressively.

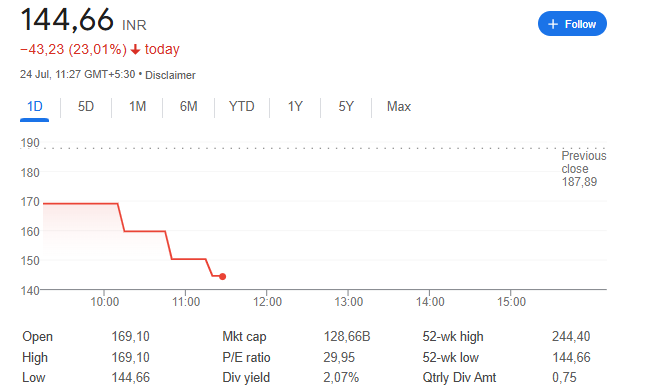

The counter hit its lower circuit immediately when markets opened, along with heavy trading volumes that reflected massive institutional selling pressure. The IEX news indicates that this regulatory shift represents a fundamental change in how energy trading operations will conduct themselves going forward.

Seven-Day Decline Reflects Deeper Regulatory Concerns

This latest crash is a further addition to what has already proven to be a very worrying week by shareholders. The shares have also been on a persistent slide and this steady down trend is an indication that investors have been in fact placing themselves before such regulatory head winds. Market players are particularly worried about the effect of the new system in the competitiveness of IEX as well as its channels of revenue.

The January 2026 deadline provides its rivals with almost 18 months to learn how to attack the new structure, which is causing more confusion regarding why IEX share is plunging at such a pace. The selling was maintained high during the session and the stock moved at its lower circuit the major part of the day.

Market Position Under Serious Threat

The approval by CERC enables a round robin system that is going to erode the competitive advantages of IEX in the energy trading sector. It is a regulatory intervention that exists in the context of a larger shift in the power sector, as renewable energy integration and grid modernization bring on new strata of complexity.

The IEX share price has already dropped over 6 percent year-to-date, implying that it is lagging behind general market indices by a wide margin. The irresistible selling force indicates increasing risks of revenue sharing agreements as well as the possible loss of market share within new operating regulations.

Investors are awaiting how the management will react to such regulatory changes and what the company will literally do to change their business model. CERC approval has core shaken the investment thesis of IEX which is a major reason as to why we are seeing a sharp down MOVE in IEX share price.