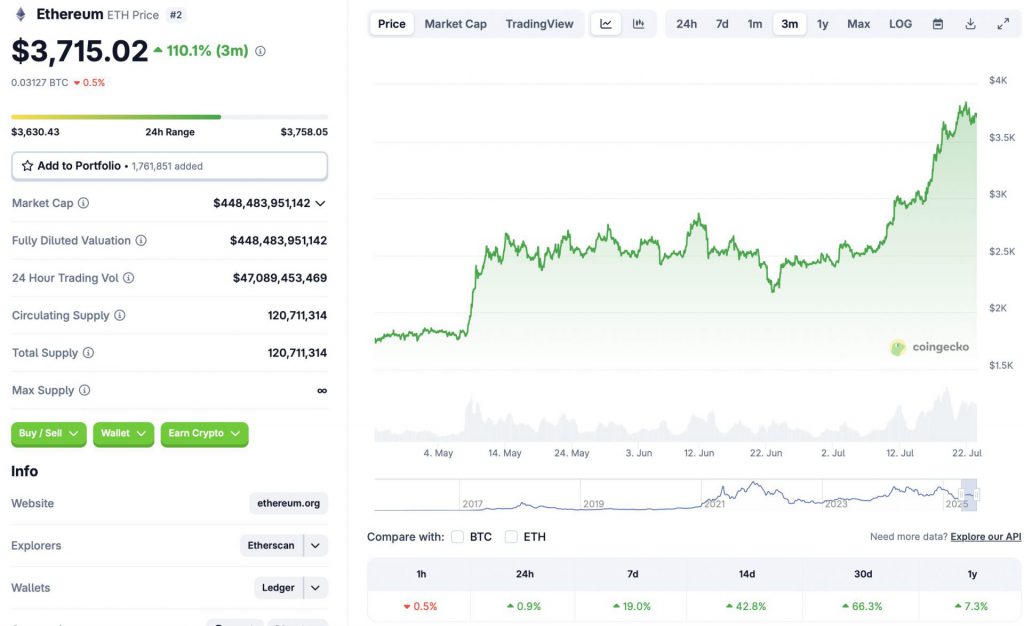

Ethereum Skyrockets 110% in 90 Days—Will $4K Be the Next Stop This July?

Ethereum’s bull run defies gravity—again. The asset’s 110% surge in three months has traders buzzing: is $4,000 the next milestone?

Breaking Down the Rally

No fluke—institutional inflows, DeFi revival, and ETF whispers fuel the fire. Retail FOMO? Just icing on the cake.

The $4K Question

Technical charts scream ‘overbought,’ but since when did crypto care? Resistance levels look like speed bumps at this velocity.

Wall Street’s Crypto FOMO

Hedge funds now ‘diversifying’ into ETH after dismissing it for years. How original.

Buckle Up

Whether it’s a moon mission or a pullback trap, July promises fireworks. Just remember—what goes up 110% in three months can do anything except bore you.

Source: CoinGecko

Source: CoinGecko

Can Ethereum Hit $4000 in July?

ETH’s price has to rally by 7.67% to hit the $4000 mark. At its current pace, ETH could hit the $4000 mark over the next week.

ETH’s latest rally is likely due to institutional ETF inflows. ETH ETFs have seen consistent inflows over the last few months. Bitcoin (BTC) and Ethereum (ETH) ETFs seem to have triggered a market-wide rally.

Another factor for ETH’s incredible rally is its adoption by corporate treasuries. Corporate entities seem to be going all in on crypto. Many have begun hoarding BTC and ETH to fill their coffers. The narrative seems to have changed over the last year. crypto was once shunned by the mainstream. Today, most major corporations can’t seem to wait to get their hands on as much crypto as possible.

ETFs and corporate treasuries have purchased more than $10 billion worth of Ethereum (ETH) since mid-May 2025.

ETH’s rally may continue over the coming weeks if ETF inflows and corporate demand remain strong. Bitwise CIO Matt Hougan believes ETH will continue its rally due to a massive demand shock. However, there always remains the possibility of a correction. Investors may decide to book profits, and institutions may slow down their investments. How the market pans out over the next week is yet to be seen.