Bitcoin’s Bull Run: Why $145K by End of 2025 Isn’t Just Hopium

The king of crypto is gearing up for a throne-worthy finale—analysts now see Bitcoin blasting past $145,000 before 2026. Here's why the smart money (and the reckless gamblers) are doubling down.

### The Halving Effect: Scarcity as Rocket Fuel

With the 2024 supply cut now baked in, Bitcoin's code-mandated scarcity is doing what it always does—pushing prices into stupid territory. Traders who ignored this script in 2020 aren't making the same mistake twice.

### Wall Street's Late-Game FOMO

BlackRock's ETF was just the appetizer. Now every hedge fund manager who mocked crypto in 2022 is quietly rebalancing portfolios between martini lunches. Spoiler: they'll take credit when it works.

### The Retail Stampede Hasn't Even Started

Mainstream investors still think 'blockchain' is a new SoulCycle class. When they realize Bitcoin's up 300% from its 2023 lows? Cue the panic buys at all-time highs—classic.

### The Cynic's Corner

Let's be real—half these price targets come from analysts who also predicted 'Bitcoin to $1M by 2020.' But even broken clocks get rich during a supercycle.

Buckle up. This train either ends at Lamborghini dealerships or the Federal Reserve's emergency meeting room—no in-between.

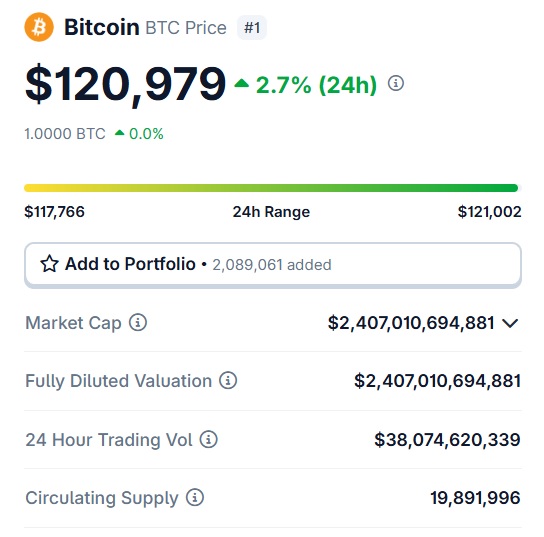

Source: Coingecko

Source: Coingecko

The latest prediction from the Finder’s panel of financial experts indicates that Bitcoin could end 2025 at $145,000. That’s another 21% uptick from today and a double-digit return to investors in less than six months. Therefore, an investment of $10,000in BTC today could turn into $12,100 by the end of the year.

A Rally Expected For Bitcoin in 2025

Bitcoin is expected to pick up speed in 2025 and remain on the greener side of the spectrum. The Finder’s outlook for BTC is bullish and taking an entry position at its all-time high of $120,980 is beneficial. The king cryptocurrency could see a few dips along the way but is on track to head north, read the forecast. If BTC soars, other leading altcoins like Ripple’s XRP, Cardano’s ADA, and VeChain’s VET could also rally in the charts.

The panel includes notable industry voices such as Miles Paschini, CEO of FV Bank. Simon Peters, Market Analyst at eToro, and Joseph Raczynski, Futurist, JT Consulting & Media.said Ruslan Lienkha, Chief of Markets at YouHodler,

he said.